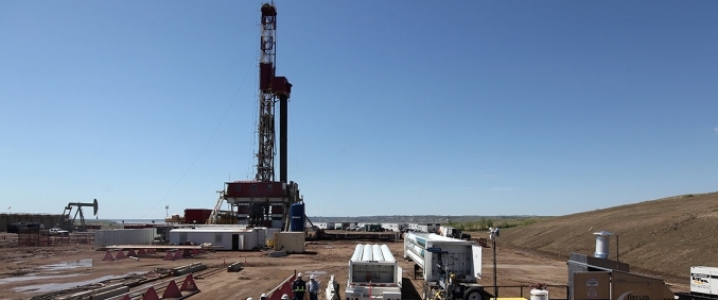

Oil explorers cut drilling in US shale fields, shrugging off oil’s rebound, as investors urge them to keep spending in check. American drillers idled 15 oil rigs last week, bringing the number of active equipment down to 847, the lowest since May, according to data released on Fri- day by oilfield-services provider Baker Hughes. Crude futures extended their rally in New York after the report was released, touching a two-month high of $55.66 a barrel. A rebound in oil prices since Christmas Eve has yet to turn the sentiment of explorers who saw a late 2018 price plunge blow up spending plans and led them to tighten belts across the industry. The biggest rig cut among major US shale plays came from the Permian Basin of West Texas and New Mexico, where the count dropped by 3 this week, to 481. Helmerich & Payne Inc, the biggest US provider of land rigs, said demand for its most expensive equipment has softened for the start of this year because of uncertainty over oil prices and more prudent spending. “Discussions with several customs- ers regarding capex outlook indicates a mix of increasing, decreasing, and flat spending budgets,” chief executive officer John Lindsay told analysts and investors this week on a conference call. “However, the consistent theme is discipline, principally keeping 2019 spending within cash flow.” Helmerich joined Halliburton Co and Schlumberger Ltd in slashing spending as their customers are under pressure from shareholders to keep budgets in check. North American explorers are expected to cut their rate of annual spending growth by half to 9%, analysts at Barclays Plc wrote last month in a note to investors. In kind, explorers have cut rig usage all but one week this year.

US shale drillers resume rig cuts, shrugging off oil’s rebound

Related tags :