Wells Fargo’s $28bn oil lenders ready for boom

One year after Wells Fargo & Co became one of the last big US banks to make a net-zero promise, essentially marking its enormous oil and gas loan business for extinction, the bankers who dole out billions of dollars to fossil fuel aren’t panicking.

The specialists in oil and gas have worked through a streak of money-burning years capped by a brutal pandemic. Now the hydrocarbon business is roaring back, and Wells Fargo’s lenders sit right at the top. No one in the world put together more fossil fuel loans last year as book runner, according to data Bloomberg compiled: The bank’s 2021 tally in the sector topped $28bn; it’s racked up more than $188bn in oil and gas loans since late 2015, when the landmark Paris Agreement was adopted. That sum is more than the market capitalisation of BP, Marathon Petroleum, and Valero Energy — combined.

There are good reasons for the leaders in fossil finance to be anxious. Start with the bank’s net-zero goal: Wells has joined more than 100 financial institutions with midcentury deadlines for axing greenhouse gas. Few bankers like to be in a line of work practically marked for elimination. Even if you happen to distrust corporate pledges, the explosion of environmental, social, and governance considerations into a multi-trillion dollar industry puts pressure on those in the business of funding oil, gas, and coal.

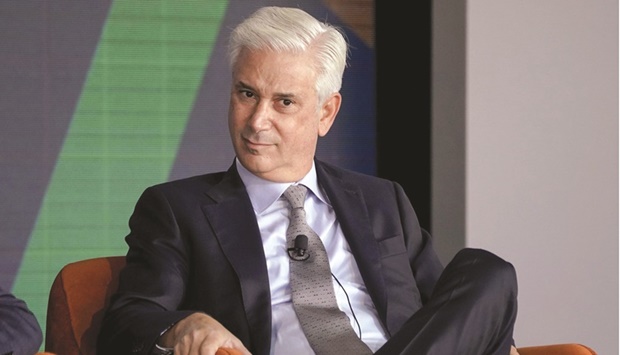

But Wells bankers are playing the long game. “There’s this idea or dynamic that it’s a light switch,” says Scott Warrender, who runs the energy and power team. The green revolution? “Our view — and in reality — it will play out over a much longer time frame.”

Wells executives won’t stop making hydrocarbon loans when the rest of us are consuming so much of it, according to interviews with 10 current and former people there. Few veterans of this business are quite sure where it goes from here. Their attitude toward the crisis of climate change veers between pragmatism and, in the case of one former executive, disdain.

It all adds up to a high-stakes moment for the energy industry, the warming world, and Wall Street, especially for a bank that chief executive officer Charlie Scharf is trying to turn around after years of scandals. Since access to capital is so important to the fossil fuel industry, which ploughs through money, the moral and financial calculations of bankers like those at Wells will play a key role in the future of the climate.

Until the economy and society both evolve, Warrender says, “our view is we need to bank the broad energy sector in all of its forms.” Over decades as an energy banker, he’s watched the hydrocarbon industry dive into busts and then climb back into big-money booms. He’s survived the tumult and learned to stick it out through the endgame, he told a journalist over a decade ago, back when he likened his job as an energy banker to his pastime of amateur boxing. Today, he says, his hobby has switched to cycling, but his focus on energy is unchanged.

“That’s going to be what’s interesting,” says Derek Detring, who had a stint eight years ago as a Wells energy banker before he started a firm advising the energy industry. “Now that we’re making money again, will investors stay away?” As the long-suffering industry returns to being lucrative, he says, “it will be harder for them to leave.”

Indeed, oil prices soared after the invasion of Ukraine and moves by the US and UK to ban Russian oil. Energy executives and their bankers are used to volatility. Wells Fargo’s fossil fuel lending has stayed at the top of the industry even as annual totals bounced around — from $23bn in 2016, up to $48.3bn in 2018, and then back down to $28.7bn last year.

Historically, bankers haven’t been under much pressure from shareholders to move faster on climate. But that could change. Last year, ahead of the United Nations climate conference, Wells joined the Glasgow Financial Alliance for Net Zero, a group of banks and fund managers representing $130tn in assets. (Michael Bloomberg, the owner and founder of Bloomberg LP, is co-chair of the alliance.) The big banks, in addition to pledging to zero out emissions, have agreed to eventually begin accounting for the carbon in their vast portfolios. Coming up with measurements for “financed emissions” will be hotly contested, and activists will be watching. In December the investor group Interfaith Center on Corporate Responsibility asked Wells and other banks to adopt a policy by the end of 2022 to ensure that lending and underwriting don’t contribute to new fossil fuel development.

For now, though, a Wall Street giant can go green and underwrite the clean-energy future while also doing deals on gas pipelines and oil fields. Wells was just ahead of JPMorgan Chase & Co last year as the book runner on syndicated loans, which means being the bank in charge when several are involved. Looking at loans gives a good sense of how fossil fuel companies finance themselves, but they also work with Wall Street to issue bonds. Wells wasn’t the biggest in that space last year — the $7.7bn it managed was about half of JPMorgan’s $15.8bn.

“We’ve been a leading financial partner to traditional energy companies, such as oil and gas producers and electric utilities, as well as the emerging renewables business, for many years,” said a Wells spokesperson. “We will continue to support our clients in this industry as they provide the fuel that powers society today, and as they respond to the evolving market.”

None of the bank’s recent oil and gas lending deals have been bigger than the $5bn revolving loan it led in 2018 for Energy Transfer LP, whose Dakota Access Pipeline is at the heart of the battle between the oil industry and the Standing Rock Sioux Tribe. Billionaire Kelcy Warren, the chairman of the Dallas-based pipeline operator, has a relationship with Wells that stretches back decades. Not long before the loan, advisory group Institutional Shareholder Services Inc recommended that Wells investors support a resolution requiring policies to help protect Indigenous groups. Protesters made their way in 2017 to the California home of Tim Sloan, then the boss of the bank, and set up an inflatable pipeline.

That didn’t scare Wells out of the business. Its most significant syndicated fossil fuel loan last year was a $3bn deal with Enterprise Products Partners LP. The Houston pipeline owner agreed in January to buy Navitas Midstream Partners and its 1,750 miles of pipeline in the Permian Basin for $3.25bn in cash.

The story of energy lending isn’t just about the future of climate — it’s also about consolidation turning dozens of banks into just a few. Wells ended up a giant in fossil loans after a string of acquisitions.