Column: Europe faces more high gas prices next winter

LONDON, Jan 20 (Reuters) – Europe is on course to end the winter of 2022/23 with a record amount of gas in storage, putting downward pressure on futures prices for deliveries this spring and summer.

But even with a record inventory carry over, the region will likely experience higher prices and renewed pressure to conserve gas in the winter of 2023/24.

Europe’s storage is designed to smooth out seasonal variations in consumption not to provide a strategic stockpile to protect against an embargo disrupting supplies.

Combined gas consumption in the European Union and United Kingdom was around 5,203 terawatt-hours (TWh) in 2019, the last full year before the pandemic, according to Eurostat.

They have enough capacity to store 1,129 TWh, equivalent to about 21% of annual consumption, according to Gas Infrastructure Europe.

In practice, storage depletion supplies a much smaller share of actual consumption each year, typically around 10%.

SEASONAL STORAGE

Seasonal storage is designed to absorb excess production during summer, discharging during winter to meet peaking consumption.

Using inventories to shift supply from summer to winter in this way is more cost-effective than maintaining lots of extra production capacity that would only be used a few months each year.

Inventories are large enough to cope with the unpredictability of winter heating demand and ensure supply does not run out in the event winter is much colder than average.

But given the relatively small volume of gas that can be stored, the inventory system cannot provide both seasonal and strategic storage at the same time.

STOCK CLEARANCE

Storage follows a two-season cycle of summer (with inventories accumulating from roughly April to September) and winter (inventories depleting from roughly October to March).

Deviations from this are usually reversed within the subsequent season via large changes in prices forcing inventories back to the long-term average within 6-12 months.

If inventories end the summer unusually high, prices fall to boost consumption, ensure inventories deplete faster and end winter close to average.

Conversely, if inventories end winter low, prices rise to curb consumption, accelerate inventory accumulation and end summer close to normal.

Price changes ensure that inventories normalise within a single storage year rather than over multiple storage years.

RECORD CARRYOVER

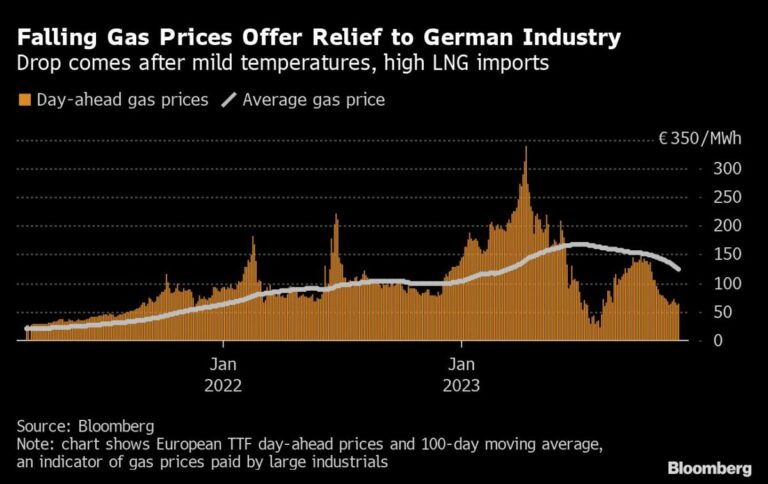

Gas conservation policies, high prices and an extended period of unusually warm temperatures between mid-December and mid-January have combined to avert possible gas shortages this winter.

EU and UK storage is on course to end the winter of 2022/23 more than 54% full, well above the average of 35% over the previous 12 years (“Aggregated gas storage inventory”, GIE, January 20).

But that means there will be much less unused space to absorb over-production during the summer season of 2023.

Lack of storage will ensure prices fall to stimulate consumption and discourage production to limit inventory accumulation.

But the futures market is forward-looking; traders are already anticipating, accelerating and amplifying the price decline.

Prices have tumbled to limit excess inventories and create more space for gas to be put into storage during summer 2023.

Futures prices for gas delivered in March 2023 have fallen to less than €65 per megawatt-hour from €177 at the start of October and a peak of €338 in August.

Pressure on storage space is likely to keep prices low this summer even if they then rise again next winter.

Given the limitations of the storage system, a record carryover from winter 2022/23 will lessen but cannot eliminate the need for high prices and conservation in winter 2023/24.

Higher inventories provide more energy security than lower ones, but policymakers should avoid implying inventories alone are enough to prevent shortages or price spikes next winter.