Roudi Baroudi

It has been a year since the Kingdom of Saudi Arabia and a few other regional countries launched an attempt to subjugate Qatar by strangling the latter’s economy with an illegal air, land, and sea blockade. They have failed, and spectacularly so.

The effort – based largely on unsubstantiated accusations of Qatari support for terrorism but actually rooted in Saudi ambitions – has forced Qatar to spend more than it had budgeted, but money is one thing that the world’s largest exporter of LNG has no trouble obtaining. After a brief period of uncertainty, therefore, economic activities returned to their usual heady pace, and business is booming in most key sectors.

There were initial concerns about shortages of some food products and other imports, for instance, but prompt government action and the responses of certain friendly countries (most prominently Turkey) have emphatically quashed both short and medium-term fears. In addition, the experience has prompted Qatar to implement long-term food security plans that will blunt any future attempts at external blackmail. Some were worried, too, that what has become the longest air blockade since World War II would wreak havoc on the transport sector.

Qatar Airways, a widely recognised symbol of Qatar’s emergence as a genuine player on the international stage, was indeed inconvenienced by losing access to the airspace over KSA, the United Arab Emirates, Egypt, and Bahrain. While the flag carrier has been forced to take longer routes and use more fuel, however, it has only redoubled its resolve to keep Qatar connected with the rest of the world.

The airline was proud to carry the first emergency supplies into the country following the imposition of the blockade, and it has added (or announced plans to add) some two dozen new destinations over the past year. In the process, Qatar Airways also picked up no less than 50 individual awards in 2017, including “World’s Best Business Class” and “Best Airline in the Middle East”. In fact the primary victims of the Saudi-led campaign have been innocent citizens of Qatar and the very countries trying to isolate it: Some 16,000 GCC families with one or more dual-national members have been cruelly torn apart by the blockade, including thousands of children separated from at least one parent. If anything, the experience has only strengthened compassion and solidarity in Qatari society, with nationals and foreign residents alike offering mutual support to bolster resilience in the face of the embargo. Never has there been stronger collective resolve to defend Qatar’s freedom and independence.

Both the resilience and the resolve have been bolstered by the performance of the marine transport industry. The siege has not only sharply curtailed Qatar’s shipping and trans-shipping options (leaving Oman and Kuwait as its only GCC outlets), but also closed its only land border (with KSA), completely eliminating overland trade. Once again, this has imposed a few new costs and prompted a few added concerns, but Qatar’s ports are reaping the rewards: the numbers of both inbound and outbound cargo shipments have risen dramatically, spinning up business for everything from modern bulk and container terminals to small local harbors and the ancillary enterprises that serve them.

In the all-important energy sector, initial concerns about possible supply disruptions have been successfully addressed, with Qatar once again leading the world in LNG exports. In addition, Qatar Petroleum has announced plans to increase LNG production from 77 million tons per annum to 100 million MTPA, which should guarantee its No. 1 exporter status for another 20–25 years. Alongside the LNG expansion, Qatar also is scaling up its already world-class petrochemical industry, with QP recently announcing plans to build a massive new complex at Ras Laffan. The company is seeking qualified partners for the enormous project, which is centred on what will be the largest ethane cracker in the Middle East, and one of the largest anywhere, plus several derivatives plants, consolidating Qatar’s position as a major player in global petchem markets.

Moreover, the entire episode has only underlined the stabilising role that Qatar has long played in the dynamics of global energy security by, inter alia, continuing to stress dialogue and diplomacy as the best means of boosting market stability, thereby protecting the interests of producers and consumers alike. Faced with serious obstacles thrown up by the blockade, Qatar’s energy sector moved quickly and decisively to ensure that its obligations would be met, and this despite conditions meeting the definition of force majeure.

It fine-tuned the tasking and disposition of its LNG carrier fleet, making even more efficient use of these assets to ensure timely deliveries to TransAtlantic, Trans-Pacific, Mediterranean, and Indian Ocean clients. It expanded and deepened cooperation with buyers and sellers to better coordinate supply with demand, further burnishing its credentials as a reliable partner. As a consequence, Qatar reaffirmed its unmatched ability to protect security of supply at any point in time, improving both security and competitiveness in world markets.

Qatar was likewise successful in demonstrating that it remains a highly attractive place to do business. Since the unlawful siege began, the government has continued to secure new foreign direct investment from some of the world’s most important oil and gas companies, including ExxonMobil, Shell, and TOTAL. Over the same period, more than 120 entities received licensing from the Qatar Financial Center, a massive increase on the previous 12-month period for the QFC platform, which confers significant benefits on registered companies, including legal and financial environments based on English common law.

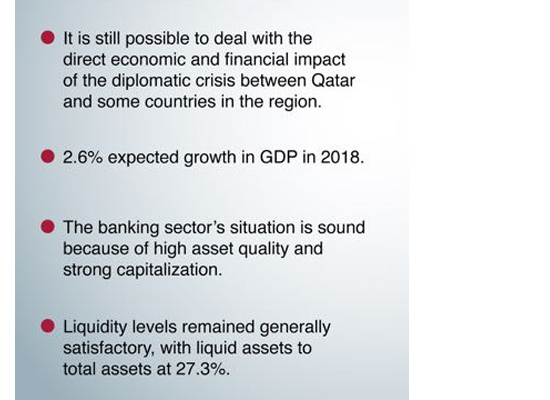

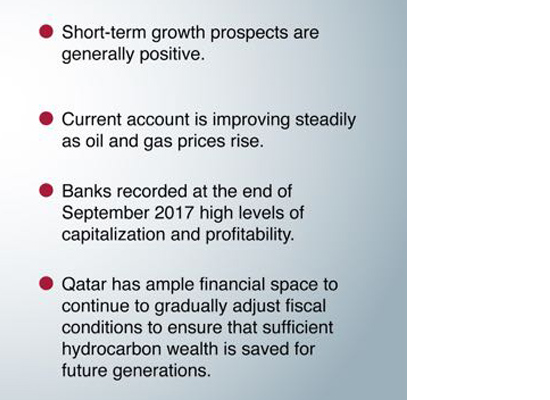

Going forward, all available data suggest that the leadership’s response to the crisis, and Qatar’s world-class financial and economic credentials, have enabled business activity to remain as robust as ever. In fact, senior officials expect growth of about 3% for 2018, meaning that in spite of the blockade, Qatar’s economy will out-perform those of most neighboring countries. In addition to all of these economic and financial successes, Qatar also has used the past year to achieve significant advances in social policy.

Nowhere was this more prominent than in the area of progressive new labor legislation, particularly as regards expatriate workers. New laws passed in 2017 give such workers several new protections, including guarantees for regular payment of wages into local bank accounts, development of mechanisms to resolve labor disputes, and the establishment of a new committee to counter human trafficking. On the geopolitical level, the entire episode has only increased Qatar’s soft power by attracting the sympathy of governments and people around the world, the great majority of whom know a manufactured crisis when they see one.

On the other hand, the failed Saudi-led attempt to isolate Qatar has managed to both exacerbate existing tensions within the GCC and to generate new ones. It also has divided much of the Arab and Islamic worlds, forced smaller countries to make impossible choices, and exposed the extent to which some governments use their financial resources to bribe or coerce those of less affluent societies. The crisis even briefly divided the top echelons of the Trump Administration in its early days. Since then, Washington has been consistent in advocating a peaceful resolution of the dispute: President Trump has offered to mediate, and then-CIA Director Mike Pompeo (now secretary of state) visited Saudi Arabia in April to warn that “Enough is enough.”

Washington also has reaffirmed its security commitments to Doha on other levels, including the continuation of its large presence at Qatar’s massive Al-Udeid Air Base. The facility, which hosts the headquarters of the Pentagon’s Central Command and more than 10,000 US and allied troops, is far and away the most important staging point for coalition air operations against terror groups across the entire region, from Syria and Iraq to Yemen and Afghanistan. In addition, the US government has approved the sale of up to 72 F-15 fighter-bombers for the Qatar Emiri Air Force. Other major powers also have lined up to help Qatar maintain its independence and, if necessary, defend its borders.

Britain, for instance, has agreed to sell Qatar at least two dozen of its multi-role Eurofighter Typhoons; France has committed to providing at least 36 of its Rafale fighters, plus almost 500 of its latest VBCI armored vehicles; and Turkey has accelerated the deployment of its troops and equipment to its own recently activated base near Doha. Several countries have continued to plan and hold joint military exercises with Qatar, and Russia has agreed to cooperation in military supplies and air defense, possibly including sales of its highly touted S-400 system.

Given these and other manifestations of support, the position of the broader international community — i.e. those not susceptible to either largesse or intimidation – is not in doubt, which means that the longer the blockading countries and their followers try to bully Qatar, the more isolated they become. By contrast, the crisis has revealed the Qatari state to have ample planning and policymaking resources. This has allowed the leadership to carry out a comprehensive response to the unlawful siege, including emergency measures to dilute the initial shock of the blockade, the fostering of greater competition in the marketplace, improved energy efficiency, and a highly ambitious program of economic self-sufficiency – all underpinned by enormously successful diplomatic and public relations campaigns.

Overall, the outlook is very positive, which is far better than anyone might have expected and indicates that Qatar will continue to play the roles for which it has become known on the world stage: championing the cause of stable, free-flowing, and competitive energy supplies; running an open, dynamic economy; providing cleaner fuels for customers around the world; developing massive new LNG capacity for global clients that will catalyse and stabilise global energy markets for years to come; advocating (and even mediating) dialogue over conflict; and exerting a moderating influence on an often volatile region.

Qatar is committed to Global Energy Partnership. All this helps to explain why Doha has refrained, on almost every level, from retaliating for the blockade by taking its own punitive measures. Solid energy policies have allowed Qatar to master the politics of LNG production and supply, and its gas sector has continued to honored all of its worldwide commitments, including those to buyers in the blockading countries. The latter are only shooting themselves in the foot by continuing their efforts to ostracise Qatar, and Doha works to maintain channels of communication so that if and when a change of heart is forthcoming, there are no obstacles to a reconciliation among brothers.

Roudi Baroudi is CEO of Energy and Environment Holding, an independent consultancy based in Doha.