Energy firms dive with oil in Asia; major markets fall into negative territory

AFP/Hong Kong

Asian energy firms took another battering yesterday after oil prices suffered their worst day in three years, while most of the region’s major equity markets fell into negative territory.

The pound enjoyed some support after Britain and the European Union said they had reached a draft Brexit deal, though observers were cautious as it faces a number of hurdles before being given the green light.

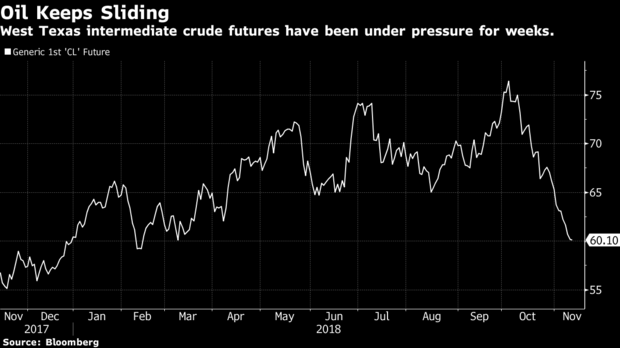

Both main crude contracts plunged Tuesday — Brent lost 6.6% and WTI 7.1% — on oversupply fears just as demand falters in the face of the China-US trade war and easing economic growth.

With prices now down more than a fifth from their four-year highs seen in early October, oil kingpin Saudi Arabia this week said it will cut output.

The announcement fuelled an initial surge in the crude market before a Donald Trump tweet calling for it to keep prices low sent the commodity plunging.

The selling continued on Tuesday and then Wednesday in Asia after Opec trimmed its outlook for demand this year.

And energy firms were caught in the crossfire.

Hong Kong-listed CNOOC dived 4.7% while Sinopec slipped 2.3% and PetroChina lost 3.6%. In Tokyo, Inpex was 1.9% down and Australia’s Woodside Petroleum sank 2.5%.

“Oil prices remain the hottest topic in capital markets if not in the world after extending their slide to 12 days and suffering one of the more precipitous falls in years,” said Stephen Innes, head of Asia-Pacific trade at OANDA.

“It’s all about the toxic combination of weakening global demand and oversupply that has sent prices tumbling.”

And Rakuten Securities commodity analyst Satoru Yoshida tipped Trump’s pressure to keep Opec from making deep cuts.

Broader markets were also lower, with Hong Kong slipping 0.5% and Shanghai down 0.9%.

Earlier, figures showed Chinese consumer spending slowed last month, with officials pointing to shoppers saving for the annual Singles Day mega-sale that took place on November 11.

However, there was some upbeat news in an improvement in investment and industrial production.

Sydney lost 1.7%, while there were also losses in Singapore, Seoul, Wellington and Bangkok.

But Tokyo edged up 0.2% despite data showing the Japanese economy shrunk in July-September owing to weakness in China and a series of natural disasters hitting domestic spending.

Manila, Mumbai Taipei and Jakarta also enjoyed gains.

In early European trade, London fell 0.5%, Paris shed 0.8% and Frankfurt was 0.9% lower.

There was little movement after comments from the White House’s top economic adviser Larry Kudlow that US and Chinese officials were “having communications at all levels” on trade ahead of a possible meeting between Trump and President Xi Jinping this month.

With both sides digging their heels in, expectations for a breakthrough are low, analysts said.

On currency markets, the pound managed to hold on to small gains that came on the back of news that Prime Minister Theresa May finally had a Brexit agreement to put to her cabinet.

However, she must now get it past a divided cabinet before putting it to parliament, where both pro- and anti-Brexit MPs are unhappy with the few details that have so far emerged from the pact. “Failure to pass the deal will raise the prospects of a disorderly Brexit, a general election and also a second referendum,” said Rodrigo Catril, senior foreign exchange strategist at National Australia Bank.

“By the end of the week with some certainty the pound won’t be trading near current levels, it could be significantly higher or massively lower.”

And Neil Wilson, chief market analyst at Markets.com warned: “The cabinet will likely pass it but with assault from all sides of the house and Brexit divide, it seems impossible parliament will vote it through.”

The euro was also enjoying some lift from the Brexit developments, though the gains were tempered by news that Italy’s populist government had stuck to its wallet-busting budget plan, putting it on course for a standoff with Brussels.

Data showing the first shrinkage of the German economy for three years added to pressure on the unit.

In Tokyo, the Nikkei 225 closed up 0.2% to 21,846.48 points; Hong Kong — Hang Seng ended down 0.5% to 25,654.43 points and Shanghai — Composite closed down 0.9% to 2,632.24 points yesterday.