New natural gas discoveries offshore Cyprus have revived the possibility of the island hosting an LNG plant

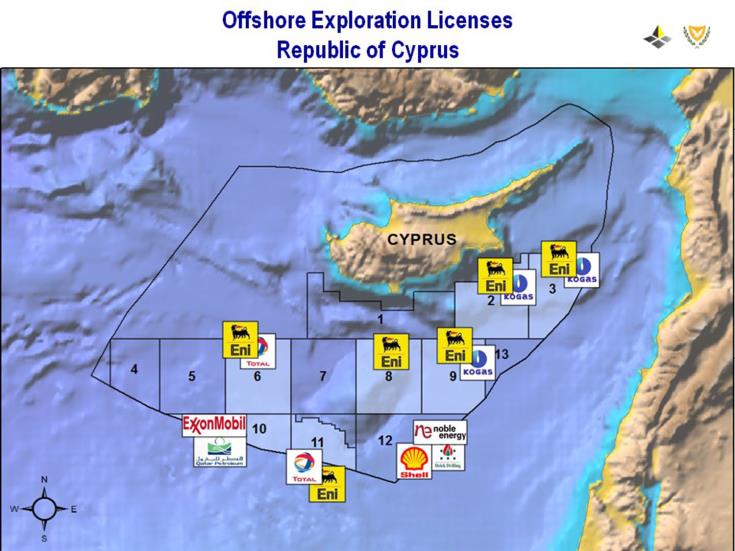

Cyprus is finally in a position where it can realistically start exploring a number of ways of getting natural gas to market. Seven years after the first discovery in Cyprus’ offshore economic exclusion zone (EEZ) — the Aphrodite field in Block 12 (4.5tn ft3 of gas in place) — the island has notched up two more finds.

Last year, an Eni-Total consortium struck gas at Calypso in Block 6 (estimated 3-5tn ft3). The most recent newcomer is Glaucus-1 (5-8tn ft3) in Block 10, discovered by ExxonMobil, partnered by Qatar Petroleum.

Energy minister Yiorgos Lakkotrypis, addressing Gulf Energy’s Eastern Mediterranean Gas Conference in Nicosia in early March, said the “quality of the reservoir in Block 10 allows us to be optimistic about the very high recoverability potential” of the ExxonMobil discovery. Last year, the first well drilled on Block 10 failed to find commercial reserves. With the Glaucos success, “we are waiting for the remodelling or re-calibrating of geological data and will look again at Block 10 targets”.

Sounding upbeat, Lakkotrypis was keen to move on to the subject of how to monetise “the discoveries we’ve had — and hopefully we’ll be having some more”. At present, the plan is for gas from Aphrodite to be exported to Egypt by pipeline. As for the other resources, “a number of parameters will determine what choice we will make, and until that moment comes we will be maturing all options together”.

LNG option favoured

According to Andreas Koutsoulides, commercial manager of the state energy firm Cyprus Hydrocarbons Company (CHC), four monetisation options are under review. The first would involve the construction of an LNG plant at Vasilikos on the southern coast of Cyprus. In the aftermath of the Aphrodite discovery a plant site was prepared and a master plan drawn up. But the scheme was deemed commercially unviable, given the limited discoveries off Cyprus at the time. Koutsoulides adds the venture would require “a minimum threshold of 10-15tn ft3 of resources to enable such a plant to go ahead”. The LNG proposal “is number one in terms of strategy because not only is it a solution that can bring upstream revenue to the country, but it will also have additional effects on the domestic economy in terms of employment and significant industrial activity”.

The second option is to export gas to the Egyptian market. The CHC executive sees potential demand in the domestic Egyptian market and for liquefaction, with capacity in the two existing LNG plants, Idku and Damietta. Plans for monetising Aphrodite gas “are crystallising towards Egypt because of the supply and demand structure there, the availability of infrastructure and changes in the gas market regulatory framework”.

The third option is for a floating LNG plant, which offers “tried-and-tested technology and we are looking at that very seriously. A floating facility gives lots of flexibility to move onto another field. Also, the threshold for the resources required to get a project up and running is lower than for an onshore facility.”

Pipeline to Europe

The final option is the East Med Gas Pipeline project that envisages natural gas from Israel and Cyprus being transported for sale in the markets of northern Europe. “There has been a sharp decline in Europe’s energy supply,” Koutsoulides says, “and they have been looking for years for diversification of supply.” FEED studies for the project have started.

In the view of East Med energy consultant Charles Ellinas, the Cypriot authorities should concentrate on the first of the four options: an onshore LNG plant—” a three-train facility to keep the unit costs down.” The gas resources could come from fields offshore Cyprus, and from the Leviathan field off Israel (22tn ft3 of gas in place). The Leviathan project, Ellinas says, “is having some troubles finding customers”. Future finds from fields offshore Israel operated by Energean might also find their way to Cyprus for liquefaction. A company spokesman tells Petroleum Economist that Energean is “examining all potential export routes for its gas fields in Israel”.

Attracting Israeli gas to Cyprus could be geopolitically advantageous for the island. Turkey, which opposes the exploitation of Cypriot gas while the island remains divided and which claims sovereignty of some of Cyprus’ EEZ, says it plans to drill off southern Cyprus—a potentially destabilising prospect for the Cypriot energy sector. But such a move could also threaten Israel’s interests, if its gas reached the island; and Turkey might think twice before risking confrontation with Israel.

Imports enthusiasm wanes

Another factor that both Cyprus and Israel have to take into account is Egypt’s rising gas production and its diminishing hunger for imports. Egyptian company, Dolphinus Holdings, has signed a 10-year contract with Noble Energy and Delek Drilling for gas supply from Israel’s offshore fields to Egypt. But a number of technical and security issues have yet to be resolved. Also, new discoveries, such as the one expected at Eni’s offshore Nour field, will boost still further Egypt’s reserves, adding to the 30tn ft3 at the mega-giant Zohr field. Enthusiasm for importing gas from elsewhere is likely to fall sharply.

In the chaotic aftermath of the 2011 popular uprising, Egypt was forced to import LNG. Now it is resuming its own LNG exports. “If the minister of petroleum is allowing Egypt to export, then he must be confident Egypt will have sufficient production to do so,” says Ellinas.

A question mark, therefore, hangs over the plans for the sale of the relatively small volume of Aphrodite reserves to Egypt. If there was no urgency for Egypt to access these when the country was short of gas, it is hard to see the Cairo authorities making the project a priority today.

Get LNG going

Ellinas considers the Aphrodite plan a distraction. “Cyprus should start developing LNG now and not wait. If Aphrodite gas was sold to Egypt, it would delay things another two-to-three years. And the longer you leave it, the more difficult it becomes. ExxonMobil has mega-projects elsewhere. Just because they made a discovery in Cyprus, it isn’t a game-changer for them.”

As for the idea of a pipeline to take East Med gas to Europe, Ellinas says it simply is not commercially viable. “To produce gas in Israel costs $4-5/mn Btu. By the time you add on pipeline costs and a profit, it is arriving in Europe at $8-9/mn Btu. Gazprom can deliver gas to Europe at a profit at $4.50/mn Btu. Even US LNG is finding it difficult. It is a very competitive market.”

So, with geopolitics keeping the vast and hungry Turkish market next door off limits, it could well be LNG or nothing for Cyprus’ offshore gas finds.

Some analysts say Cyprus could become an East Med energy hub. Others, more realistically, see Egypt taking that role, leaving Cyprus as a regional service centre. But even the more limited goal will not be met, companies say, if they are not allowed more space to operate.

The Cypriot government has approved the development of Vasilikos, the site of the proposed LNG plant on the southern coast, as a dedicated energy port. But this will not be ready until 2023. Until then, energy sector companies will share space at the island’s main commercial port, Limassol. And it is proving to be a tight fit.

Alessandro Barberis, managing director of Eni Cyprus, says “currently, we as operators are forced to use the only oil and gas space available, at Limassol port. It is not enough if simultaneous drilling operations are under way. The Vasilikos port project is targeted for 2023, but we need to think of the medium term.” Dalio Vitale of Halliburton agrees: “Vasiliko is important, but it’s five years away. We need something in the shorter term.

Varnavas Theodossiou, head of ExxonMobil in Cyprus praises the island’s stable investment climate, well-defined legal system and robust tax regime. But he, too, is frustrated by the cramped working conditions. “Maybe Cyprus can expand Limassol port, maybe we can use Larnaca,” he says. “But the current port situation is not sustainable for operators.”

In the view of Yves Grosjean, general manager of Total, Cyprus should put aside any notion of becoming an energy hub — that would take five-to-10 years to achieve. “However,” he adds, “when we talk about an oil and gas service centre we are talking about an urgent need that won’t go away.” Space is needed without delay because “in some cases there are up to 20 different companies working with one operator for drilling one well”.

Jorgen Berg managing director of Schlumberger Cyprus, says it is “important to assess the needs of the industry, and certainly a port is one of those needs. If the issue is not addressed adequately, then “we as operators will follow our own interests elsewhere”. Other deep-water ports such as Malta could fit the bill. Cyprus’ “advantageous position will not last for ever”. As it is, the lack of space seems certain to slow down IOCs’ drilling schedules, with Eni-Total planning five wells at the end of this year, ExxonMobil two next year. It is hard not to see a queue forming at Limassol port.