Looks like OPEC is at it again.

Looks like OPEC is at it again. With record amounts of Oil all over the place, including the fully loaded ships at sea, Oil prices are artificially Very High! No good and will not be accepted!

Looks like OPEC is at it again. With record amounts of Oil all over the place, including the fully loaded ships at sea, Oil prices are artificially Very High! No good and will not be accepted!

(Bloomberg) — The geologist who earned the wrath of shale drillers a decade ago with forecasts that natural gas was about to run out is now warning that the Permian Basin has just seven years of proven oil reserves left.

Arthur Berman, a former Amoco scientist who now works as an industry consultant near Houston, said the Permian region of Texas and New Mexico that currently pumps more oil than any other North American field won’t last for long. And the Eagle Ford shale about 350 miles (560 kilometers) away in South Texas isn’t looking good either.

Berman’s grim outlook, based on analyses of reserves and production data from more than a dozen prominent shale drillers, flies in the face predictions from the U.S. Energy Department, Chevron Corp. and others that the Permian is becoming one of the dominant forces in global crude markets.

Permian output already exceeds that of three-fourths of OPEC members.

“The best years are behind us,” Berman told a gathering of engineers, geologists, lawyers and financiers at the Texas Energy Council’s annual gathering in Dallas on Thursday. “The growth is done.”

Berman came to prominence as a shale skeptic and peak-oil advocate during the first decade of the new century, when intensive fracking and sideways drilling techniques were just beginning to unlock vast reserves of gas from shale fields in Texas and Louisiana. At the time, his dire warnings that shale gas was mostly hype drew the ire of fracking pioneers including Devon Energy Corp. and Chesapeake Energy Corp.

In 2009, Devon’s exploration chief Dave Hager — who has since risen to CEO — published an op-ed piece in an Oklahoma City newspaper to refute Berman’s thesis. In it, Hager likened shale to a World Series-winning home run and said Berman “is in the stands speculating on whether the slugger is on steroids.”

Berman on Thursday said investors banking on shale fields to make major contributions to future global crude supplies will be disappointed: “The reserves are respectable but they ain’t great and ain’t going to save the world.”

Still, he hasn’t sold the stock of shale driller EOG Resources Inc. that he inherited from his deceased father “because they’re a pretty good company.”

His parting advice to the assembled was, “Conserve what you’ve got, learn to live with less, open your eyes and enjoy the rest of your day.” No one participated in the Q and A session.

The shale boom’s back in full swing, with fracking crews the busiest since 2014. The novelty this time around: Oil executives stressing their prudence, along with their production.

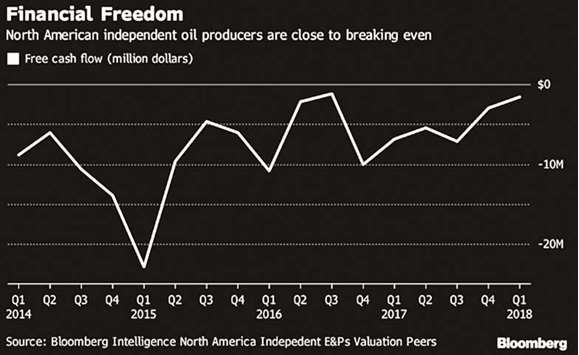

The combination of surging output, oil prices at three-year highs and spending under control means that the shale patch – which has notoriously burnt more cash than it makes as investors bankroll their expansion – got closer to a milestone in the first-quarter: Positive free cash flow. As oil rises above $70 a barrel, the outlook for the coming quarters looks even brighter.

It’s a shift that came with the help of new high-tech well systems, and at the insistence of investors pushing payback over growth. Here are five key takeaways from the first quarter to track moving forward: Production is thriving

EOG Resources Inc and Pioneer Natural Resources Co are among producers that posted record output, while keeping capital expenditures in check.

But how can they keep growing without overspending?

Producers have sought to cut costs since prices crashed more than three years ago, but those efforts can only go so far. It’s mainly better technology that’s allowing them to get more from each well without blowing their budgets.

Pioneer, in a recent presentation, offered insight into how its high-tech wells are delivering at a faster rate, a theme repeated over and over again in earnings calls. Devon Energy Corp said it completed the two highest-rate wells in the Delaware section of the Permian in its 100-year history, helping it to a 20% production boost.

Almost living within their means

Buybacks, dividend increases and a cap on capital expenditures. Oil executives couldn’t keep from crowing about their thriftiness while producing record amounts of product, and how their efforts can be a benefit to both their shareholders, and to continued growth.

The numbers back them up, showing a pretty good rise in free cash flow, starting from the end of 2016.

The oil rally’s flip side: HedgingA big risk facing some producers now is the amount of wrong-way bets on oil prices that they hold. When crude markets slumped, explorers used hedging contracts to lock in payments for future barrels that could now turn sour as futures trade above $70 a barrel.

Wood Mackenzie Ltd’s Andrew McConn estimates top producers will lose $7bn on their hedging contracts in 2018.

The reality on the ground

To make record production a reality, oil-service providers are sending a growing number of fracking crews to shale fields to blast the oil-rich layers of rock with water, sand and chemicals.

But for the service providers, that hasn’t translated into better profits yet.

The rush to respond to heightened demand has inflated costs for materials like sand and has triggered transportation bottlenecks and labour shortages. All that has weighed down on their first-quarter results. Schlumberger Ltd, the world’s biggest oilfield service provider, and Halliburton Ltd, the top fracker, have both promised investors things will improve. If that means increasing prices for their services, costs will rise for producers.

LONDON (Reuters) – A decade ago, the news that the world’s top oil and gas companies had less than 12 years of production left in their reserves might have caused a panicked sell-off in their shares.

But as consumers try to move away from fossil fuels to cleaner and cheaper energy sources, investors and executives say reserve size is no longer the gold standard for measuring the value and health of a company.

The cost of developing existing reserves and the amount of carbon those reserves produce has now become more important, they say. This is leading to a profound shift in company strategies.

“The quality of reserves and the commercial viability of reserves has eclipsed the quantity of reserves by far in recent years,” said Adi Karev, Global Leader for Oil and Gas at EY.

The sector is emerging from one of its longest and deepest downturns after an oil price slump that started in 2014.

The largest publicly-traded oil companies — Exxon Mobil, Royal Dutch Shell, Chevron, ConocoPhillips, France’s Total, BP, Equinor (formerly Statoil) and Italy’s Eni — have adapted. They saved money by cutting jobs and increasing technology spending and now make more money with oil at $60 a barrel than they did at $100.

But they also cut spending on exploration for new resources and development of new fields. This led to a decline in reserves.

An analysis by Reuters and Guinness Asset Management of the annual reports of those eight companies shows that the size of their oil and gas reserves, when added together, fell to 91 billion barrels in 2017. That was the lowest since the same amount in 2005.

BP and Chevron’s oil and gas reserves increased by a small 5 percent since 2014. Eni was the only one to significantly boost its reserves by over 20 percent thanks to the discovery of the giant Zohr gas field off the coast of Egypt.

The cumulative reserve life – the number of years a company can sustain its current production levels with existing reserves – of the eight companies fell to 11.7 years in 2017. That was the lowest level in at least 20 years although that drop is also the result of a sharp increase in production. Reuters does have access to data going back beyond 1998.

Exxon’s reserves life shrank from 17 years in 2014 to 15 in 2017. Eni’s from 10.6 to 10.1 years despite its discoveries. Shell slipped from 12 to 9 years over the period.

“There is clear deterioration (in reserves) and this will be a problem in time,” according to Jonathan Waghorn, manager of the energy fund at Guinness Asset Management.

But for now, “10-12 year’s reserve life should be fine, so it is not a materially important component between the Majors.”

With electric vehicles on the ascent and a peak for fuel demand on the horizon, the focus on the reserves is shifting to the quality of the reserves rather than the quantity

“At some point we see a shrinking oil and gas industry, when that will be I do not know, but then it is really important that the best barrels come in and that will be increasingly a competitive factor.”

Some companies are already changing strategies to adapt to the new focus.

Oil prices are not expected to rise sharply in the long-term and governments are seeking to reduce pollution and greenhouse gas emissions. This means firms are adjusting by setting ceilings for the cost of projects, often below $35 a barrel. Oil reached a $80 a barrel this month, the highest since late 2014.

Crude oil and natural gas have different grades and the cost of pumping them can vary hugely. Saudi Arabia’s oil is easier and therefore cheaper to extract than Angola’s complex deepwater wells.

Canada’s oil sands have become less attractive due to their high cost of extraction and high carbon intensity. Exxon wrote down a large part of its Canadian oil reserves in 2017. Its largest rival, Shell, has sold most of its Canadian assets in recent years.

North American shale which has emerged over the past decade can be developed relatively quickly and at low cost, in contrast to multi-billion dollar deepwater projects that take years to develop.

The Permian basin in Texas, the heartland of the shale oil boom in recent years, saw production costs drop sharply to as low as $30 a barrel.

Exxon and U.S. rival Chevron have both acquired large acreage in the Permian in recent years. Shell is also expanding in U.S. shale.

The Gulf of Mexico also has low extraction costs because it has large reservoirs of oil and some infrastructure is already located there such as services companies and onshore bases.

Brazil’s pre-salt reserves also have low costs as there are huge reservoirs and also some existing infrastructure. All eight companies are there and several have recently sharply increased their production in the basin.

“We are now getting to the point that the focus on efficiencies and producing reserves at a low level is what investors expect,” Karev said.

Higher oil prices offer “temporary” relief to the oil exporters of the Middle East and North Africa (Mena) whose economic prospects are improving, according to the Institute of International Finance (IIF), the Washington-based economic think tank.

Oil prices rose rapidly in the past six months on unanticipated sharp output fall in Venezuela, the extension of the producers’ pact on production cuts to the 2018- end, the escalation of tensions in the Mena, which enhanced risks of oil supply disruption; and higher global oil demand. We have revised upward our average Brent oil price assumption to $72 per barrel for 2018 (33% increase form 2017),” IIF said.

With the projected $18 increase in average oil prices in 2018 against last year, it expects the cumulative current account surplus for the nine Mena oil exporters (Saudi Arabia, the UAE, Kuwait, Qatar, Oman, Bahrain, Algeria, Iraq and Iran) to increase from $56bn in 2017 to $233bn (9.5% of gross domestic product) in 2018. “The fiscal situation for Mena oil exporters (except Bahrain and Oman) is now on firmer footing. The respective authorities in the region have implemented serious fiscal adjustment in recent years,” it said.

Higher oil prices, combined with additional non-hydrocarbon revenue, should more than offset the 7% average increase in public spending, leading to narrower deficits (excluding investment income), according to the IIF. “We expect the consolidated fiscal deficit for the nine Mena oil exporters to decrease from 7.5% of GDP in 2017 to 3% in 2018,” it said, adding when included investment incomes, which are very large in Kuwait, the UAE and Qatar, the cumulative deficit will be much smaller.

Highlighting that gross public foreign assets will resume its rise to $2.9trn by end-2018; it said about 70% of these assets are in the form of sovereign wealth funds. With relatively little public external debt, the region’s net public external assets position of $2.6bn (108% of GDP) is substantial, the report added. Expecting non hydrocarbon growth to accelerate from 2.3% in 2017 to 2.8% in 2018 (still well below the average growth of 6.2% in 2001-2014); IIF said the growth pickup will be supported by the shift to fiscal expansion following three years of consolidation. A tighter monetary stance in the six GCC countries and Iraq, whose currencies are pegged to the US dollar, could offset some of the gains from expansionary fiscal stances. “We expect a cumulative increase of 100 bps in key policy rates, in line with the four Fed hikes of 25 bps each,” it said.

ATHENS: Offshore gas from the Eastern Mediterranean could usher in a new era of energy independence and economic renaissance for Europe, a regional energy expert told a high-profile industry conference in Athens on Friday.

“Almost instantly, the flow of East Med gas into Europe would mean additional diversification and flexibility of supply, closely followed by enhanced competitiveness for European industry, accelerated economic growth, and dramatic long-term improvements for public finances,” Roudi Baroudi, a veteran of more than 36 years in the oil and gas business, told the Athens Energy Conference.

While “East Med gas would be more of a complement than a competitor to supplies already flowing … from Russia” and other countries, he explained, other factors were also likely to help Europe diversify its energy supply, putting downward pressure on prices and “reducing the potential impact of possible interruptions elsewhere”.

Baroudi, who currently serves as CEO of Energy and Environment Holding, a Doha-based independent consultancy, has advised governments, companies, and multilateral institutions on energy matters, even helping to craft policy for agencies of the European Union and the United Nations. Speaking on the sidelines of the conference, which drew a broad audience including senior figures from both the public and private sectors, he said the timing “could not be better” for Europe.

“Shale gas has made America another energy superpower alongside Russia and OPEC, and liquefied natural gas is now a fully fledged global commodity,” he said. “Plus, the East Med producers will be sitting on Europe’s doorstep, and several countries are already gearing up to start taking massive LNG shipments. Decades of benefits for hundreds of millions of people, all there for the taking.”

And expected producer countries like Cyprus, Greece, and Lebanon, Baroudi added, stand to gain even more. “For a variety of historical reasons, most of these countries have not yet achieved the levels of development enjoyed in most of the European Union,” he told the conference. “Given the potential rewards for their peoples, the governments involved have nothing less than a moral responsibility to take advantage of propitious circumstances by tapping the oil and gas wealth within their respective social, economic, and geopolitical reaches.” Baroudi also has emphasized some of East Med countries are not party to UNCLOS but all countries are signatories to the UN Charter. Therefore, Baroudi reminded that all these countries are under an obligation to “settle their international disputes by peaceful means in such a manner that international peace and security, and justice, are not endangered.”

He also sounded notes of caution, however. For one thing, he stressed the need for producer countries to ensure proper management of the proceeds from gas sales to pay social justice. For another, he reinstated on the same countries to avoid international tensions that might impede development of the sector.