CYPRUS AND LEBANON PARTNERSHIP WOULD BE WIN-WIN – BY ROUDI BAROUDI

Lebanon’s hosting of a key Cypriot Cabinet minister this week must have optimists in both countries hoping that in politics, at least, there really is no such thing as coincidence. Both sides have long experience with the various discomforts associated with being buffeted by outside forces, but only rarely – if ever – have both had so much to gain by joining forces to ride out the storm.

The minister in question was George Lakkotrypis, holder of the powerful Energy, Commerce, Industry and Tourism portfolio in the recently installed government, and while diplomatic sources were quoted as saying the visit was mostly “symbolic,” there is reason to believe that what it presages could be very concrete indeed.

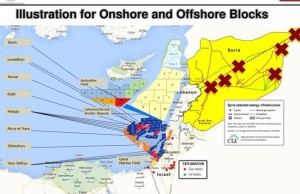

Both Cyprus and Lebanon are just a few years from becoming producers of natural gas, and while their opening positions and respective approaches have thus far been different, each is looking increasingly like the other’s best friend.

Their relatively large banking system having been crippled by exposure to the meltdown in Greece, the Cypriots had to request a bailout and are still emerging from a bruising encounter with the so-called “troika” of the European Union, the European Central Bank and the International Monetary Fund.

The government has managed to negotiate a better overall deal than that which the troika originally sought to impose, but it remains to be seen whether Cyprus can also secure the necessary time and space to meet its obligations without putting its economy through undue – and completely unnecessary – hardship.

The irony here is that while Cyprus is currently starved for cash and forced to implement strict measures against capital flight, the coming gas bonanza will soon make short work of its debt, a single undersea block having been reliably estimated to hold deposits of gas worth approximately twice the total cost of the bailout. And since these reserves are hardly a state secret, it is difficult to understand why the troika has been so insistent on enforcing such tough terms.

Some suggest that the motivations actually have little to do with Cyprus’ finances but are driven instead by Europe’s complex relationship with Russia.

Harsh as the bailout measures are, Cyprus had little choice in the circumstances but to accept and implement them in full to help the country emerge from the crippling financial crisis. There are useful lessons to learn from now on in economic management.

How early Cyprus emerges and bounces back to a new era of economic prosperity – which is for sure soon – will depend on the focus and attention given, as well as reinforcing the enabling environment to attract private investment into the large emerging oil and gas developments.

Cypriots should take consolidation that the current hardships will be short-lived, if the appropriate measures are taken to tap its hydrocarbon reserves. There is still a lot of good will in the international financial markets and the Gulf toward Cyprus. With the show of commitment and demonstrated will, and resolve to ride the current storm, the future looks bright. After the crisis, there are prospects for economic rebound and long-term steady growth.

Come what may, the combined logics of geology, geography and economics dictate that Cyprus will become a regional energy hub. That destiny may be delayed and/or diluted by other factors – including the U.S.-brokered reconciliation that is expected to open up massive sales from another emerging gas power, Israel, to the nation that still occupies a third of Cyprus’ territory, Turkey – but it will not be denied.

All that remains to be seen is how soon the island nation will be able to build the liquefied natural gas plant and other infrastructure elements that only make sense on its shores, and the biggest obstacle is the troika’s insistence on frontloading Cyprus’ obligations under the bailout deal, which will make funding more difficult to secure.

For these and other reasons, many Cypriots feel they are being treated unfairly by their European partners, a conclusion that is difficult to question. Just as understandably, the Cypriot government will be casting about to see what gains it can realize by pursuing stronger economic and political ties with its friends outside Europe.

And here sits Lebanon, hemmed in between an ever-hostile Israel and a self-immolating Syria. Its people, too, dream of a more affluent future made possible by gas revenues, but it also faces constraints imposed by geopolitical factors.

Whatever the extent of the hydrocarbons locked off its coast, their practical value is largely a function of whether Israel will try to prevent their recovery; and how cheaply they can be got to market.

The Lebanese need Cyprus on both counts because the latter already has a signed deal delineating its maritime boundaries with Israel and could therefore be instrumental in mediating a Lebanese-Israeli understanding (even if unofficial); and its opening of the aforementioned LNG plant would provide a necessary outlet for Lebanese exports.

As luck would have it, the Cypriots could use a little help from Lebanon too: a long-term deal for Lebanese gas as feedstock would further enhance the LNG facility’s economic viability, and Lebanon’s contacts in the Arab world might be useful in securing strategic investors for this and other projects, something that would pay added dividends by boosting broader international confidence in the recovery of Cyprus’ economy.

The potential for a genuine win-win outcome is very real, but only if the Lebanese and the Cypriots recognize the need to work together – and avoid getting distracted by either local or international politics.

Roudi Baroudi is an energy and environment economist based in Doha, Qatar.