What’s next after new Energean gas discovery in Israel’s Karish North Field? Expert underlines need for Lebanon to lay groundwork for maritime boundary deals with Cyprus and Syria

DOHA/BEIRUT – By Myriam Balaa: Israel’s latest undersea gas find further demonstrates that Lebanon should be doing everything it can to pave the way for its own offshore oil and gas industry, specifically by settling its maritime boundaries with Cyprus and Syria, one of the region’s foremost authorities on energy development says.

In an interview following Greek/Israeli-owned Energean’s announcement of a second discovery in the Karish North Field adjacent to Lebanese waters, energy consultant Roudi Baroudi said the news was actually good for Lebanon.

“It’s no surprise that they found more. It just underscores what we’ve known for several years: we haven’t located all the resources tucked away beneath the seabed of the East Med, including deposits awaiting discovery off Lebanon’s coast,” said Baroudi, who has more than four decades of experience in the energy business. “The problem is that Lebanon’s ongoing political quagmire has caused significant delays in the development of the country’s nascent offshore hydrocarbon sector.”

Baroudi, who currently serves as CEO of Energy and Environment Holding, an independent consultancy based in Doha, Qatar, confirmed that the new find seemed to be located very close to the maritime boundary line (MBL) agreed to by Lebanon and Israel in October 2022. That agreement, reached after years-long mediation by the United States, was a “necessary step”, he explained, but “it alone has not been sufficient to fully activate Lebanon’s oil and gas industry.”

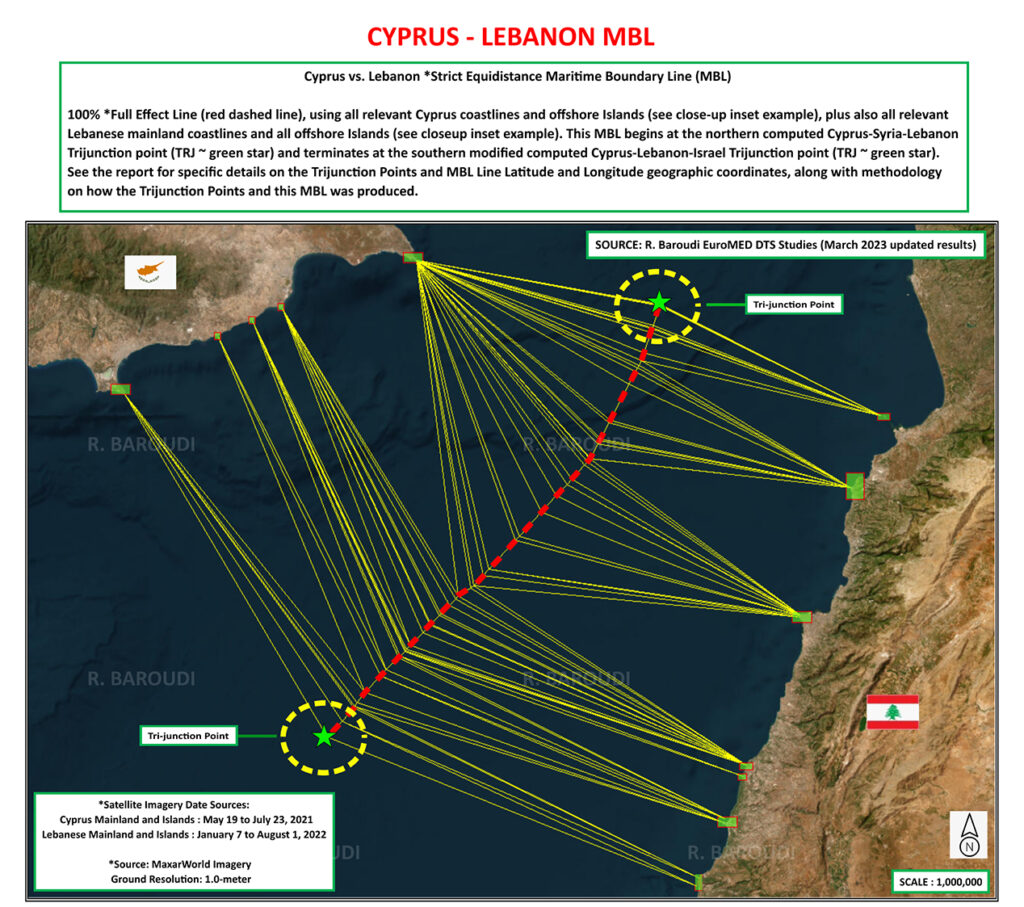

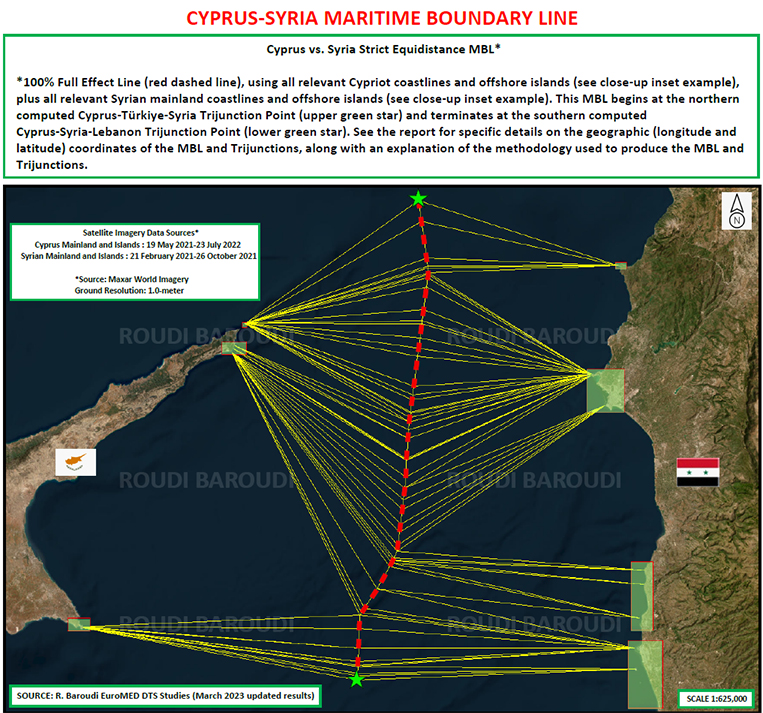

Asked how Beirut should proceed at this juncture, he stressed the importance of moving ahead with efforts to finalize Lebanon’s MBLs with Cyprus and Syria, “which would achieve full international recognition of Lebanon’s Excusive Economic Zone, thereby reducing the risk for the big energy companies whose assistance we need in order to fully explore and exploit our offshore resources.”

“We’ve already negotiated the different equidistance points for a completed MBL agreement with Cyprus, we just haven’t ratified it,” Baroudi explained. “That means we just have to adjust a few coordinates in order to set a trijunction point where the Lebanese, Cypriot, and Israeli MBLs intersect at sea. And setting that trijunction in the south will automatically simplify the process of setting another in the north for Lebanon-Cyprus-Syria”.

He also played down claims in some circles that a significant gap exists between the Lebanon-Cyprus line and the Cyprus-Israel line, making it more difficult to set a trijunction.

“There is a gap, of course, but it’s really quite small,” Baroudi told the reporters “The proof of this is in the delineation of the offshore blocks issued by both Lebanon and Cyprus about a decade ago. On all the international blocks maps of the area, even including the ones issued by the oil and gas companies, which focus on accurate portrayals of acreage, there is no overlap. In fact, virtually all of the line between Lebanese and Cypriot blocks precisely tracks almost a MBL line agreed which Nicosia and Beirut agreed to in the unratified agreement. The difference at the southern end of the trijunction point is very, very small.”

The smaller the gap, he explained, the easier it should be to finish defining Lebanon’s EEZ.

“Since the lines are so close, setting a trijunction – the point where the Lebanese, Cypriot, and Israeli boundaries intersect – should be relatively easy,” he said. “In addition, agreeing that trijunction in the south would automatically simplify the process of setting one in the north for Lebanon-Cyprus-Syria. And keep in mind: Lebanon has strong & friendly relations with both Cyprus and Syria, so these negotiations will be a lot friendlier than the ones with Israel, which had to be pursued indirectly via American mediation.”

When asked about how any new diplomatic efforts might be affected by the long-running political paralysis in Beirut, where the presidency has been vacant since late 2022 because rival parties in Parliament can’t agree on a successor to former President Michel Aoun, Baroudi said the quagmire only accentuated the need for action.

“Right now, Lebanon can’t officially ratify into a new MBL agreement with either Cyprus or Syria because it requires a presidential signature, but that doesn’t stop us from carrying out the necessary talks,” he said. “In fact, we should be rushing to get all of this settled now so that when we finally fill the vacancy at Baabda Palace, we’ll have everything ready for the new president’s signature.”

In addition to settling its maritime boundaries, Baroudi said Lebanon also had another reason to re-engage with neighboring countries.

“It’s been almost ten years since Cyprus proposed a unitization agreement (joint development agreement) with Lebanon for joint production from any deposits that straddle their shared MBL,” he recalled, “and the Lebanese paralysis has kept it from happening. We need to revive this process and get a deal in place. That way, again, once we have a president in office, we’ll be ready to hit the ground running, with no further delays, and start collecting the badly needed gas revenues”.

FLORENCE – The 25th anniversary of the euro’s introduction, which has passed largely under the radar, offers an opportune moment to assess the current state of the greatest monetary experiment in modern history.

The euro’s launch in January 1999 polarized economists. In the face of much skepticism – the late American economist Martin Feldstein even argued that the single currency could trigger a war in Europe – the euro’s architects envisioned a future characterized by macroeconomic stability, anchored by an independent central bank and a fiscal framework geared toward stability. Structural reforms, which the European Union’s member states were expected to implement, were meant to enhance the monetary union’s capacity to adjust to shocks.

None of those scenarios materialized. Over the past quarter-century, the euro has shown extraordinary resilience, navigating through several critical challenges and defying early predictions of its collapse. But while the single currency has delivered on some of its promises – most notably, maintaining price stability for most of its existence – it has failed to boost Europe’s potential growth or facilitate the continent’s full economic and political integration.

This mixed record can be attributed largely to the fact that Europe’s economic union was incomplete from the outset. Despite the significant progress that has been made since its inception, the eurozone’s fiscal and economic frameworks remain woefully underdeveloped compared to its monetary infrastructure.

To understand the consequences of the eurozone’s unfinished architecture, it is useful to divide the past 25 years into four distinct periods. The first phase, from 1999 to 2008, could be labeled the “2% decade”: economic growth, inflation, and budget deficits (as a share of GDP) all hovered around this rate. This phase was characterized by the excessive optimism of the “Great Moderation.”

But the internal imbalances that emerged during this period would haunt the eurozone for years to come. The convergence of interest rates, evidenced by minimal spreads, resulted in overly sanguine portrayals of member states’ public finances. Simultaneously, loose fiscal and monetary conditions reduced European governments’ incentives to undertake structural reforms and bolster their banking systems.

Nominal convergence also masked more profound structural disparities, as capital flowed from the eurozone’s richest members to their poorer counterparts, where it was frequently channeled into less productive sectors, such as real estate and non-tradable services, often through instruments like short-term bank loans. Consequently, while the eurozone’s current accounts appeared balanced, significant imbalances emerged.

The fallout from the 2008 global financial crisis, particularly the discovery that Greece had lied about its budget deficits and debt, eroded trust among member states. The prevailing narrative shifted to one of moral hazard, emphasizing the need for each country to get its own house in order. By the time eurozone governments finally coordinated a response – establishing the European Stability Mechanism (ESM), launching the banking union project, introducing the European Central Bank’s Outright Monetary Transactions program, and expanding the ECB’s balance sheet – the euro appeared to be on the brink of collapse.

The key turning point was the pledge by then-ECB President Mario Draghi to do “whatever it takes” to preserve the euro in July 2012. But with monetary policy increasingly viewed as the “only game in town,” the eurozone’s economic and financial structures remained fragmented.

The COVID-19 crisis changed that. The exogenous nature of the pandemic shock, together with the lack of impending elections, enabled EU leaders – led by French President Emmanuel Macron, then-German Chancellor Angela Merkel, and European Commission President Ursula von der Leyen – to present a unified front, unencumbered by the pressure to avoid moral hazard. The EU suspended the Stability and Growth Pact, which had previously capped member states’ budget deficits at 3% of GDP, and rolled out the Support to mitigate Unemployment Risks in an Emergency and the NextGenerationEU recovery programs, financing both through common borrowing. Meanwhile, the ECB introduced its €1.85 trillion ($2 trillion) Pandemic Emergency Purchase Program.

Although this demonstration of collective leadership reassured markets, fueling an economic rebound, the optimism proved to be short-lived. A global inflationary surge, fueled by robust macroeconomic stimulus and pandemic-related supply-chain disruptions, was exacerbated by the energy-price shock that followed Russia’s full-scale invasion of Ukraine. Although European policymakers worked together to reduce the EU’s dependence on Russian gas, they failed to mount a collective response akin to the NextGenerationEU initiative. Confronted with rising deficits and debt, not to mention the most aggressive monetary-tightening cycle since the 1980s, EU countries have once again put eurozone reforms on hold.

Two important lessons follow from the euro’s first 25 years. First, the monetary union’s incomplete institutional framework has proven to be both costly and dangerous. Finalizing the banking union, especially the creation of a common resolution fund with the backstop of the ESM and deposit insurance, is essential to ensure stability and bolster the international role of the euro. Thus, Italy’s recent failure to ratify the ESM treaty is a serious setback. Pushing forward the capital market union is essential if Europe is to meet the financial challenges posed by the digital and green transitions. To achieve all of this, EU leaders must strike a balance between risk sharing and risk reduction.

Second, completing the euro is crucial for safeguarding and developing the EU’s greatest achievement: the single market. European countries’ current pursuit of national industrial policies, funded through state aid, undermines the core values of the single-market project. To address this challenge, the EU must formulate a cohesive European industrial policy. This should include an increase in cross-border investments, focusing on European public goods such as human-capital development, the availability of critical materials, and the green and digital transitions.

After the fall of the Berlin Wall, German Chancellor Helmut Kohl, French President François Mitterrand, and European Commission President Jacques Delors turned the dream of a single currency into a reality. During the COVID-19 crisis, Macron, Merkel, and von der Leyen managed to overcome seemingly insurmountable obstacles and achieve a historic breakthrough. Now, a quarter-century after its introduction, the euro requires visionary leaders to shepherd European sovereignty to its next phase.

This article draws on the CEPR Policy Insights February 1, 2024, paper “The First 25 Years of the Euro,” written under the auspices of the European University Institute’s Economic and Monetary Union Laboratory (EMU Lab).