Three words, 11mn jobs: Draghi’s legacy for euro area

Explore what’s moving the global economy in the new season of the Stephanomics podcast. Subscribe via Pocket Cast or iTunes.

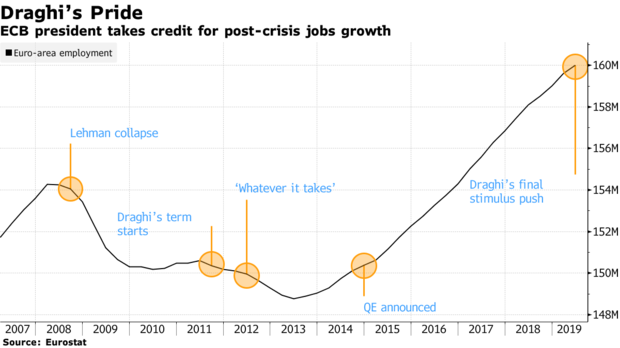

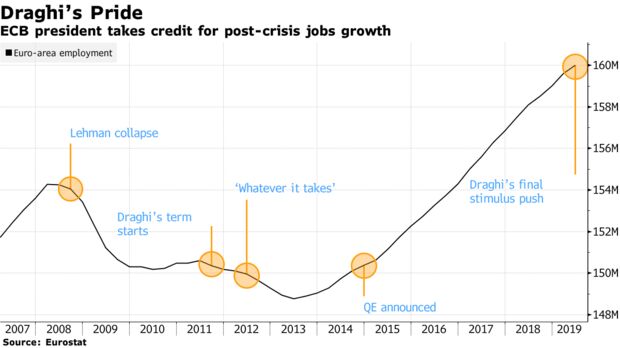

Three words — whatever it takes — defined Mario Draghi’s time as European Central Bank president, but he’s prouder of another number: 11 million jobs.

Hardly a public appearance goes by without Draghi mentioning employment growth in the euro zone as a justification for the extraordinary monetary stimulus he’s pushed through since 2011.

The focus on jobs might be understandable given that, despite all his efforts, he’s fallen far short on his primary mandate of inflation. That failure forced him into a last-ditch, and controversial, push in September to boost price growth. He leads his last Governing Council meeting on Thursday before retiring on Oct. 31.

So how has the region’s economy fared under Draghi, with his 2012 pledge to save the euro, and crisis-fighting measures such as negative interest rates and asset purchases? Here are some of the metrics that show his successes and failures.

Labor Market

Employment growth since 2013, when the 19-nation euro zone emerged from its double-dip recession, is unequivocally Draghi’s biggest economic achievement — if you discount that the single currency might not even exist today without his commitment the previous year to protect it when a debt crisis sparked breakup fears.

The labor market has underpinned the bloc’s recovery, feeding private spending and investment. It has become one of the biggest bulwarks against the recent chaos from the U.S.-China trade war, President Donald Trump’s protectionist rhetoric against Europe, and Brexit.

Looking deeper though, the picture is more complex. Germany has built on impressive job creation that started well before Draghi’s term, after domestic reforms, and was only briefly interrupted by the Great Recession. France can tell a similar tale, but labor markets in Spain and Greece along with some of the smaller euro members still haven’t made up the lost ground.

Economic Growth

Regional differences are equally striking when analyzing economic growth. Aside from Greece and Cyprus — both deeply scarred after years of austerity and a near-collapse of their financial system — no country has done worse than Draghi’s native Italy in terms of total output per head.

Inflation

The prime reason for the ECB’s record-low interest rates, cheap long-term loans and 2.6 trillion euros ($2.9 trillion) of asset purchases — so far — is its attempts to overcome weak inflation.

That hasn’t gone well. Consumer-price growth over Draghi’s eight-year term has averaged 1.2% which, unlike with his predecessors, falls short of the goal of “below, but close to, 2%.” It was even negative at times — so Draghi can at least console himself with the fact that he beat deflation.

Subdued price pressures are a mystery, and not only for Draghi. Central bankers around the world have puzzled over why low unemployment and rising wages aren’t translating into stronger inflation as standard economic models predict. The suspicion is that developments such as global supply chains and internet commerce are at least partially to blame.

The result is dwindling inflation expectations, a dangerous development for a central bank whose credibility hinges on convincing investors and the public that it can deliver on its mandate. The drift has kicked off a debate about whether incoming president Christine Lagarde needs to commission a review looking at both how the ECB sets policy and whether its definition of price stability, last updated in 2003, is still appropriate.

Bank Lending

One other key indicator the ECB uses to gauge its success is lending by banks to companies and households, and that has responded better to stimulus. At just under 4%, credit is expanding at three times the rate of gross domestic product. Banks say that growth is threatened by negative interest rates, which squeeze their profit margins and might eventually force them to pull back.

Greece

One small economy has taken an outsized chunk of Draghi’s attention. Concerns about Greece’s public finances first surfaced in late 2009, and by 2015 the ECB was enmeshed in a banking crisis and game of political brinkmanship that threatened to splinter the single currency area.

Draghi’s kept the country’s lenders alive, by approving emergency liquidity, just long enough to allow a political solution that kept Greece in the bloc. Since then, the economy has started to recover, though lags far behind its peers. Draghi himself said this year that the Greek people paid a high price.Euro’s Future

For all the furor over a possible “Grexit” and the flirtations of factions in France and Italy with the idea of a future outside the currency union, membership has actually continued to grow. Latvia joined in 2014, Lithuania one year later, and other countries in eastern Europe have expressed an interest in doing likewise.

At the end of Draghi’s term, a measure of the probability of a breakup of the bloc is near a record low. It might be his ultimate legacy.

For Sarah Hewin, an economist at Standard Chartered Bank in London, both Draghi’s role in keeping the euro region intact and his record of “huge” job creation won’t be easily forgotten.

Those were “two really huge achievements during his time,” she told Bloomberg Television on Tuesday. “I think those are the ones that he’ll be remembered for.”