China advocates shared future with Five Principles of Peaceful Coexistence

This year marks the 70th anniversary of the Five Principles of Peaceful Coexistence. The commemorative conference of the 70th anniversary of the Five Principles of Peaceful Coexistence was held in Beijing on June 28. Xi Jinping, President of the People’s Republic of China, attended the commemorative conference and delivered an important speech. He expounded on the essence of the Five Principles of Peaceful Coexistence and their relevance for our times, pointed the direction for building a community with a shared future for mankind amid major global transformation, and voiced a strong message of the Global South to work with people around the world for a better future.

70 years ago, in face of the scourge of hot wars and the confrontation of the Cold War, the Chinese leadership specified the Five Principles in their entirety for the first time, namely, mutual respect for sovereignty and territorial integrity, mutual non-aggression, mutual non-interference in each other’s internal affairs, equality and mutual benefit, and peaceful coexistence. The Five Principles are included in the China-India and China-Myanmar joint statements, which jointly called for making them basic norms for state-to-state relations.

After 70 years of practice, the Five Principles of Peaceful Coexistence have set a historic benchmark for international relations and international rule of law, served as the prime guidance for the establishment and development of relations between countries with different social systems, remained a powerful rallying force behind the efforts of developing countries to pursue cooperation and self-strength through unity, and contributed historic wisdom to the reform and improvement of the international order.

Over the past 70 years, the Five Principles of Peaceful Coexistence have extended its reach from Asia to the world, transcending ideological differences, social system variations and uneven levels of development. They have become open, inclusive, and universally applicable basic norms for international relations and fundamental principles of international law, making indelible historic contributions to the cause of human progress.

Seventy years on, we are now in a volatile and unstable era where changes and turbulence are intertwined. At this historic moment when mankind has to choose between peace and war, prosperity and recession, unity and confrontation, the spirit of the Five Principles of Peaceful Coexistence has become more appealing rather than obsolete. Bearing the intertwined destinies of countries and the shared and fundamental interests of all peoples in mind, President Xi Jinping put forward the vision of building a community with a shared future for mankind, providing a new answer to what kind of world to build and how to build it. This is the best way to inherit, advance and enrich the Five Principles of Peaceful Coexistence under new circumstances.

From the Five Principles of Peaceful Coexistence to building a community with a shared future for mankind, China has remained consistent in the exploration for new ways of state-to-state relations, remained committed to our responsibility in upholding world peace and development, and remained steadfast in pursuing a just and equitable international order.

Over the past decades, the Five Principles of Peaceful Coexistence conformed to the trend for national independence and liberation in Asia, Africa and Latin America, and answered the very important question of how to handle state-to-state relations. Going forward, the Chinese initiative of building a community with a shared future for mankind has become an international consensus. The beautiful vision has been put into productive actions. It is moving the world to a bright future of peace, security, prosperity and progress.

Of all the forces in the world, the Global South stands out with a strong momentum. Standing at a new historical starting point, the great cause of building a community with a shared future for mankind requires the Global South to stay ahead of the historical trend. The Global South should be more open and more inclusive, jointly maintain peace and stability, promote open development, construct global governance, and advocate for the exchange among civilisations.

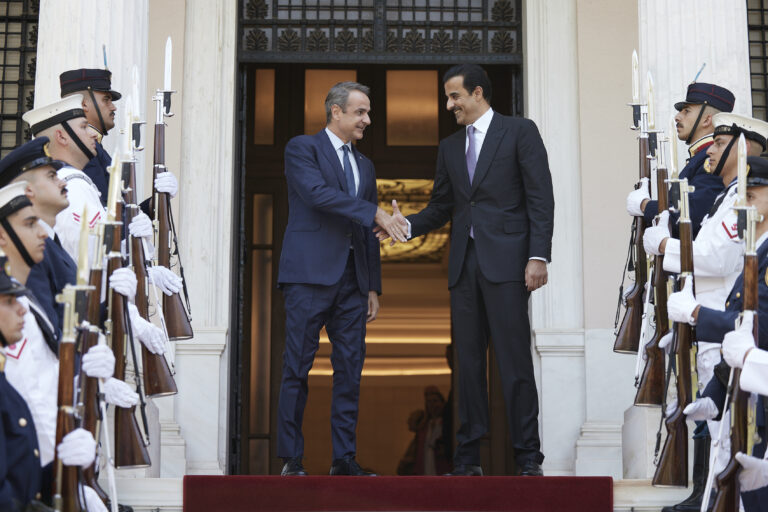

Both China and Qatar are important members of the Global South. In recent years, under the strategic guidance of President Xi Jinping and His Highness the Amir Sheikh Tamim bin Hamad al-Thani, China-Qatar relations have developed rapidly and comprehensively, serving as a model for countries with different social systems to firmly adhere to the Five Principles of Peaceful Coexistence, engage in friendly exchanges, and foster mutually beneficial co-operation.

Both China and Qatar are the staunch forces for peace, dedicated to promoting peaceful settlement of international disputes, and participating constructively in the political settlement of international and regional hotspot issues. They are core driving forces for open development, committed to restoring development as the central international agenda item with clear and feasible national development visions and goals, reinvigorating global partnerships for development, and deepening South-South co-operation as well as North-South dialogue.

China and Qatar are also construction teams of global governance and advocates for exchange among civilisations. Both countries actively participate in reforming and developing the global governance system and contribute to enhancing inter-civilisation communication and dialogue.

This year marks the 10th anniversary of the establishment of the China-Qatar strategic partnership. China wishes to work with Qatar to take this opportunity to strengthen the political foundation of bilateral relations, elevate the mutually beneficial cooperation between the two countries to a new level.

China stands ready to join hands with Qatar and other countries in the world to overcome challenges, achieve shared prosperity, create an open, inclusive, clean and beautiful world of lasting peace, universal security, and shared prosperity, build a community with a shared future for mankind, and open up a brighter future for humanity.