This is a bit surprising since Canada enjoys many of the same advantages that the U.S. shale revolution does (U.S. gas output has risen 55% since 2008). Among other benefits, Canada has: 1) a huge shale gas resource, 2) leading oil/gas companies and experts, and 3) free market competition that helps ensure that “the best teams win.”

Up 25% over the past decade, Canada’s proven gas reserve base now stands at a very solid 70 trillion cubic feet (Tcf). And the Montney shale play in the west could hold a staggering 450 Tcf of recoverable gas. Today, although yielding less than 20% of what the U.S. does, Canada is still the world’s 5th largest gas producer, offering 4-5% of global supply. Some 97% of all natural gas produced in Canada occurs in the western-most provinces, with Alberta alone constituting 75% of the country’s output.

With such a western-based supply system, the obvious problem is that over 70% of the population lives in the far off eastern half of the country (Calgary to Toronto is a 33 hour drive!).

Canada’s natural gas industry has quickly devolved into crisis mode. For example, soaring shale production in the U.S. has lowered the need for Canadian gas to be imported. Canada’s gas exports to the U.S., long its only customer, have steadily declined 25% since 2007 to 7.8 Bcf/d. Although this is still a pretty solid export level, expected non-stop growth in U.S. shale will continue to erode the need for Canadian gas, especially as more and more interstate pipelines are built in the U.S. to share domestic supply.

In fact, some companies such as TransCanada have been cutting pipeline tolls to try and get western Canadian gas to central and eastern provinces and better compete with imports of cheap shale flowing into the country from the U.S. While not growing, U.S. gas exports to Canada still hit a healthy 2.3 Bcf/d in 2018 – almost a quarter of Canada’s total demand.

Worse, pipelines to move gas out of distant Alberta have been extremely slow to get built, facing pushback from environmental groups and/or Indigenous peoples, regulatory burdens, costs overruns, and a number of other problems. For western Canada, too much supply, not enough demand, and worsening pipeline constraints have saddled the gas industry with “the lowest prices in the world,” even in negative territory.

As is true for oil,

If production can grow as hoped, the capacity to export will be strong. Blessed with an incredible water resource, hydro accounts for over 60% of Canada’s electricity, with gas only at 10% (gas holds a rising 35% share in the U.S.).

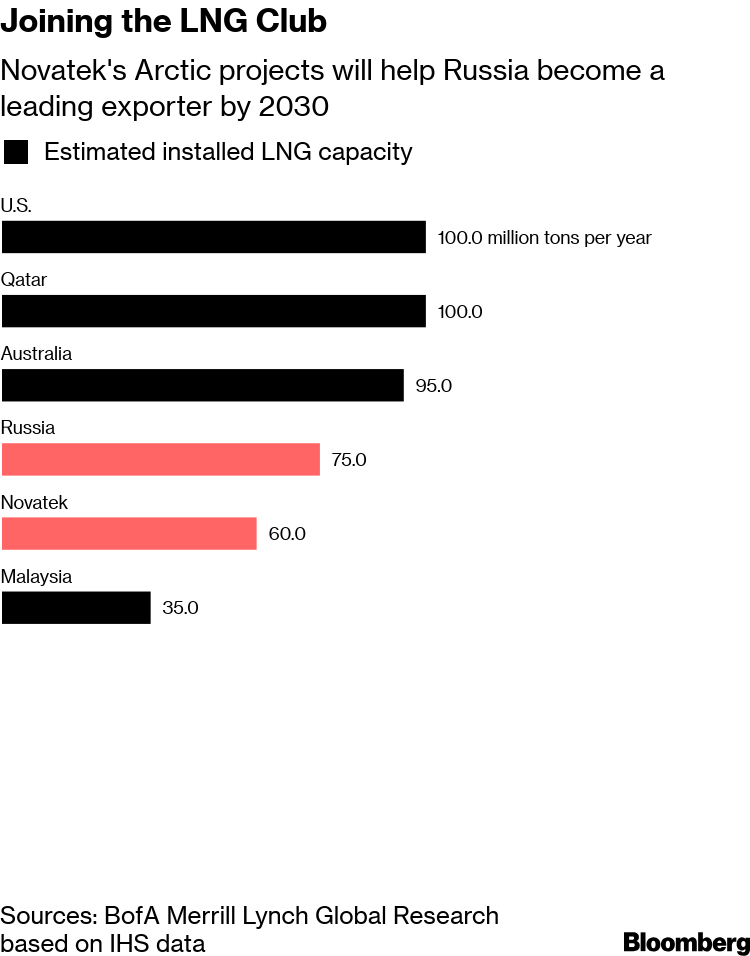

Democratic with a stable political system, the appetite for Canada’s gas will surely be there. The world is turning to cleaner, reliable, and more flexible natural gas to grow economies and reduce greenhouse gas emissions. Canada’s goal of course is to splash into the rapidly growing LNG pool. Although now just 12-14% of the global gas market, LNG is the fastest growing way to trade gas, rising 4-7% per year for as far out as is currently being modeled.

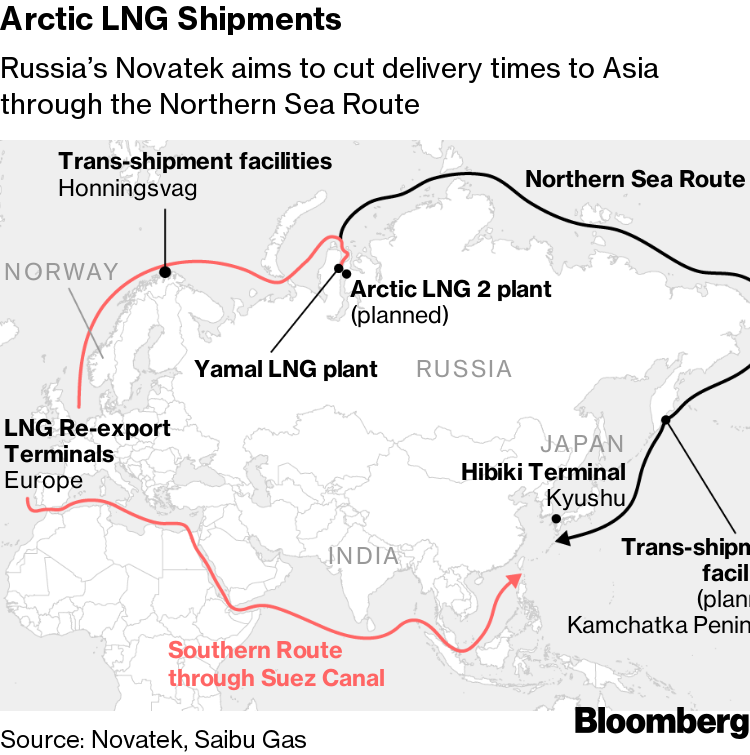

Two key advantages for potential Canadian LNG are low-cost domestic supply and short shipping distance to gas-hungry Asia. For example, drastically cutting transport costs, it takes just 10 days for an LNG cargo to get from British Columbia to Asia, versus as many as 30 days for projects along the U.S. Gulf Coast.

Last fall, Shell and partners green-lighted the $31 billion LNG Canada export project, the first of its kind in the country. Interestingly enough, LNG Canada made a final investment decision without first securing the usual long-term off-take contracts that have typically been used to underpin projects, instead being a joint venture with five participants and an equity financing structure. With PetroChina a partner, the U.S.-China trade row has also been bolstering hopes in Canada. And the government of British Columbia has offered a variety of incentives, such as exempting LNG Canada from carbon tax hikes if it can maintain the cleanest possible standards.

There are a variety of issues, however, that will be challenging for Canada’s LNG exports.

Let me just mention a few. As greenfield (i.e., developed from scratch), LNG export projects will be more expensive in Canada than in the U.S., where many are simply retrofitted to export. Pipeline bottlenecks and pushback will make supplying west coast terminals even more challenging. In addition, the potential Jordan Cove LNG export project in Oregon will be strong competition for Canada.

Canada’s other key natural gas problem has also been that gas is mostly a forgotten commodity as compared to oil, a higher revenue generator. Canada’s oil producers have also faced such destructive price discounts for their product that Alberta’s Premier Rachel Notley had to step in and demand nearly a 10% reduction in output to lift unsustainable prices.

We do know that Canada’s LNG projects must move more quickly to be primed to ship when a global supply deficit materializes in less than five years.

Looking forward, Canada’s National Energy Board (NEB) forecasts around a 30% increase in output to 21 Bcf/d by 2040, or what the Permian and Eagle Ford plays in Texas produce today combined. The NEB projects a 130% boom in the Montney to 12.1 Bcf/d by 2040.

I would argue that a strong LNG buildout would prove these as very conservative estimates. And an expected boom in Canada’s tar oil sands development – which uses natural gas as a key input for operations – would also help encourage more gas production in the western region.

https://www.forbes.com/sites/judeclemente/2019/04/05/canadas-natural-gas-industry-really-needs-lng/amp/?__twitter_impression=true