Qatar’s growth helps maintain GECF’s status as largest coalition of global LNG supplier: Sentyurin

Reuters /London

Total yesterday became the first major energy company to quit the main US oil and gas lobby due to disagreements over its climate policies and support for easing drilling regulations.

Total said it would not renew its 2021 membership with the American Petroleum Institute (API) following a review of the lobby’s climate positions, describing them as being only “partially aligned” with Total’s.

Its withdrawal from the century-old API comes ahead of a sweeping change in policy direction in the United States, with incoming President Joe Biden promising to tackle climate change and bring the country to net-zero emissions by 2050.

The points of difference include API’s support for the rollback of US regulation on emissions of methane, a potent greenhouse gas, for oil and gas drillers as well as on how to assign a price to carbon, seen as a critical method to curb emissions.

“As part of our Climate Ambition made public in May 2020, we are committed to ensuring, in a transparent manner, that the industry associations of which we are a member adopt positions and messages that are aligned with those of the Group in the fight against climate change”, Total chief executive Patrick Pouyanné said.

In a statement, the API thanked Total for its membership.

“We believe that the world’s energy and environmental challenges are large enough that many different approaches are necessary to solve them, and we benefit from a diversity of views,” the API said.

Total’s operations in the United States include a number of offshore oil and gas fields in the Gulf of Mexico, a major refining and petrochemical plant in Port Arthur, Texas as well as renewable energy businesses.

Total last year announced plans to cut its carbon emissions, with the aim of reaching net zero emissions from its operations and its energy products sold to customers in Europe by 2050 or sooner.

Europe’s top energy companies, including BP and Royal Dutch Shell, have outlined plans to curb emissions and boost renewable energy output following years of growing investor pressure.

Total, BP and Shell have already pulled out of the American Fuel & Petrochemical Manufacturers, a US oil refining group, also due to differences over climate policies.

They also said they would regularly review their alignment over climate with industry associations but until Friday those companies had elected to remain in API, the primary trade group for the oil and gas industry.

BP last year decided to remain in the API even though it was only partially aligned with the lobby.

Andrew Logan, director for oil and gas programmes and clean energy investor group CERES, said the announcement was significant and would put pressure on other European oil majors.

“Given the size and influence of API, this is a much more significant move than previous decisions to pull out of more niche trade groups like AFPM.

I think that we will see other companies follow suit,” Logan said.

LONDON: Democratic Senate seat wins in the state of Georgia have given US President-elect Joe Biden a “green light to move forward” on some key shifts in national climate policy, such as much greener pandemic stimulus spending, US policy analysts said.

With Democrats now in control of the Senate, “it’s a huge, huge difference”, Nigel Purvis, CEO of the Washington-based Climate Advisers policy group, told the Thomson Reuters Foundation.

“This almost doubles what he can do — he has a whole additional range of tools and levers at his disposal,” said Purvis, who has worked with three former US administrations on climate policy.

Biden has proposed a $2-trillion, climate-smart economic stimulus plan, for instance, which he would not have been able to get through if the Georgia election had turned out differently. “Now he has a real chance,” Purvis added. Biden’s thin Senate majority means he is unlikely to be able to pass a single comprehensive climate change bill, which would require the approval of 60 per cent of senators.

But many measures related to raising or spending money — including stimulus funding for things like electric vehicle infrastructure, or incentives for farmers to sequester more carbon — can win approval with a simple majority.

Biden should, for instance, now be able to back his plans to mainstream climate action into all government agencies with cash to make that possible, said Christina DeConcini, director of government affairs at the World Resources Institute (WRI).

“There are limits for sure, but it’s … a green light to move forward,” she said. “I really think this is a new day for climate in the United States.”

Talking jobs

How shifts in climate policy are framed for a country politically divided on the issue will be crucial to Biden’s success in bringing change, the analysts said.

Gina McCarthy, former administrator of the Environmental Protection Agency under President Barack Obama and Biden’s nominee to become the first national climate adviser, for instance, speaks more about the need for a “cleaner, stronger, more resilient economy” than about climate change.

“We know clean energy supports millions of jobs in the United States and it can support millions more,” as well as saving money and improving people’s health, she told an online event in November.

To get people behind climate action, governments “need to give citizens and communities a better life today” — not just promises that future catastrophes will be avoided, she added.

Rachel Kyte, a former UN special representative on energy and dean of the Fletcher School for Law and Diplomacy at Tufts University in Massachusetts, said McCarthy and other Biden cabinet picks excel at talking about the need for climate-friendly reforms “in language ordinary people can understand”.

“They will find a very main-street narrative for why these are common-sense policies” — and that could galvanize broader bipartisan support, she predicted.

Alden Meyer, a strategic adviser with independent climate change think-tank E3G, noted that during the last fiscal crisis in 2009, the Obama-Biden administration crafted a stimulus package that included $90 billion for clean energy technology.

Biden’s pick for energy secretary, former Michigan governor Jennifer Granholm, in that crisis helped negotiate a rescue of the US auto industry that included an agreement by Detroit to adopt much more aggressive fuel economy standards.

Such “green strings” on stimulus cash will be needed to help drive effective climate action in the United States and globally, climate analysts say.

“This is not new territory for Biden,” Meyer said. “He knows this game very well. He gets this, he feels this in his bones.”

Pressure from the left

Another challenge for Biden, the analysts said, will be keeping onboard factions of the Democratic Party – such as the youth-led Sunset Movement — that are demanding swift, immediate and aggressive action on climate threats.

The Sunrise Movement has already told Democratic Senate leaders it expects “an enormous green spending bill on day one”, Kyte said — and that desire for rapid change may be at odds with efforts to sell climate action to a broader US audience.

Yet, despite paralysing political polarisation on many climate-related issues, a few hints of possible bipartisan compromise have emerged in recent months, the analysts said.

Stimulus and relief packages passed in December included policies that could help set the stage for decarbonisation of the US economy, such as tax incentives for clean energy and carbon capture technologies.

Congress also agreed, with bipartisan support, to phase out hydrofluorocarbons (HFCs), powerful climate pollutants used in air-conditioning and refrigeration equipment.

As well, a Democrat-controlled US Congress is likely to work more closely with the cities, states and other bodies that have driven US climate action during global-warming skeptic President Donald Trump’s administration, said WRI’s DeConcini.

US businesses — a growing number of which have adopted net-zero emissions goals, or are having to adhere to tougher climate policies in other countries where they work — also increasingly want consistent, clear climate policy, she said.

“At some point, the desire to just stay the course — because they see the future on the wall and because it’s good for their bottom line — will become so strong it will provide the political momentum for the U.S. to move toward a decarbonized economy,” she predicted.

Published in Dawn, January 10th, 2021

إستبشر اللبنانيون خيرًا بإنطلاق المفاوضات الحدودية البحرية غير المباشرة مع العدو الإسرائيلي بوساطة أميركية وبرعاية الأمم المتحدة، كون المهمة سُلّمت لجيشهم الوطني الذي يثقون به ويعتبرونه المؤسسة الأكثر قدرة على استعادة الحقوق الوطنية التي قد تساهم في انتشال لبنان من أزمته المالية الخانقة.

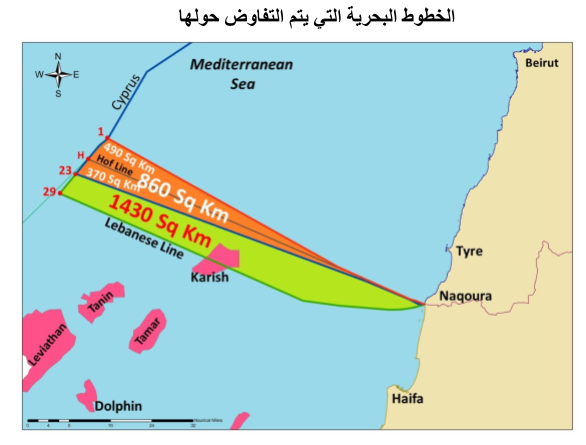

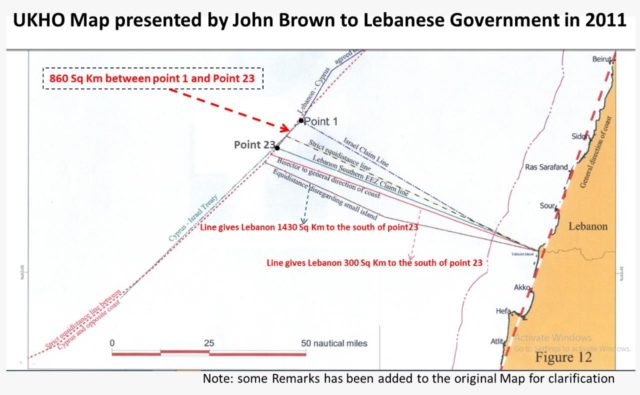

خاض الوفد اللبناني الجولات الأربع بكفاءة عالية برغم النيران الصديقة التي تعرّض لها قبل انطلاق مهمته وبرغم تجريده من السلاح القانوني الأهم وهو تعديل المرسوم رقم 6433 تاريخ 1/10/2011 الذي يحدّد النقطة (23) كنقطة حدود ثلاثية في حين أن الوفد اللبناني انطلق من خط يعتمد النقطة (29) أي بزيادة 1430 كلم2 عن الخط اللبناني المعلن بموجب المرسوم المذكور وبزيادة 2290 كلم2 عن الخط المعلن من قبل العدو الإسرائيلي.

فوجىء وفد العدو الإسرائيلي بصلابة الوفد اللبناني ودفاعه المحكم المستند كلّيًا إلى القانون الدولي، ولما لم يجد نفسه قادرًا على مواجهته بالقانون شنّ حملة إعلامية شعواء بقصد تشويه صورة لبنان وتقليب المجتمع الدولي عليه وبصورة خاصة الوسيط الأميركي.

لم تُعقد الجولة الخامسة التي كانت مقرّرة بتاريخ 2/12/2020 واستعيض عنها بجولة قام بها الوسيط الأميركي على بعض القيادات اللبنانية عرض خلالها العودة إلى التفاوض حول مساحة 860 كلم2 لكن الجانب اللبناني أكّد رغبته بمتابعة المفاوضات على أساس القانون الدولي دون حصرها بمساحة معيّنة.

في ظل عدم تحديد موعد جديد للجولة الخامسة، اعتُبرت المفاوضات بحكم المعلّقة، فاستفاد العدو الإسرائيلي من ذلك لإعادة تنظيم صفوفه من خلال تحصين فريقه المفاوض بعد أن فهم جيّدًا موقف الوفد اللبناني، وأيضاَ من خلال متابعة التحريض الدولي على لبنان.

نجح العدو الإسرائيلي في ذلك فأقدم السيد فريدريك هوف بنشر مقالٍ له بتاريخ 4/12/2020 على موقع ” نيوزلاين” شرح فيه بالتفصيل كيف وضع خطه في العام 2012 برضى الجانبين اللبناني والإسرائيلي وذكر إسميًا اللبنانيين الذين عملوا معه في تلك الفترة. طبعًا لم يكن هذا المقال بهذا التوقيت من باب الصدفة بل هدف منه تذكير اللبنانيين بأنهم سبق ووافقوا على المقترح الأميركي، وبالتالي دعم المزاعم الإسرائيلية القائلة بأن اللبنانيين غير ثابتين على رأي.

بعد فريدريك هوف، دخل وزير الخارجية الأميركي مايك بومبيو على الخط بتاريخ 22/12/2020 فدعا الجانبين للعودة إلى التفاوض على أساس الإدعاءات السابقة التي أودعوها الأمم المتّحدة، أي بمعنى آخر العودة إلى التفاوض ضمن مساحة 860 كلم2.

وجدت قيادة الجيش أن العدو الإسرائيلي يعتمد المماطلة والمراوغة فاقترحت تعديل المرسوم 6433 لتصبح النقطة الثلاثية هي النقطة (29) بدلاً من النقطة (23) وإيداع المرسوم الأمم المتّحدة قبل بدء العدو الإسرائيلي استخراج النفط والغاز من حقل كاريش حيث من المتوقع بدء الإستخراج منه اعتبارًا من شهر حزيران/ يونيو المقبل، وبالتالي إجباره للعودة إلى طاولة المفاوضات تحت ضغط عاملي الوقت والالتزامات المادية نظرًا لارتباطه ببرنامج زمني مع شركتي شفرون ونوبل انيرجي، الأمر الذي قد يجبره على التنازل ويساعد الوفد اللبناني لتحصيل أقصى الممكن من الحقوق اللبنانية.

انتظرنا الردّ من العدو الإسرائيلي لكن للأسف برزت هجمة سياسية ـ إعلامية لبنانية، في سياق حملة بدأت بتاريخ 8/1/2020، يبدو أن مطلقيها أخطأوا الهدف فبدل التصويب على العدو الإسرائيلي وجّهوا نيرانهم باتجاه الجيش اللبناني فشكّكوا علنًا بالخط اللبناني الجديد واعتبروه خطّا إيرانيًا واتهموا الجيش اللبناني باختلاقه لخلق مزارع شبعا بحرية ولدفع العدو الإسرائيلي لإيصال خطّه إلى قبالة صيدا.

ذنب قيادة الجيش أنها تحلّت بالجرأة فانطلقت من الخط الجديد (النقطة 29) لقناعتها بقانونية هذا الخط برغم معرفتها المسبقة بأن المهمة ستكون أصعب بسبب الأخطاء السابقة التي ارتكبها عن قصد أو غير قصد بعض الذين تعاقبوا على هذا الملف منذ العام 2006.

فالخط الذي انطلق منه الوفد اللبناني ليس جديدًا بل هو نتيجة آراء ودراسات لبنانية وأجنبية وضعت بتصرف السلطات اللبنانية منذ العام 2011 ولكنها لم تأخذ بها لأسبابٍ ما تزال مجهولة حتى الآن ومطلوب من هذه السلطات شرحها للرأي العام اللبناني. أذكر من هذه الاراء والدراسات على سبيل المثال لا الحصر:

كذلك فإن محاولات قيادة الجيش لتصحيح الخطأ ليست جديدة، فقد أرسلت مجموعة كتب إلى رئاسة الحكومة اللبنانية تقترح عليها تشكيل هيئة وطنية تعنى بموضوع الحدود البحرية وتلفت نظرها إلى وجود طرق أخرى تعتمد الحل المنصف وتعطي لبنان الحق بمساحات إضافية جنوب النقطة (23) دون الحصول على جواب سلبًا كان أم إيجابًا. أكتفي بذكر ستة من هذه الكتب:

إن مهمة التفاوض هي مهمة وطنية بامتياز، والمحافظة على حقوقنا واجب وطني كونها ترتبط بمستقبل أولادنا وأحفادنا والتفريط بها خيانة وطنية. فأين المصلحة الوطنية باطلاق النار على الوفد اللبناني المفاوض وفي توقيت جاء استتباعًا لمواقف فريدريك هوف ومايك بومبيو؟ هل تعلمون أنكم بهجماتكم هذه تفتحون ثغرات في الجسم الدفاعي اللبناني قد يستغلّها العدو الإسرائيلي للتسلل منها وتطويق الفريق اللبناني؟

تذكّروا أنكم لاعبون ولستم متفرّجين. البارحة رأيناكم تتصارعون على الصلاحيات فما بالكم اليوم تتراجعون أثناء تحمّل المسؤوليات؟ المطلوب منكم التحلّي بالروح الوطنية العالية واتخاذ القرارات الجريئة؟ إذا كنتم غير مقتنعين بخط الجيش اللبناني قولوا ذلك صراحة، إتخذوا القرار الذي تريدونه، وزوّدوا الفريق المفاوض بقراراتكم.

أما إذا كنتم مقتنعين، فعليكم تحصين موقف الوفد المفاوض بتعديل المرسوم 6433. لا يمكنكم أن تطلبوا منه التفاوض على النقطة 29 والمرسوم رقم 6433 يحدّد النقطة 23. عدّلوا هذا المرسوم فورًا قبل أن يبدأ العدو الإسرائيلي بالاستخراج من حقل كاريش.

المطلوب تجنّب التجاذبات السياسية والمطلوب محاذرة الوقوع في الأزمة لا المساهمة في بلوغها أو الإنزلاق إليها.. التخاذل في هذا الموضوع جريمة بحق الوطن، بادروا فالتاريخ لن يرحم المتخاذلين، وإلا فلتبادر السلطة السياسية إلى سحب تفويضها للقيادة العسكرية.

(Bloomberg) — After a bumper year for Europe’s renewable-energy stocks, underappreciated utilities shares are now gaining support from the market as 2021’s hot sector to play the clean power transition.

Helped by government policies such as the European Union’s Green Deal and investors’ environmental, social and governance concerns, renewable assets have strongly outperformed traditional utilities peers this year in the Stoxx Europe 600 Index. Turbine maker Vestas Wind Systems A/S has almost doubled in value, while U.K. electric company SSE Plc is up less than 3%.

Some strategists warn that opportunities in wind and solar stocks may be more uneven in 2021 as valuations appear stretched. Utilities may be a lower-risk way to buy into green energy growth than renewables equities, said Ursula Tonkin, head of listed strategies at infrastructure investor Whitehelm Capital Pty Ltd.

“Over the long run, the tortoise will likely outperform the hare,” she said. “For every new solar, wind or battery installation, the grid has to expand to accommodate it.”

While coronavirus-pandemic winners such as tech shares are losing favor in the latest vaccine-fueled stock rally, sustainable companies have stayed in favor, also helped by November’s U.S. presidential election victory for Joe Biden, who pledged a clean-energy agenda. Still, utilities as a whole have gained only modestly so far this year.

Many utilities have positioned themselves to capitalize on opportunities in green energy after “cleaning up” their portfolios in the past few years, said Sam Arie, an analyst for the industry at UBS AG.

“We’ve gone from a world five years ago which didn’t really have climate goals in view to one where now those are the most important goals across all the sectors,” he said.

Investors will have to be more selective, with next year unlikely to be as “exceptional” as 2020 for the renewables segment, said Louise Dudley, a global equities portfolio manager at Federated Hermes Inc. Stocks such as Orsted A/S trade at about 53 times estimated earnings, versus 19 times for the Stoxx 600 Utilities Index. The Danish offshore wind-farm developer was recently downgraded at Bank of America Corp. and Royal Bank of Canada.

Investors are giving “insufficient credit” to utilities like SSE, Germany’s RWE AG, and Portugal’s EDP SA that balance spending on renewables with defensive earnings flow from electricity networks, RBC Capital analysts said in a 2021 outlook note for the utilities sector. Analysts tracked by Bloomberg see 16% upside for RWE and 6% for EDP, while average price targets are for at least 11% declines for Vestas and peer Siemens Gamesa Renewable Energy SA.

Another plus is attractive payouts. Investors would struggle to find another industry that delivers utilities’ highly predictable, strong earnings growth alongside comparatively high dividend yields, UBS’s Arie said.

Still, while 2021 may involve a “bumpier ride” for renewables, valuations for Vestas, Orsted and peers aren’t likely to slide as their business growth forecasts are so positive, Whitehelm Capital’s Tonkin said.

Green Competition

An additional concern for the pure renewables industry in 2021 is increasing competition, both from utilities ramping up spending and oil companies aggressively investing in green energy. This could pose a “real threat” to the economics of wind and solar, said Ulrik Fugmann, co-head of the Environmental Strategies Group at BNP Paribas Asset Management.

Others, however, are sanguine. James Smith, fund manager at the Premier Miton Global Renewables Trust, said oil companies that “seek projects simply for the sake of it” would put returns at risk at a time when the sector must strike a balance between operating core crude-oil assets, executing the shift to renewables and paying dividends.

The energy market “needs to grow very aggressively in the next two decades” to reach regulators’ emission-cutting goals, said Harry Boyle, a portfolio specialist at sustainability-focused fund manager Impax Asset Management. “There should be ample room for all actors.”

©2020 Bloomberg L.P.

It was always likely to come down to fish, and even the final hours were occupied by cod and mackerel.

After nine months of bartering, British Prime Minister Boris Johnson could declare that his trade deal with the European Union was done, while the bloc got to keep close ties with one of the world’s biggest economies.

Yet, while the outline was agreed around Wednesday lunchtime, it took a night to go through the legal text. Then, with the choreography already in place, last-minute haggling over fish stocks in the draft meant that an announcement didn’t come until the afternoon of Christmas Eve. The situation became more frantic because of disagreements over how the figures had been calculated.

For about 200 officials agonizing over the minutiae, it was time to finally emerge from the darkness. They spent more than 2,000 hours shut in rooms with little or no natural light as negotiators confronted each other in London and Brussels while Brexit was overshadowed by the human and economic cost of the coronavirus pandemic.

Some learned to respect their opposite numbers, others grew to resent them. At times, mutual suspicion and paranoia over listening devices made Brexit look like a chapter from the Cold War, all heightened by COVID-19 restrictions. Intimate chats in cafes were out; liaisons in parks were in. One British diplomat called it “Brexit noir.”

France’s blocking of the U.K.’s biggest port before Christmas was ostensibly to prevent a new strain of the coronavirus spreading to the continent. Yet there was also the sense in Paris that the chaos that halted thousands of trucks would demonstrate to the U.K. what was at stake. Officials said the two-day stoppage had focused the minds on what the EU’s chief negotiator, Michel Barnier, termed the “final push.”

For the negotiating teams, it was just another twist after spending the greater part of 2020 poring over air cargo, fingerprint data and — critically — 100 different fish species. One official described the process as like “pulling out eyelashes, one by one.”

They lived out of suitcases, working through two waves of infections that forced many into isolation. On occasions, tears were shed when they thought they were about to fail, even as recently as the morning of the deal. In the end, many were airlifted out of Brussels on a Royal Air Force plane to get home for Christmas.

This account of how the talks unfolded is based on conversations with officials with intimate knowledge of what went on. All of them asked not to be identified.

While the outcome brought celebration and relief as the final deal took shape, it had looked very different on Dec. 10. In a third-floor conference room in the British government’s building in Brussels, British lead negotiator David Frost told his team a deal looked almost impossible. Johnson was warning his country that failure looked likely.

The evening before, on Dec. 9, a dinner meeting on the 13th floor of the European Commission’s Berlaymont headquarters in Brussels between Johnson and Commission President Ursula von der Leyen hadn’t gone to plan. After she warned him publicly to “keep distance” when they took their face masks off, they found themselves wrangling over the same points that had bogged down the negotiations since the start.

At one point, von der Leyen’s aides showed Johnson a PowerPoint slide that the EU had published in February. It showed how close the U.K. is to Europe geographically and how much the two sides trade with each other, to explain why the EU insisted on fair competition rules in any deal.

But the U.K. had already dismissed the chart at the start of the year. To the people close to the negotiations, it felt like they were back at square one.

“We were numb,” said one U.K. official after Frost briefed them the following morning. Another fought back tears. “We just wanted to know when we could go home and see our families,” the official said.

As it looked like their efforts had come to nothing, the British negotiating team distracted themselves by challenging each other to come up with the best haiku. But the dinner at least had shown more clearly where the differences lay — helped in some small part by the menu of scallops and turbot — and Johnson and von der Leyen were now in charge.

Compromises were found on one of the longstanding sticking points: the level playing field for fair competition, or rules to ensure neither side held a post-Brexit advantage for companies. The U.K. knew a deal was attainable if it backed down on some of its objections to the EU being able to impose tariffs if Britain does not follow the bloc’s toughening of labor, social and environmental standards.

But the U.K. wanted something in return. The final days came down mainly to the fishing rights in British waters. Johnson and von der Leyen held further phone calls and, although officials said they still seemed to be talking across each other, on the ground the sides started to converge.

On Dec. 19, the prime minister was preparing to announce to the nation that he was taking drastic action to lock down London and ban Christmas gatherings because of a new highly virulent coronavirus strain. He also signaled to Frost that the time had come to do a deal.

As talks focused in on the issue of fishing rights, British negotiators were taken aback that the EU wasn’t budging as much as they thought it would, and by the following night things looked bleak again.

In an attempt to get the deal over the line, Johnson and von der Leyen held two tense phone calls Monday. The Commission president said the EU, particularly France, wouldn’t accept anything more than a 25% reduction in the amount of fish it could catch in British waters — and that this was the final offer.

Johnson had been pushing for 80%, though had just proposed 30%, a figure that might already be difficult to sell to his party in Parliament. Both sides were now feeling nervous about the prospects of a deal before Christmas, and when Johnson and von der Leyen spoke on Tuesday afternoon, they were still sticking to their guns.

That all changed on Tuesday night. After frantic phone calls between Brussels, Paris and Berlin, the EU came through with a new offer: Von der Leyen’s Brexit adviser, Stephanie Riso, called Frost and told him the bloc would drop its longstanding demand that it should be able to impose far-reaching tariffs on the U.K. should it restrict fish access in the future, a power known as cross-retaliation.

That was the final piece of the jigsaw. The U.K.’s top team sent urgent messages to their colleagues, some of whom were already back at their Brussels hotel packing their suitcases to go home for Christmas. They got down to work on fishing rights immediately and worked late Tuesday night.

By Wednesday, when Johnson and von der Leyen spoke again — four times that day — the outline of a deal was there. In return for the dropping of cross-retaliation, Johnson accepted a reduction of 25% on fishing, with a five-and-a-half-year transition period. That means that he can say that in June 2026, on the 10th anniversary of the EU referendum, the U.K. will have full control of its waters.

“This moment marks the end of a long voyage,” von der Leyen told a news conference in Brussels on Thursday. “At the end of such voyages, I normally feel joy. But today I feel satisfaction and relief. It’s time to leave Brexit behind.”

The most recent leg of that journey started in March, but made little progress until after the summer. The coronavirus pandemic derailed arrangements almost immediately.

Shortly after the first negotiating round, several members of the two teams, including Frost and Barnier, were laid low either because they tested positive or were displaying symptoms. They continued talks over videoconference, though couldn’t meet in person again until the end of June.

That meant negotiators couldn’t strike up a rapport. “There were no handshakes, no gentle pats on the back, no opportunity to chat things over informally over a drink,” said one EU official. “That’s how deals are normally done.”

Intimacy came in the form of web cameras into people’s homes. One EU negotiator worked from a blood-red room with a bird cage, while a British official spoke from his shed in the English Midlands. Another from the U.K. sat in her kitchen between a bouquet of lilies and a set of knives. “It was perfect for her,” one person involved in the talks joked.

There were technical problems with video technology, and both sides were worried about the security of discussing sensitive issues online. Officials found it difficult to work jointly on documents.

When they did resume face-to-face contact, the British side tried to win Barnier over. Over the summer, Frost wooed the Frenchman during private dinners at Carlton Gardens, an elegant 19th century London townhouse carefully chosen because of the emotions it might stir. The building served as the headquarters of the “Free France” government in exile during World War II led by Charles de Gaulle, Barnier’s political hero — though also the French leader who vetoed Britain’s membership of the EU’s precursor.

Months went by in almost constant deadlock, though. Barnier told Frost that before going into a submarine you need to make sure the doors are firmly shut, in response to Frost’s requests to intensify negotiations. As one negotiator put it: “There’s only so many times you can tell each other exactly the same thing about fish without going slightly crazy.”

The coronavirus weighed on the talks almost from the start. The revised train timetable under the English Channel meant there was only one shuttle to Brussels in the morning and one to London at night. Lockdowns closed bars and restaurants, and officials were forced to eat tepid dinners dropped off in paper bags alone in their hotel rooms for days on end.

In November, Barnier worked at home by candlelight after a power cut affected part of Brussels while he was in quarantine after one of his team tested positive for COVID-19.

Indeed, darkness became a theme of the talks. In London, they took place in an underground conference center belonging to the U.K. government’s business department dubbed “The Cave.” In Brussels, meetings in the drab 1970s-style Borschette center took place from early morning to late at night. Starved of fresh air and exercise, negotiators started sharing vitamin D pills.

And with darkness came the sense of noir. During the first set of Brexit negotiations in 2018, the EU’s trade supremo, Sabine Weyand, told attaches of her concern they were being bugged by the British secret service, something the U.K. flatly denied. Two years on, that paranoia persisted, an EU diplomat said. Johnson and his aides were asked to surrender their phones when they met von der Leyen for dinner.

Brussels officials in normal times might have allowed trusted journalists into their offices to view documents too sensitive to email. Now, they hid print-outs in the pages of the Le Soir newspaper as they sipped takeaway coffees on street corners.

While nervousness extended to both sides, key decision-making was taking place elsewhere anyway. Johnson exchanged text messages with French President Emmanuel Macron. Frost was in regular contact with Uwe Corsepius, German Chancellor Angela Merkel’s top adviser.

For all the hours together, the two sides spent most of the time talking past each other. Even when Johnson and von der Leyen spoke again on the phone, officials said it sounded like they were talking from completely different positions.

The reasons for Brexit were something many on the EU side struggled to understand. While “sovereignty” became the U.K.’s mantra throughout the nine months, it was a running joke among the EU negotiators. Whenever Frost tweeted the word, they expected little to be achieved for the next few days.

In her speech Thursday, von der Leyen pointedly remarked that everyone should ask themselves what sovereignty actually means in the 21st century.

At various times, the talks were very close to collapse, not least when the British government threatened to break international law by unpicking part of the withdrawal agreement on leaving the EU. But the EU saw the move as just provocation. It was clear that, despite everything, both sides desperately wanted a deal.

Indeed, they always returned to the table. As it became closer to Christmas, and the end of the U.K.’s post-Brexit transition period, tensions increased. British officials said they observed cross words between Barnier and senior members of the EU team. Witnesses reported hearing shouting from the U.K. team’s base in London.

Asked how they planned to celebrate the deal, one member of the British group already knew: “I’m going to sleep.”

(Bloomberg) — A great global restock is at hand, filling ships, trucks and trains, and also firing oil demand.

During the depths of China’s coronavirus crisis at the start of the year, shipping behemoth A.P. Moeller-Maersk A/S reported an unprecedented number of canceled sailings as the Asian country all but shut itself off from the world. Since then, the company’s shares have surged to the brink of a record in Copenhagen. In the U.S., BNSF Railway Co., the freight giant owned by Warren Buffett, is riding a boom that’s pushed the number of carloads and containers it hauls up year-on-year in recent weeks.

A shift in consumer behavior, particularly in western countries, has driven oil prices above $50 a barrel in the past few weeks. People have been diverting expenditure previously earmarked for now-unattainable things — like holidays and meals in restaurants — toward purchasing physical goods. And that’s only the start of it: stores, warehouses and industries have undertaken a huge inventory restocking phase. As more boxloads of stuff get moved across the planet, so demand for fuel to power ships, trucks and freight trains has soared.

“This is the perfect storm for global container flows,” said Lars Mikael Jensen, head of network at Maersk, which marshals a fleet of almost 700 ships. “The current restocking in the U.S. and Europe raises demand, whilst global measures to contain the pandemic cause severe strain across the supply chain from lack of vessels, containers and trucking capacity.”

While beneficial to oil prices and freight haulers, the boom is straining important transport infrastructure. Bottlenecks are worsening at ports around the world, contorting supply chains for everything from car parts to cosmetics. The recent closing of freight deliveries from France into the U.K. serves as a reminder that things could become even more snarled — but also that the full economic and trade impacts of the coronavirus remain far from certain.

Los Angeles is emblematic of the turnaround in activity. Together with Long Beach, L.A. is a corridor for the import of goods from Asia into the U.S. Earlier this year, thousands of empty containers were sitting at the dock in Los Angeles, a symptom of both trade tensions with China, and Covid. Today, imported goods are now flooding in.

“Right now, what we are grappling with is a change in buying habits,” said Gene Seroka, executive director of the Port of Los Angeles. “Where we were once buying mainly services, now you and I have turned back to buying products and those warehouses need to be restocked. Folks have been ordering so much for delivery, we can’t process it fast enough.”

Exports from China are surging, pushing the country’s trade surplus to a record. The nation’s companies shipped $268 billion of goods in November, a 21% increase year-on-year.

In India, the lifting of lockdown restrictions and a full resumption of intra-state vehicle movement led to a boost in road transport fuel consumption in October, with diesel demand growing more than 7% year-on-year, according to Senthil Kumaran, head of South Asia oil at industry consultant FGE.

Shipping rates are going crazy. Moving a 40-foot steel box by sea from Shanghai to the European trade hub of Rotterdam costs about $6,500 per container, the most for the time of year since at least 2011, according to data from Drewry.

The trends matter for the oil market because trucking accounts for about 16% of global oil consumption and almost half of all diesel demand, according to 2019 data from the International Energy Agency.

The rebound in activity, combined with the onset of Northern Hemisphere winter, has been lifting a previously disastrous market for the fuel for about two months.

Back in September, the so-called crack spread — diesel’s premium to crude — plunged as low as $2 a barrel in Europe.

As well as stuttering demand, a key cause of the diesel-market weakness was a collapse in global aviation. Oil refineries responded to that slump by diverting output of jet fuel into making diesel instead, boosting output when consumption was weak. In addition, because people were often staying off public transport to avoid catching the virus, refineries needed to keep high output levels to service gasoline demand — further swelling diesel supply at a time when it wasn’t needed.

Those dynamics have turned. Last week, the crack spread rallied to $6.28 a barrel. That’s at a time when the underlying price of crude oil has also rallied strongly.

Keep on Trucking

In the U.S., freight by truck is the primary influencer of diesel and viewed as a sign of the health of the wider economy. Interstate miles covered by trucks are up above 9% over last year, while traffic for all vehicles is down more than 10%, federal Department of Transportation statistics show.

A proxy for demand in U.S. is how much of a petroleum product oil refineries supply. And in the week to Dec. 11, they supplied 4 million barrels a day of distillate fuel oil, the category that includes diesel. Back in May, that figure slumped to 2.7 million a day, the lowest in decades, Energy Information Administration data show. Stockpiles remain high but are far less bloated than they were earlier this year.

The pull on diesel can be seen in excess demand for deliveries this year. Data from consultant Freight Waves show that 26% of requests for freight hauling are being turned down this quarter, double the rejection rate from a year ago.

While trucking may be the mainstay of diesel demand, one of the largest U.S. buyers of the fuel — after the Navy — is Buffett’s BNSF Railway. It too reports surging activity.

“We have seen a strong recovery in intermodal volumes as an increase in e-commerce sales drives demand for parcel and truckload intermodal shipments on our network,” said Tom G. Williams, BNSF group vice president consumer products. “As cities and states began reopening, intermodal demand was further supported by recovering brick-and-mortar retailers.”

Current volumes at some of BNSF’s intermodal facilities are as much as 20% higher than they were at this time last year, and the company is continuing to work with its customers to meet a “consistent surge” in demand while replenishing inventories that have been low since the onset of the pandemic, he said.

Even Europe

Over in Europe, the continent’s biggest owner of trucks reports the same dynamics, filling the company’s fleet and boosting usage of diesel.

“There is definitely a new consumer pattern,” said Kristian Kaas Mortensen, an executive at Girteka Logistics, a Vilnius, Lithuania-based owner of more than 7,500 trucks. “Because we can’t give it face-to-face we are shipping it.”

Girteka is so busy that it’s giving overflow business to other trucking companies. It anticipates the busiest year-end in its history.

In Germany, miles driven by large trucks have been steadily rising since September and are currently their highest in a month, according to the nation’s statistics office. Polish heavy traffic in the week to Dec. 20 is about 20% higher than the equivalent year ago. It was a similar picture in the U.K. prior to the country’s most recent set of lockdown rules.

But it’s a surge that’s global and may well be without precedent, according to Gebr. Weiss, a 500-year-old firm that lays claim to being the world’s oldest logistics company.

“Looking back at our history, you could say we’ve weathered a few challenges: a war, a revolution or two but still, in all my years in logistics I’ve never had a year like this,” said Gebr. Weiss board member Lothar Thoma. “Covid choked up, disrupted transport arteries on a global scale, messed the cycles of goods-in, goods-out, be it air, sea, rail or road.”

Qatar Airways on Thursday said it had started rerouting flights through Saudi Arabian airspace.

“This evening, Qatar Airways began to reroute some flights through Saudi airspace,” Qatar’s

national carrier tweeted, adding the first flight to use Saudi airspace was QR1365, which was

scheduled to leave Doha for Johannesburg at 8.45pm.

Flight-tracking websites later showed QR1365’s flight path over Saudi Arabia on its way to the

South African city.

This was the first scheduled Qatar Airways service to fly over Saudi Arabia since the start of the

Gulf crisis in mid-2017.

Earlier this week, the Al-Ula Declaration was signed during the GCC Summit for the restoration

of full relations between Qatar and the four nations – Saudi Arabia, the UAE, Bahrain and Egypt –

that had cut ties in 2017. This includes the reopening of borders and airspace.

Meanwhile, aviation analyst Alex Macheras told Gulf Times that “this is the most significant

development in more than three and a half years, as ‘NOTAMs’ (notices to flight crew issued by

country aviation regulators) were updated by Saudi Arabia on Thursday, removing the airspace

ban on Qatari-registered jets”.

“The removal of the ban was effective immediately, meaning just moments later a Qatar Airways

A350 bound for South Africa became the first commercial airline flight in over three years to

cross into Saudi airspace, reducing flight time and saving fuel,” he said. “The airspace of Saudi

Arabia is now open to Qatar without restriction, and we should expect Qatar’s national airline,

Qatar Airways, to resume flights to Saudi Arabia very soon.

“For now, flights that have been avoiding Saudi airspace for the duration of the blockade will

now overfly the kingdom.”

Qatar Airways pilots will once again be communicating with Saudi’s air traffic controllers, and the

airline will enjoy the fuel savings immediately – a win for the environment too, he noted.

“We’re expecting the ‘NOTAMs’ of the United Arab Emirates, Bahrain and Egypt to also be

updated in due course, following Saudi Arabia in removing their airspace bans on Qatar,”

Macheras added.

ew York: Electric carmaker Tesla closed trading on Wednesday with a market value topping $700 billion for the first time.

The latest surge means the company is worth more than General Motors, Ford, Toyota, Honda, Fiat Chrysler and Volkswagen combined.

Tesla’s share price ended with a gain of 2.8 percent to $755.98 for a total value of whopping $717 billion. That came after the stock saw a more than 700 percent ascendance in 2020 — a gain some analysts viewed as inflated.

The auto industry disruptor led by Elon Musk wowed Wall Street yet again over the weekend, reporting annual car deliveries of 499,550, just shy of its 2020 target of half a million, but well above analyst estimates.

The disclosure capped a year that saw Tesla report a series of profitable quarters and join the S&P 500, establishing the company as one of the world’s most valuable businesses and elevating Musk to the second-wealthiest person behind Amazon CEO Jeff Bezos.

While industry analysts do not expect another massive surge in value this year, they remain optimistic about the company’s sales prospects, even if the cars remain out of reach for many buyers.

The optimism comes as construction continues on new Tesla factories in Texas and Germany, which will join existing plants in California and Shanghai that are ramping up production.

Musk has expressed determination to cut the price for Tesla’s electric cars, which currently start at $37,990 in the US market.

The Tesla chief is developing battery design, material and production innovations that combine to cut the cost per kilowatt hour by 56 percent.

That should enable Tesla to field a $25,000 model in “three years-ish,” Musk said in September, adding, “it is absolutely critical that we make cars that people can actually afford.”

And US sales could be helped by President-elect Joe Biden’s commitment to green technology to combat climate change.