Regional Energy Expert Roudi Baroudi Earns Award from Washington Think Tank

Transatlantic Leadership Network Recognizes Author for Contributions to Peaceful Development in Eastern Mediterranean

WASHINGTON, DC November 9, 2023: Doha-based Lebanese author Roudi Baroudi was one of two people presented with the 2023 Transatlantic Leadership Award at a ceremony in Washington this week.

Although circumstances relating to the conflict in the Gaza Strip prevented Baroudi from attending the event, both he and Joshua Volz – the Deputy Assistant Secretary for Europe, Eurasia, Africa, and the Middle East and the Office of International Affairs at the US Department of Energy – were recognized by the Transatlantic Leadership Network (TLN). Each was cited at a gala dinner on Monday for his “valuable contribution in building a peaceful and prosperous Eastern Mediterranean” as part of the TLN’s 2nd Annual Conference on Freedom of the Media.

“I was deeply honored to be named a recipient of this prestigious award, and I will always be grateful for the many ways in which the TLN has supported my work for several years now,” Baroudi said. “I also look forward to working together in the future so that one day, our descendants can know the benefits of peace and coexistence. It is precisely in difficult and trying times that cooler heads must be able and willing to look at the reasons for current bloodshed and recrimination, then envision pathways to a better future.”

Baroudi, who serves as CEO of independent consultancy Energy and Environment Holding in Doha, is a long-time champion of dialogue, cooperation, and practical solutions to both the global climate crisis and recurrent tensions in the East Med. A regular speaker at regional energy and policy conferences, Baroudi’s insights are also avidly sought by local and international media, as well as governments, major energy companies, and investors.

Having advised both public and private sector actors on a wide variety of energy issues, Baroudi is widely credited with bringing unique perspective to all manner of policy discussions. He is the author of several books, including “Maritime Disputes in the Eastern Mediterranean: The Way Forward” (2021), and “Climate and Energy in the Mediterranean: What the Blue Economy Means for a Greener Future” (2022). Together with Notre-Dame University – Louaize, Baroudi has also published a study of the US-brokered October 2022 Maritime Boundary Agreement between Lebanon and Israel, and is currently preparing another volume on Lebanon’s prospects for similar deals with Cyprus and Syria.

The TLN describes itself as “a nonpartisan, independent, international network of practitioners, private sector leaders and policy analysts dedicated to strengthening and reorienting transatlantic relations to the rapidly changing dynamics of a globalizing world.”

Monday’s ceremony was attended by a broad cross-section of high-profile figures, including senior officials from the Departments of Energy and State, numerous members of Washington’s extensive diplomatic corps, and representatives of both international organizations and various media outlets.

Air pollution, a global scourge that kills millions of people a year, is shielding us from the full force of the sun. Getting rid of it will accelerate climate change.

That’s the unpalatable conclusion reached by scientists poring over the results of China’s decade-long and highly effective “war on pollution”, according to six leading climate experts.

The drive to banish pollution, caused mainly by sulphur dioxide (SO2) spewed from coal plants, has cut SO2 emissions by close to 90% and saved hundreds of thousands of lives, Chinese official data and health studies show.

Yet stripped of its toxic shield, which scatters and reflects solar radiation, China’s average temperatures have gone up by 0.7 degrees Celsius since 2014, triggering fiercer heatwaves, according to a Reuters review of meteorological data and the scientists interviewed.

“It’s this Catch-22,” said Patricia Quinn, an atmospheric chemist at the US National Oceanic and Atmospheric Administration (NOAA), speaking about cleaning up sulphur pollution globally. “We want to clean up our air for air quality purposes but, by doing that, we’re increasing warming.”

The removal of the air pollution — a term scientists call “unmasking” — may have had a greater effect on temperatures in some industrial Chinese cities over the last decade than the warming from greenhouse gases themselves, the scientists said.

Other highly polluted parts of the world, such as India and the Middle East, would see similar jumps in warming if they follow China’s lead in cleaning the skies of sulphur dioxide and the polluting aerosols it forms, the experts warned.

They said efforts to improve air quality could actually push the world into catastrophic warming scenarios and irreversible impacts.

“Aerosols are masking one-third of the heating of the planet,” said Paulo Artaxo, an environmental physicist and lead author of the chapter on short-lived climate pollutants in the most recent round of reports by the Intergovernmental Panel on Climate Change (IPCC), completed this year.

“If you implement technologies to reduce air pollution, this will accelerate — very significantly — global warming in the short term.”

The Chinese and Indian environment ministries didn’t immediately respond to requests for comment on the effects of pollution unmasking.

The link between reducing sulphur dioxide and warming was flagged by the IPCC in a 2021 report which concluded that, without the solar shield of SO2 pollution, the global average temperature would already have risen by 1.6 degrees Celsius above preindustrial levels.

That misses the world’s goal of limiting warming to 1.5C, beyond which scientists predict irreversible and catastrophic changes to the climate, according to the IPCC, which pegs the current level at 1.1C.

The Reuters review of the Chinese data provides the most detailed picture yet of how this phenomenon is playing out in the real world, drawing on previously unreported numbers on changes in temperatures and SO2 emissions over the past decade and corroborated by environmental scientists.

Reuters interviewed 12 scientists in total on the phenomenon of unmasking globally, including four who have acted as authors or reviewers of sections on air pollution in IPCC reports.

They said there was no suggestion among climate experts that the world should let-up on fighting air pollution, a clear and present danger that the World Health Organisation says causes about 7mn premature deaths a year, mostly in poorer countries.

Instead they stressed the need for more aggressive action to cut emissions of climate-warming greenhouse gases, with reducing methane seen as one of the most promising paths to offset pollution unmasking in the short term.

President Xi Jinping pledged to tackle pollution when he took power in 2012 following decades of coal-burning that had helped turn China into “the factory of the world”. The following year, as record smog in Beijing inspired “Airpocalypse” newspaper headlines, the government unveiled what scientists called China’s version of the US Clean Air Act.

On March 5, 2014, a week after Xi went on a walkabout during another extreme bout of smog in the capital, the government officially declared a war on pollution at the National People’s Congress.

Under the new rules, power plants and steel mills were forced to switch to lower-sulphur coal. Hundreds of inefficient factories were shuttered, and vehicle fuel standards toughened up. While coal continues to be China’s largest power source, smokestack scrubbers now strip out most SO2 emissions.

China’s SO2 emissions had decreased from a 2006 peak of at nearly 26mn metric tons to 20.4mn tons in 2013 thanks to more gradual emissions restrictions. But with the war on pollution, those emissions had plummeted by about 87% to 2.7mn metric tons by 2021.

The drop in pollution was accompanied by a leap in warming — the nine years since 2014 have seen national average annual temperatures in China of 10.34C, up more than 0.7C compared with the 2001-2010 period, according to Reuters calculations based on yearly weather reports published by the China Meteorological Administration.

Scientific estimates vary as to how much of that rise comes from unmasking versus greenhouse gas emissions or natural climate variations like El Nino.

The impacts are more acute at a local level near the pollution source. Almost immediately, China saw big warming jumps from its unmasking of pollution near heavy industrial regions, according to climate scientist Yangyang Xu at Texas A&M University, who models the impact of aerosols on the climate.

Xu told Reuters he estimated that unmasking had caused temperatures near the cities of Chongqing and Wuhan, long known as China’s “furnaces”, to rise by almost 1C since sulphur emissions peaked in the mid-2000s.

During heatwaves, the unmasking effect can be even more pronounced. Laura Wilcox, a climate scientist who studies the effects of aerosols at Britain’s University of Reading, said a computer simulation showed that the rapid decline in SO2 in China could raise temperatures on extreme-heat days by as much as 2C.

“Those are big differences, especially for somewhere like China, where heat is already pretty dangerous,” she said.

Indeed, heatwaves in China have been particularly ferocious this year. A town in the northwestern region of Xinjiang saw temperatures of 52.2C (126F) in July, shattering the national temperature record of 50.3C set in 2015.

Beijing also experienced a record heatwave, with temperatures topping 35C (95F) for more than four weeks.

The effects of sulphur unmasking are most pronounced in developing countries, as the US and most of Europe cleaned up their skies decades ago. While the heat rise from sulphur cleanup is strongest locally, the effects can be felt in far-distant regions. One 2021 study co-authored by Xu found that a decrease in European aerosol emissions since the 1980s may have shifted weather patterns in Northern China.

In India, sulphur pollution is still rising, roughly doubling in the last two decades, according to calculations by NOAA researchers based on figures from the US-funded Community Emissions Data System.

In 2020, when that pollution plummeted due to Covid lockdowns, ground temperatures in India were the eighth warmest on record, 0.29 C higher than the 1981-2010 average, despite the cooling effects of the La Nina climate pattern, according to the India Meteorological Department.

India aims for an air cleanup like China’s, and in 2019 launched its National Clean Air Programme to reduce pollution by 40% in more than 100 cities by 2026.

Once polluted regions in India or the Middle East improve their air quality by abandoning fossil fuels and transitioning to green energy sources, they too will lose their shield of sulphates, scientists said.

“You stop your anthropogenic activities for a brief moment of time and the atmosphere cleans up very, very quickly and the temperatures jump instantaneously,” added Sergey Osipov, a climate modeller at the King Abdullah University of Science and Technology in Saudi Arabia.

As the implications of the pollution unmasking become more apparent, experts are casting around for methods to counter the associated warming.

One proposal called “solar radiation management” envisions deliberately injecting sulphur aerosols into the atmosphere to cool temperatures. But many scientists worry that the approach could unleash unintended consequences.

A more mainstream plan is to curb methane emissions. This is seen as the quickest way to tame global temperatures because the effects of the gas in the atmosphere last only a decade or so, so cutting emissions now would deliver results within a decade. Carbon dioxide, by comparison, persists for centuries.

As of 2019, methane had caused about 0.5C in warming compared with preindustrial levels, according to IPCC figures.

While more than 100 countries have pledged to reduce methane emissions by 30% by the end of the decade, few have gone further than drawing up “action plans” and “pathways” to cuts. China — the world’s biggest emitter — has yet to publish its plan.

By targeting methane, the world could mitigate the warming effect of the reduction in pollution and potentially avert catastrophic consequences, said Michael Diamond, an atmospheric scientist at Florida State University.

“This doesn’t doom us to going above 1.5 degrees Celsius if we clean up the air.”

NEW YORK, Oct 28: ExxonMobil and Chevron reported lower profits Friday compared with the year-ago blowout quarter as the oil giants touted recent acquisitions they said balance economic and environmental priorities.

The two petroleum heavyweights — which in recent weeks have unveiled large takeovers of midsized fossil fuel players — both reported third-quarter profits that were big, but dwarfed by those in the year-ago period.

ExxonMobil reported third-quarter profits of $9.1 billion, less than half the level in the 2022 period of booming commodity prices, while Chevron scored profits of $6.5 billion, down 42 percent from the year-ago level.

The lower profits reflected an ebbing in commodity prices compared with the year-ago period, when Russia’s invasion of Ukraine lifted oil and natural gas prices.

The results were released only days after Chevron announced a $53 billion acquisition of Hess that includes a significant stake in an oil-rich Guyana offshore territory.

That followed on the heels of ExxonMobil’s $60 billion takeover of Pioneer Natural Resources, a big player in the Permian Basin, a fast-growing petroleum region in the southwestern US.

The two large transactions have raised hopes among investment bankers of additional merger and acquisition activity involving fossil fuels, while angering progressive lawmakers and others focused on addressing climate change.

“While our homes get destroyed by climate-supercharged storms, Chevron and Exxon are betting the house on a fossil-fueled future,” Democratic Senator Ed Markey said on X, formerly Twitter, earlier this week.

“We have to make Big Oil fold their hand before our future goes bust.”

In the latest quarter, ExxonMobil scored higher oil and natural gas volumes compared with the second quarter and said that 2023 capital and exploration spending would be “at the top end” of its forecast “as the company pursues value accretive opportunities,” according to its earnings press release.

“We delivered another quarter of strong operational performance, earnings and cash flows, adding nearly 80,000 net oil-equivalent barrels per day to support global supply,” said Chief Executive Darren Woods.

ExxonMobil has said it plans significant investment in Pioneer’s Permian Basin fields that would enable Exxon to more than double its current volumes from the region to two million barrels of oil equivalent per day in 2027.

In its press release, ExxonMobil characterized its approach as a balanced strategy, noting the company has also announced a $4.9 billion takeover of Denbury Inc. as a bet on carbon capture and sequestration, which the company has touted as a climate solution. ExxonMobil said its would boost petroleum output and “accelerate Pioneer’s path to net zero” emissions.

“The two transactions we’ve announced further underscore our ongoing commitment to the ‘and’ equation by continuing to meet the world’s needs for energy and essential products while reducing emissions,” Woods said.

“Pioneer will help us grow supply to meet the world’s energy needs with lower carbon intensity while Denbury improves our competitive position to economically reduce emissions in hard-to-decarbonize industries.”

Chevron’s results also showed an uptick in third-quarter production, with the company citing the boost from it earlier purchase of PDC Energy, smaller Permian operator.

Chevron as well highlighted its comparatively small efforts in its “New Energies” division, which last month closed a transaction to acquire a majority stake in Aces Delta. The first projet in that venture will convert and store hydrogen made from renewable energy, is expected to enter commercial service in 2025.

“Chevron is delivering strong financial results while also investing to profitably grow our traditional and new energy businesses to drive superior value for shareholders,” said Chevron Chief Executive Mike Wirth.

But critics such as clean energy podcaster David Roberts ripped both deals, saying on X, “Oil companies are quite flagrantly telling the world that they don’t take decarbonization goals seriously. They are betting on climate failure, to the tun of billions.”

Shares of ExxonMobil rose 0.3 percent in pre-market trading, while Chevron fell 2.1 percent. �AFP

Qatar is participating with a delegation headed by HE the Minister of Transport and Communications Jassim Seif Ahmed al-Sulaiti in the Tbilisi Belt and Road Forum, which was inaugurated on Tuesday in Tbilisi, Georgia, under the theme: “Partnership for Global Impact”.

Inaugurated by the Prime Minister of Georgia, Giorgi Gakharia, on Tuesday, the forum saw the attendance of over 2,000 participants from 60 countries, including heads of states, ministers, diplomats and representatives of international and business organisations.

In his opening speech, Gakharia stressed the importance of the new Silk Road in modern economic integration and globalisation, saying that the participation in the initiative is among the top priorities of the Georgian government.

Georgia was one of the first countries applauding the China-proposed Belt and Road Initiative (BRI) to create new trade corridors between Europe and Asia and improve existing ones, he said.

The Tbilisi Silk Road Forum, he said, is “an important opportunity” and a platform on which the countries involved in the BRI, international organisations and the private sector discuss regional economic challenges and explore ways to overcome the challenges and share experience.

The forum is being held for the third time in Tbilisi.

It is opened by the Prime Minister of Georgia and organised by the Georgian ministries of foreign affairs, economy and sustainable development and supported by China and the Asian Development Bank.

The mission of the forum is to serve as an international platform for multilateral high-level dialogue among senior policymakers, businesses and community leaders to discuss important issues on trade and connectivity, examine challenges facing countries along the New Silk Road connecting East and West, and find common solutions that have a positive impact on the region and the global economy.

Day 1 provides opportunities to discuss a full spectrum of issues related to trade, artificial intelligence (AI), transport and energy in separate panel discussions, and Day 2 focuses on the private sector and investment opportunities in Georgia.

Meanwhile, Prime Minister Gakharia met HE al-Sulaiti in Tbilisi on Tuesday. The meeting reviewed bilateral relations between Qatar and Georgia in the fields of transportation, mobility and communications and means of further enhancing them, in addition to discussing a number of topics of common interest.

COP season is almost here. For the climate-conscious, the annual Conference of the Parties of the UN Framework Convention on Climate Change (UNFCCC) is a fixture of the late-year calendar and an opportunity to take stock of our goals, needs, and achievements. We spend two weeks preoccupied with a distant event hoping that negotiators will make meaningful progress toward mitigating the climate threat. But to keep our expectations for COP28 realistic, we must understand what a COP can and cannot do.

We are steadily decarbonising our economies. Within a decade, wind and solar power will be the major sources of electricity, and sales of electric vehicles (EVs) are likely to overtake those with internal combustion engines. According to the International Energy Agency, the world’s fossil-fuel consumption will start falling by 2030. Though this is probably too late to limit the global temperature increase to 2C, let alone 1.5C, above pre-industrial levels, it is sooner than one would have expected only a short time ago.

But little of this progress is directly attributable to COPs, including COP21 in 2015, from which the Paris climate agreement emerged. In fact, the Paris agreement specifies nothing about EVs or wind or solar power. Instead, it is Tesla that is responsible for the growth of EV sales: the commercial success of the company’s Model S drove other high-end automakers to develop the competitive products which are now debuting.

Is there any connection between COPs and Tesla’s success? If there is, it is not direct. During its early growth stages, Tesla benefited greatly from the United States’ Corporate Average Fuel Economy (CAFE) regulations, which enabled it to sell zero-emissions credits to other manufacturers. The revenues from ZEC sales sometimes surpassed those of car sales.

The CAFE regulations date back to 1975, two decades before the first COP was held. They have, however, been tightened over time, a process that might partly reflect increased awareness, fostered by the COPs, of the climate challenge. Similarly, the COPs might have encouraged the subsidies, in both the US and the European Union, from which Tesla has benefited more recently, after it had already become a major force in the auto industry.

As for solar and wind, the sharp decline in costs has driven their dramatic growth. From 2009 to 2019, the cost of solar power fell from $0.36 per kilowatt-hour to $0.03. This decline is attributable to two main factors: economies of scale, which lowered the costs of producing each silicon wafer, and learning by doing, which led to more efficient – and thus cheaper – manufacturing processes. Both factors sustain a virtuous cycle: as the use of solar power increases, costs come down, further accelerating the adoption of solar power.

This process was kicked off by Germany’s adoption of generous feed-in tariffs for solar power in 2000. The Chinese government subsequently began investing heavily in solar, which it identified as a strategically important industry. Again, these important policy moves could have been encouraged by the increased awareness of climate change that they generate at COP meetings.

For offshore wind, the decline in costs has been driven largely by Orsted and Equinor, two Scandinavian companies that leveraged their offshore oil and gas expertise to develop offshore wind farms, which use many of the same technologies. Government subsidies helped the nascent technology to become commercially viable.

In short, progress on decarbonisation has primarily reflected technological breakthroughs brought about by for-profit ventures with the help and guidance of supportive government policies. Those policies might have been crystallised by the discussions at, and publicity surrounding, the COPs, though they were not the result of specific directives from those meetings or contained in the Paris agreement.

So, what should we hope emerges from COP28? COPs can produce two types of positive outcomes. The first are “big picture” outcomes, such as maintaining pressure on governments and corporations to reduce emissions. Here, it is important not only to reiterate the importance of reaching zero emissions and highlight how far we have yet to go, but also to recognise the progress that has already been made.

The second type of outcome is more granular. This year’s COP must mark the beginning of a process that will clarify what constitutes a valid carbon offset. Many corporations are currently expecting to reduce, but not eliminate, their emissions, on the assumption that they can buy carbon offsets to take them to net-zero. But the world obviously cannot get to zero emissions – the ultimate goal – if anyone is still emitting.

Equally important, it has lately become clear that many voluntary carbon offsets are worthless, as they do not meet the standard of additionality (the guarantee that the relevant emissions reductions would not have occurred without support from carbon credit sales) or avoid leakage (the shifting of emissions elsewhere). An international body must set clear standards for the validity of offsets and impose limits on their use, and the UNFCCC is the obvious candidate.

COP28 has the potential to encourage further climate action, including the introduction or strengthening of policies that can lead to emissions-reducing technological breakthroughs, as well as to deliver a much-needed rulebook on important technical issues, such as the use of offsets. Whether it succeeds depends entirely on execution. – Project Syndicate

بارودي مُصرّ على التفاؤل وينشر الخارطة: اكتشاف الغاز لا يكون دائماً من خلال حفر البئر الاول

الدراسات والأبحاث تؤكد ان احتمالات اكتشاف الغاز في المياه اللبنانية مرتفعة جداً

خاص “اخبار اليوم”

أكد الخبير في شؤون الطاقة رودي بارودي أن القصة لم تنته مع عدم اكتشاف الغاز في البئر الاول إذ أنه من المهم جداً معرفة أن كل بلوك بحري يجب تقسيمه إلى عدد من الآبار ومن الطبيعي جداً أن تقوم شركات الاستكشاف بحفر آبار عدة قبل اكتشاف البئر الرئيسي الذي يحتوي على مخزون تجاري من الغاز.

و في حديث الى وكالة “أخبار اليوم”، اوضح بارودي إنه لم ييأس من عدم اكتشاف الغاز في البئر الأول، ذلك أن أكبر حقل للغاز في البحر المتوسط الذي هو حقل “ظُهر” والذي يقع في منطقة بلوك شروق في مصر، ويمتد على الحدود بين مصر وقبرص. كانت حقوق استغلال هذا الحقل تعود لشركة شل لمدة 15 عاماً، وخلال هذه الفترة قامت الشركة بحفر العديد من الآبار ولكنها لم تنجح في العثور على أي كميات من الغاز حتى قامت ببيع حقوق الاستكشاف لشركة إيني الإيطالية في عام 2015، التي بدورها حفرت بئراً واحداً على عمق 5100 متر لتجد أكبر مخزون من الغاز في شرق المتوسط والمقدر بـ 850 مليار متر مكعب.

ورأى بارودي أن هذا الأمر يشير إلى أن اكتشاف الغاز لا يكون دائماً من خلال حفر البئر الاول. وقد تكرر هذا الأمر مع حقول الغاز في قبرص إذ إنه لم تكتشف أي كمية من الغاز التجاري في البئر الاول، علماً أن حقل أفروديت في قبرص والقريب من لبنان احتاجت شركة نوبل لحفر بئر على عمق 5800 متر لكي تجد الغاز، والخريطة المرفقة تبين الاعماق في البحر في كل من قبرص واسرائيل ومصر للحقول المستكشفه ومنها: كاريش (٤٨٨٠ متر) ، تمار (٥٠٠٠ متر) ، لفثيان (٥١٧٠ متر)، افروديت (٥٨٠٠ متر) ، كرونوس (٢٢٨٧ متر)، ظُهر (٤١٣١ متر)، كاليبسو (٢٠٧٤ متر).

من هنا من غير الجائز علمياً القول بإنه لا يوجد كميات من الغاز التجاري في البلوك 9 اذ ان عملية الاستكشاف لم تشمل لغاية تاريخه إلا بئراً واحداً وعلى عمق فقط 3500 متر.

أما عن وجود مؤامرة تقوم بها شركات التنقيب، فقال بارودي: من المؤسف أن بعض المحللين وخبراء النفط يتحدثون عن مؤامرة يقوم بها الكونسورتيوم المكون من شركات عالمية وهي إيني، توتال، وقطر للطاقة وهي من الشركات العملاقة في مجال الطاقة والتي لا تدخل في البازار السياسي ولديها مصالح في كل بلاد العالم.

واضاف: علينا أن نستفيد من وجودها في لبنان بدل اتهامها ورمي الشائعات عليها. ولكن من الممكن أن يؤثر الوضع العام الحالي، وخصوصاً أن الحرب دائرة على حدودنا أن تقوم الشركات بتعليق أنشطتها موقتاً ريثما تنجلي الصورة.

وتابع: الاتفاق المبرم بين الدولة اللبنانية والكونسورتيوم المكلف بالاستكشاف ينص على أن تقوم الشركات بحفر اثنين من آبار الاستكشاف قبل أن يتخذ قرار بشأن وجود الغاز أو عدمه. من هنا، فأن بث الأجواء السلبية وفكرة المؤامرة لا تفيد لبنان بشيء، بل على العكس علينا المثابرة بالعمل للحفاظ على حقوقنا.

وختم: كما من واجب الحكومة والمجلس النيابي المباشرة فوراً بالاصلاحات المالية والاقتصادية المطلوبة من لبنان لكي نستطيع أن نواكب عمليات الاستكشاف، فلا تذهب الثروة النفطية الموعودة في نهر الفساد الجارف الذي نعاني منه.

Natural gas consumption is projected to increase by 36% even as its contribution to the global energy mix will go up from the current 23% to 26% by 2050, Doha-headquartered GECF said in its updated Global Gas Outlook.

The outlook foresees a sustained increase in primary energy consumption over the next three decades. This growth is underpinned by a rising global population and a doubling of the global economy’s size by 2050.

Natural gas’ leadership position establishes it as the dominant energy source, surpassing coal, oil, and even renewables, despite the latter being the fastest-growing energy sector during this period.

Following the 25th GECF Ministerial Meeting in Malabo, Equatorial Guinea, the Gas Exporting Countries Forum, examined recent short-term gas market developments and immediate prospects.

The meeting noted with satisfaction the continued growth in natural gas demand, and number of LNG importing countries, and despite a mild winter season, expanded renewable and nuclear energy output, and policy-driven demand reduction measures in some countries.

It also recognised the resilience of global gas supply, as well as the sustainable gas output of GECF member countries, which contributes to strengthening global energy security.

While prices have markedly softened in comparison of last year’s summer levels, and volatility has declined, gas markets will nevertheless continue to be tight should the upcoming winter be colder than normal in the Northern Hemisphere.

The ministers also noted that in the medium term, market tightness will begin to ease after 2025 when the majority of new LNG projects are set to be commissioned, with GECF member countries spearheading this expansion.

The meeting welcomed the efforts of GECF member countries in reducing gas flaring, methane emissions, and the carbon footprint of natural gas operations.

It also underscored the crucial role of technology in making natural gas even cleaner, such as carbon capture, utilisation, and storage, as well as low-carbon hydrogen and ammonia.

It resoundingly affirmed its unwavering support for African nations in their resolute pursuit of eradicating energy poverty, recognising the profound urgency of this mission in the face of grim statistics. It is a stark reality that over 600mn individuals in Africa still lack access to electricity, while more than 970mn do not have access to clean cooking.

Moreover, the Meeting underscored the pressing role of the United Nations Sustainable Development Goals (UN SDGs) and the imperative of implementing them in a comprehensive and harmonious manner, considering their economic, social, and environmental dimensions.

This holistic approach resonates with the concerns highlighted in the recent UN SDG progress report, which regrettably reveals that nearly half of the targets are behind schedule.

GECF asserted the essential role of investment and the necessity of fostering an environment that encourages unrestricted investment and promotes financial cooperation across continents.

It also emphasised the importance of ensuring equitable access to all technologies. These actions are instrumental in safeguarding the stability of both energy demand and supply, taking into account national circumstances, capabilities, and priorities.

In this context, the meeting cautioned against misguided calls to halt natural gas investment. Such actions could lead to supply shortages, inflated prices, and a potential return to coal, as seen in 2022, undermining emission reduction objectives.

Furthermore, it reiterated the crucial significance of safeguarding critical gas infrastructure, both on a national and international scale, to facilitate the seamless flow of natural gas. It underscored the imperative of protecting these facilities from natural disasters, technological mishaps, man-made threats, and deliberate attacks.

ميريام بلعة

المركزية– تتقدَّم عمليات الحفر واستكشاف النفط والغاز التي تجريها المنصّة العائمة في الـ”بلوك 9″ في المياه الإقليمية اللبنانية بقيادة “توتال إنرجي”، بوتيرة سريعة جداً من دون أي صعوبات أو عراقيل، بحسب المعلومات المتداولة في الساعات الأخيرة والتي رجّحت أن تصدر النتائج الأوّلية لعملية الحفر قبل 15 يوماً من الموعد المحدَّد!

هذه المعطيات حملتها “المركزية” إلى خبير الطاقة الدولي رودي بارودي لاستشراف أي معطى جديد في الأمد القريب، وعما يتوقّعه من المرحلة الاستكشافية مع بدء عمل الباخرة TRANSOCEAN BARENTS في البلوك 9، فيُجيب بارودي: لقد قام الكونسورتيوم الذي تترأسه شركة “توتال” والذي يضمّ شركات “توتال” و”إيني” و”قطر للطاقة” بما وعد به والتزم باستئجار هذه المنصّة الاستكشافية الرئيسية. لكن للأسف، لم تقم الحكومة اللبنانية بدورها بعد، فلبنان يحتاج أولاً وقبل كل شيء إلى انتخاب رئيس للجمهورية وهو أمر مهم جداً للبلاد. كما على السلطات اللبنانية القيام بالكثير من الإصلاحات العاجلة، والأكثر إلحاحاً هو إحياء و/أو تعيين هيئة جديدة لإدارة قطاع البترول اللبنانية، علماً أنه تم تشكيل الهيئة في العام 2012، وقام أعضاؤها بأعمال كثيرة ومهّدوا الطريق أمام عملية الاستكشاف، إنما انتهت مدة ولاية الهيئة في العام 2018، ومنذ ذلك الحين غادر العديد من أعضائها لبنان أو استقال.

ويُضيف: الإصلاح الثاني الأكثر أهمية هو الإصلاح القضائي على المستويات كافة من أجل حماية مصالح لبنان وشركات النفط والغاز الكبرى. ومن المعروف أن القضاء المستقل يجذب الاستثمارات المهمة، من هنا فإن استعادة الثقة بالقضاء وعلى كل الأصعدة، واجبٌ. إضافة إلى ذلك، من الضروري تطبيق الإصلاحات المطلوبة من المجتمع الدولي ولا سيما الإصلاحات المالية التي تعطي الثقة مجدداً بالقطاع المصرفي، وبالطبع يجب إقرار قانون صندوق سيادي يوافق بين الحاجات اللبنانية والمبادئ العالمية، خصوصاً لناحية الشفافية. لذلك ينبغي القيام بدراسة معمّقة لقانون الصندوق السيادي ليكون صندوقاً شفافاً يمكنه أن يؤدي واجباته على أكمل وجه، خصوصاً أن الثروة النفطية هي ملك الشعب اللبناني ويُفترض عدم التفريط بها.

ولم يغفل بارودي الإشارة في هذا المجال، إلى أنه “في حال وجد لبنان النفط في مياهه الإقليمية، فإن الاستثمار الأجنبي المباشر (FDI) الذي سيحتاجه الكونسورتيوم الذي تترأسه “توتال”، سيتراوح بالتأكيد ما بين 1 و3 مليارات دولار، وذلك حسب البنية التحتية اللازمة. علماً أن الاستثمار الأجنبي المباشر يحتاج دائمًا إلى سيادة القانون والشفافية المطلقة والاستقرار السياسي”.

موجودات الـ”بلوك 9″

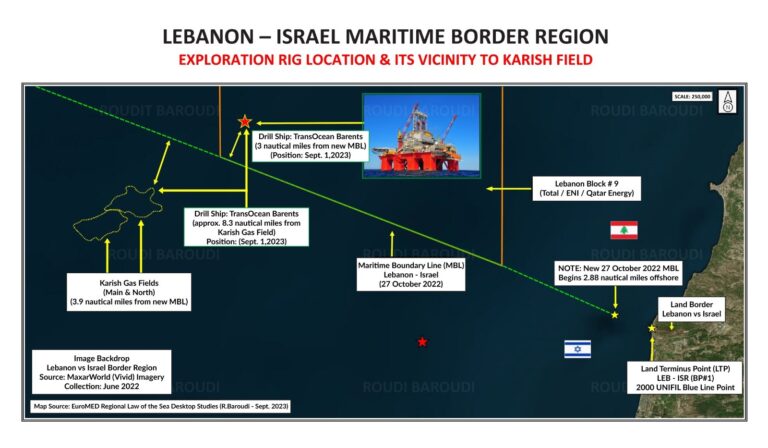

وعن رأيه في احتمالية موجودات الـ”بلوك 9″ وعما إذا كان هناك من أمل، يقول بارودي “إذا نظرنا إلى هذه الخريطة الحصريّة لـ”المركزية” والتي تُظهر موقع باخرة BARENT Ocean Rig، سنرى من موقعها أنها بالكاد تبعُد 3 أميال فقط عن خطوط الحدود البحرية الجديدة بين لبنان وإسرائيل. وإذا نظرنا أيضًا إلى الجنوب الغربي، فهي بعيدة حوالي 8.3 أميال، هذه هي المسافة التي تفصلها عن حقل غاز “كاريش”. إضافة إلى ذلك، فإن أن سفينة الحفر لا تبعُد أكثر من 25-30 ميلاً عن الخطوط البحرية اللبنانية القبرصيّة حيث تم اكتشاف كميّات تجاريّة. من هنا، فإن احتمال وجود كميّات تجاريّة في البلوكات اللبنانية 8 و9 و10 وفقًا لعلماء الجيولوجيا الأميركيين، مرتفعة جدًا.

ويُلفت في هذا السياق، إلى أن “مساحة الـ”بلوك 9″ تبلغ حوالي ± 1700 كيلومتر مربّع، ومساحة الـ”بلوك 8″ من ± 1400 كيلومتر مربّع، ومساحة الـ”بلوك 10” ± 1380 كيلومتراً مربّعاً على بُعد أميال قليلة جنوبًا، حيث تقع حقول الغاز مثل “تمار” و”كاريش” و”ليفياثان”، ويُضيف: يتمتّع لبنان وحوض “ليفياثان” بشكل عام، بإمكانات عالية جداً ليس فقط في البحر إنما أيضاً في البرّ. هذا ما أكّدته دراسات عديدة موثوقة منذ العام 1992.

ويختم بارودي: بالتالي، هناك إمكانات كبيرة لاستكشافات تجاريّة واعدة، ما يحتاج إليه لبنان هو الاستعداد لتلقي الموارد النفطية والغازية بطريقة آمنة لضخ هذه الثروة في الاقتصاد والتنمية الاجتماعية والرعاية الصحية، وإطفاء الديون المالية… كل ذلك، شرط إجراء إصلاحات حقيقيّة وعلى كل الأصعدة المالية والاقتصادية، وإبعاد المناكفات السياسية عن هذا الملف الحساس.

Vasudhaiva Kutumbakam – these two words capture a deep philosophy. It means ‘the world is one family.’ This is an all-embracing outlook that encourages us to progress as one universal family, transcending borders, languages and ideologies. During India’s G20 presidency, this has translated into a call for human-centric progress. As One Earth, we are coming together to nurture our planet. As One Family, we support each other in the pursuit of growth. And we move together towards a shared future – One Future – which is an undeniable truth in these interconnected times.

The post-pandemic world order is very different from the world before it. There are three important changes, among others.

First, there is a growing realization that a shift away from a GDP-centric view of the world to a human-centric view is needed.

Second, the world is recognizing the importance of resilience and reliability in global supply chains.

Third, there is a collective call for boosting multilateralism through the reform of global institutions.

Our G20 presidency has played the role of a catalyst in these shifts.

In December 2022, when we took over the presidency from Indonesia, I had written that a mindset shift must be catalyzed by the G20. This was especially needed in the context of mainstreaming the marginalized aspirations of developing countries, the Global South and Africa.

The Voice of Global South Summit in January 2023, which witnessed participation from 125 countries, was one of the foremost initiatives under our presidency. It was an important exercise to gather inputs and ideas from the Global South. Further, our presidency has not only seen the largest-ever participation from African countries but has also pushed for the inclusion of the African Union as a permanent member of the G20.

An interconnected world means our challenges across domains are interlinked. This is the midway year of the 2030 Agenda and many are noting with great concern that the progress on SDGs is off-track. The G20 2023 Action Plan on Accelerating Progress on SDGs will spearhead the future direction of the G20 towards implementing the SDGs.

In India, living in harmony with nature has been a norm since ancient times and we have been contributing our share towards climate action even in modern times.

Many countries of the Global South are at various stages of development and climate action must be a complementary pursuit. Ambitions for climate action must be matched with actions on climate finance and transfer of technology.

We believe there is a need to move away from a purely restrictive attitude of what should not be done, to a more constructive attitude focusing on what can be done to fight climate change.

The Chennai High-Level Principles for a Sustainable and Resilient Blue Economy focus on keeping our oceans healthy.

A global ecosystem for clean and green hydrogen will emerge from our presidency, along with a Green Hydrogen Innovation Center.

In 2015, we launched the International Solar Alliance. Now, through the Global Biofuels Alliance, we will support the world to enable energy transitions in tune with the benefits of a circular economy.

Democratizing climate action is the best way to impart momentum to the movement. Just as individuals make daily decisions based on their long-term health, they can make lifestyle decisions based on the impact on the planet’s long-term health. Just like yoga became a global mass movement for wellness, we have also nudged the world with Lifestyles for Sustainable Environment (LiFE).

Due to the impact of climate change, ensuring food and nutritional security will be crucial. Millets, or Shree Anna, can help with this while also boosting climate-smart agriculture. In the International Year of Millets, we have taken millets to global palates. The Deccan High Level Principles on Food Security and Nutrition is also helpful in this direction.

Technology is transformative but it also needs to be made inclusive. In the past, the benefits of technological advancements have not benefited all sections of society equally. India, over the last few years, has shown how technology can be leveraged to narrow inequalities, rather than widen them.

For instance, the billions across the world that remain unbanked, or lack digital identities, can be financially included through digital public infrastructure (DPI). The solutions we have built using our DPI have now been recognized globally. Now, through the G20, we will help developing countries adapt, build and scale DPI to unlock the power of inclusive growth.

That India is the fastest-growing large economy is no accident. Our simple, scalable and sustainable solutions have empowered the vulnerable and the marginalized to lead our development story. From space to sports, economy to entrepreneurship, Indian women have taken the lead in various sectors. They have shifted the narrative from the development of women to women-led development. Our G20 presidency is working on bridging the gender digital divide, reducing labor force participation gaps and enabling a larger role for women in leadership and decision-making.

For India, the G20 presidency is not merely a high-level diplomatic endeavor. As the Mother of Democracy and a model of diversity, we opened the doors of this experience to the world.

Today, accomplishing things at scale is a quality that is associated with India. The G20 presidency is no exception. It has become a people-driven movement. Over 200 meetings will have been organized in 60 Indian cities across the length and breadth of our nation, hosting nearly 100,000 delegates from 125 countries by the end of our term. No presidency has ever encompassed such a vast and diverse geographical expanse.

It is one thing to hear about India’s demography, democracy, diversity and development from someone else. It is totally different to experience them first-hand. I am sure our G20 delegates would vouch for this.

Our G20 presidency strives to bridge divides, dismantle barriers and sow seeds of collaboration that nourish a world where unity prevails over discord, where shared destiny eclipses isolation. As the G20 president, we had pledged to make the global table larger, ensuring that every voice is heard and every country contributes. I am positive that we have matched our pledge with actions and outcomes.