East Mediterranean Maritime Borders: Lebanon vs. Israel: Whatever talks achieve both Lebanon and Israel need to update Maritime Boundaries

Θαλάσσια σύνορα της Ανατολικής Μεσογείου

Από τον Ρούντι Μπαρούντι

Λίβανο VS Iσραήλ : Σε όποιες συνομιλίες και εάν καταλήξουν τόσο το Ισραήλ όσο και ο Λίβανος πρέπει να επικαροποιήσουν τα θαλάσσια σύνορα

Οι πολιτικοί κύκλοι του Λιβάνου ασχολούνται και πάλι, αυτή τη φορά σχετικά με το εάν ο Λίβανος πρέπει να καταθέσει στα Ηνωμένα Έθνη νέες συντεταγμένες που να ορίζουν την υπεράκτια αποκλειστική οικονομική ζώνη (ΑΟΖ) της χώρας.

Στην πραγματικότητα, δύο ερωτήσεις πρέπει να απαντηθούν:

1) Ο Λίβανος έχει το δικαίωμα να επικαιροποιήσει τους θαλάσσιους ισχυρισμούς του στον ΟΗΕ;

2) Εάν ναι, θα πρέπει ο Λίβανος να κάνει χρήση αυτού του δικαιώματος υπό τις παρούσες συνθήκες;

Το ζήτημα είναι κρίσιμο, όχι μόνο επειδή σχετίζεται άμεσα με τις συνομιλίες επί των θαλασσίων ζωνών οι οποίες επί τους παρόντος έχουν καθεστερήσει αλλά και επειδή επηρεάζει την ταχύτητα με την οποία μπορεί να αρχίσει να λαμβάνει απτά οφέλη από τυχόν υποθαλάσσιους υδρογονάνθρακες εντός της ΑΟΖ της .

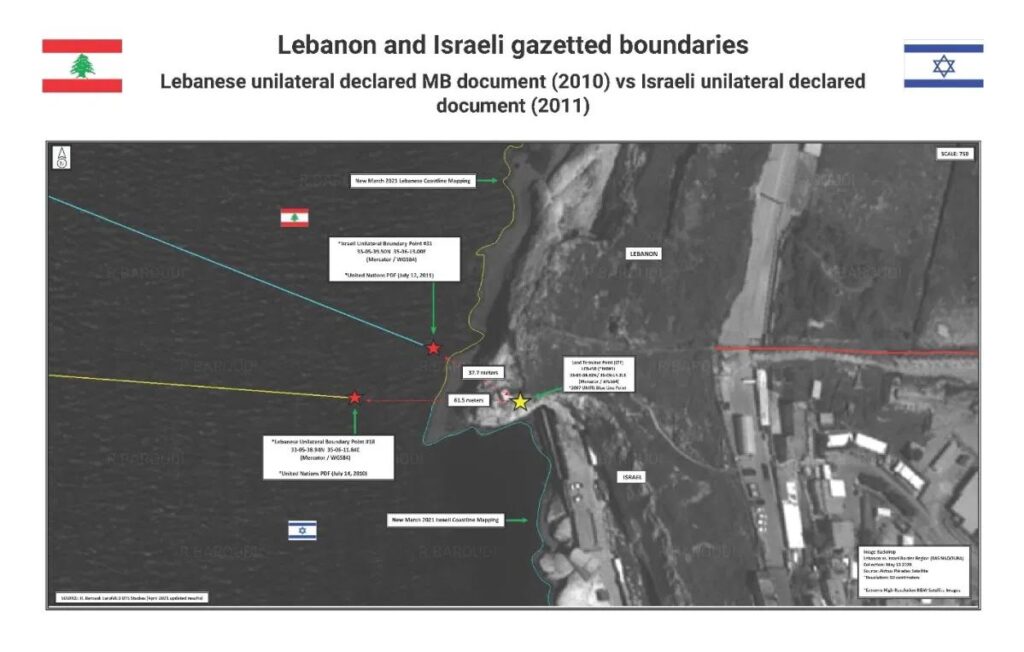

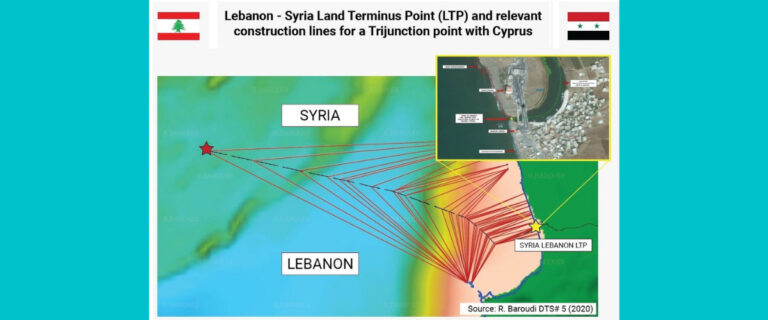

Για να σας βοηθήσω, η πρώτη ερώτηση είναι η ευκολότερη. Το δικαίωμα του Λιβάνου να επικαιροποιησεί τις συντεταγμένες στον ΟΗΕ όχι μόνο κατοχυρώνεται στη Σύμβαση των Ηνωμένων Εθνών για το Δίκαιο της Θάλασσας (UNCLOS), αλλά προστατεύεται επίσης από το Διεθνές Εθιμικό Δίκαιο (CIL), και καθιερώθηκε από αμέτρητες προηγούμενες περιπτώσεις ως συνήθη πρακτική των χωρών που επιδιώκουν να καθορίσουν και να υπερασπιστούν τους θαλάσσιους ισχυρισμούς τους, κυρίως επειδή η συνεχής τεχνολογική πρόοδος επιτρέπει όλο και πιο ακριβή χαρτογράφηση.Είναι επίσης σημαντικό να σημειωθεί ότι το Προεδρικό Διάταγμα 6433 του 2010, σύμφωνα με το οποίο οι συντεταγμένς του Λιβάνου κατατέθηκαν για τελευταία φορά στον ΟΗΕ, προέβλεπε ρητά τη δυνατότητα μελλοντικών ενημερώσεων. Το άρθρο 3 δεν αφήνει κανένα περιθώριο παρερμηνείας: «Ανάλογα με τις ανάγκες, και υπό το πρίσμα των διαπραγματεύσεων με τα σχετικά γειτονικά κράτη, τα σύνορα της αποκλειστικής οικονομικής ζώνης μπορούν να οριστούν και να βελτιωθούν και, κατά συνέπεια, να τροποποιηθεί ο χάρτης των συντεταγμένων της, εάν γίνουν διαθέσιμα ακριβέστερα δεδομένα. Να μην υπάρχει αμφιβολία, και όπως θα δούμε παρακάτω, τέτοια δεδομένα έχουν καταστεί διαθέσιμα.Επιπλέον, όταν η Μόνιμη Αποστολή του Λιβάνου στα Ηνωμένα Έθνη κατέθεσε τους ισχυρισμούς που εγκρίθηκαν βάσει του διατάγματος 6433, η συνοδευτική επιστολή περιελάμβανε την ακόλουθη δήλωση : «Υπάρχει ανάγκη διεξαγωγής μιας λεπτομερούς έρευνας, χρησιμοποιώντας ένα παγκόσμιο σύστημα εντοπισμού θέσης, της ακτής που εφάπτεται στην νότιο όριο, συμπεριλαμβανομένων όλων των νησιών και των νησίδων με σκοπό την ενημέρωση των ναυτικών χαρτών και της γραμμής βάσης ανάλογα στο μέλλον. ” Και πάλι, για να είμαστε απόλυτα σαφείς: έχουν διεξαχθεί τέτοιες έρευνες.Επίσης, ενώ οι Ισραηλινοί αξιωματούχοι έχουν επιδιώξει (όχι πολύ πειστικά) να αμφισβητήσουν το δικαίωμα του Λιβάνου να κατατεθέσει τους ισχυρισμούς του, η συμφωνία οριοθέτησης ΑΟΖ του Οκτωβρίου 2010 της ίδιας της χώρας τους (η οποία βασίζεται σε ισραηλινές συντεταγμένες τις οποίες γνωρίζουμε τώρα ότι είναι λανθασμένες και, επομένως, θα απορριφθούν από οποιοδήποτε δικαστήριο) με την Κύπρο να αναγνωρίζει επίσης ρητά το γεγονός ότι σύμφωνα με το Εθιμικό Διεθνές Δίκαιο τέτοιες συντεταγμένες υπόκεινται σε αλλαγές. Το άρθρο 1 παράγραφος e, της εν λόγω συμφωνίας έχει ως εξής: «Λαμβάνοντας υπόψη τις αρχές του εθιμικού διεθνούς δικαίου σχετικά με την οριοθέτηση της αποκλειστικής οικονομικής ζώνης μεταξύ κρατών, οι γεωγραφικές συντεταγμένες των σημείων 1 ή 12 θα μπορούσαν να αναθεωρηθούν ή και να τροποποιηθούν ως αναγκαία υπό το φως μιας μελλοντικής συμφωνίας σχετικά με την οριοθέτηση της Αποκλειστικής Οικονομικής Ζώνης από τα τρία ενδιαφερόμενα κράτη σε σχέση με καθένα από τα εν λόγω σημεία. ”

Επιπλέον, σε μια μεταγενέστερη μονομερή κατάθεση των συντεταγμένων στον ΟΗΕ, η αντιπροσωπεία του Ισραήλ στον παγκόσμιο οργανισμό όχι μόνο αναφέρεται στις «σχετικές διατάξεις του άρθρου 1 παράγραφος e αλλά επίσης αναπαράγει τη γλώσσα, ουσιαστικά κατά λέξη. Ο ισχυρισμός μάλιστα επανειλημμένα ανέφερε «τα τρία ενδιαφερόμενα κράτη», το οποίο στο πλαίσιο μπορεί να δείξει μόνο τον Λίβανο ως το τρίτο κράτος.

Στο δικαίωμα του Λιβάνου να υποβάλει νέες συντεταγμένες, λοιπόν, η ετυμηγορία είναι αναπόφευκτη: έχει σίγουρα αυτό το δικαίωμα. Ρεαλιστικά, όποιος υποστηρίζει διαφορετικά είτε αντιτίθεται στα συμφέροντα του Λιβάνου (που χρειάζεται να αναπτύξει αυτούς τους πόρους), των Λιβανέζων (που αξίζουν να αποκομίσουν τις συνοδευτικές οικονομικές ανταμοιβές) και των Λιβανέζικων Ένοπλων Δυνάμεων (που επενδύουν σε μεγάλο βαθμό σε ένα θετικό αποτέλεσμα).

Απορριποντας τα γεγονότα και τους κανόνες · ή επιδιώκοντας κάποιο άλλο πολιτικό, οικονομικό ή και άλλο προσωπικό κομματικό πλεονέκτημα.

Επόμενη ερώτηση: πρέπει ο Λίβανος να ασκήσει το δικαίωμά του σε αυτήν τη συγκεκριμένη συγκυρία;

Σε μια πρώτη ανάγνωση των δεδομένων, αυτή η απάντηση είναι σχεδόν εξίσου σαφής. Το 2011, λίγους μήνες μετά τη συμφωνία Ισραήλ-Κύπρου και την τελευταία κατάθεση των συντεταγμένων του Λιβάνου στον ΟΗΕ, η κυβέρνηση του Λιβάνου έλαβε ανάλυση εμπειρογνωμόνων και αναλύσεις σχετικά με τα διαγράμματα του Υδρογραφικού Γραφείου του Ηνωμένου Βασιλείου – που θεωρείται από καιρό το χρυσό πρότυπο της θαλάσσιας χαρτογραφίας – για την περιοχή. Αυτό που βρήκαν οι ειδικοί είναι ότι τόσο ο Λίβανος όσο και το Ισραήλ είχαν χρησιμοποιήσει εσφαλμένες συντεταγμένες ως σημεία εκκίνησης για τα θαλάσσια σύνορά τους (βλ. Συνημμένο χάρτη): όπου τέτοια σημεία πρέπει να βρίσκονται στην ακτογραμμή, και οι δύο χώρες είχαν τοποθετήσει δεκάδες μέτρα υπεράκτια. Αυτό μπορεί να μην ακούγεται πολύ σημαντικό, αλλά τη στιγμή που μια γραμμή που χαράσσεται προς τη θάλασσα από ένα τόσο αδύνατο σημείο εκκίνησης φτάνει σε αυτό που θα έπρεπε να είναι η σύζευξη – όπου συναντώνται οι ΑΟΖ της Κύπρου, του Ισραήλ και του Λιβάνου – το σφάλμα μπορεί να ανέλθει σε αρκετά ναυτικά μίλια .Εξ υπαρχής, τόσο ο Λίβανος όσο και το Ισραήλ έχουν βασίσει τους προηγούμενους ναυτικούς ισχυρισμούς τους σε ελαττωματικές συντεταγμένες, κάτι που καθιστά τα πάντα που συνεπάγονται από αυτά ξεπερασμένα, αυτό που οι Γάλλοι θα αποκαλούσαν «caduc» – που σημαίνει άκυρο. Και στους δύο, αυτό παρέχει όχι μόνο δικαίωμα ενημέρωσης των αξιώσεών τους ενώπιον του ΟΗΕ, αλλά και υποχρέωση να το πράξει βάσει του συμφέροντος κάθε πλευράς. Επιπλέον, η πρόσφατη εμπειρία δείχνει ότι, ειδικά με τέτοια στοιχεία οι αντίστοιχοι ισχυρισμοί τους ήταν λάθος, εάν οι τρέχουσες συνομιλίες απέτυχαν και οι δύο χώρες πήγαν στο δικαστήριο ή σε διαιτησία για το ζήτημα, το πρώτο πράγμα που τους ζητήθηκε θα ήταν να αντικαταστήσουν το ελαττωματικούς χάρτες πραγματοποιώντας λεπτομερείς έρευνες και αναλύσεις για τον ακριβή προσδιορισμό τυχόν σημείων διαφωνίας.Από τεχνική άποψη, τότε, ναι, ο Λίβανος πρέπει σίγουρα να κινηθεί γρήγορα για να ενημερώσει για τις συντεταγμένες που είχε προηγουμένως καταθέσει στον ΟΗΕ. Αλλά και άλλες σκέψεις πρέπει επίσης να σταθμιστούν.Για παράδειγμα, ενώ ο Λίβανος είναι κυρίαρχη χώρα, δεν μπορεί να αγνοήσει εντελώς τις θέσεις εξωτερικών παραγόντων. Όταν αυτοί έρχονται σε αντίθεση με τις δικές του επιθυμίες και ανάγκες, πρέπει να σταθμίζει τα υπέρ και τα κατά και να αποφασίζει ανάλογα. Σε αυτήν την περίπτωση, Ισραηλινοί αξιωματούχοι προσπάθησαν να αποθαρρύνουν τον Λίβανο να καταθέσει τις συντεταγμένες ή να καθυστερήσουν με άλλο τρόπο την επανάληψη των προαναφερθεισών συνομιλιών, αυξάνοντας την προοπτική ότι κάτι τέτοιο θα μπορούσε να αποτρέψει την πρόοδο, να επιδεινώσει τις εντάσεις και να αναγκάσει μια μεγαλύτερη αναμονή για οποιαδήποτε υπεράκτια ανάπτυξη πετρελαίου και φυσικού αερίου. Το τελευταίο σημείο θα μπορούσε να έχει ιδιαίτερη σημασία λόγω της σημασίας μιας ενεργειακής έκρηξης για τον πληθυσμό του Λιβάνου. Η οικονομία του Λιβάνου έχει συρρικνωθεί κατά περίπου 25% κατά το παρελθόν έτος, μετά την αθέτηση χρεών που οδήγησε στην κατάρρευση του νομίσματος και στις αυξήσεις των τιμών καταναλωτή που χαρακτηρίζονται ως υπερπληθωρισμός. Ακόμη χειρότερα, η πολιτική τάξη έχει δείξει λίγο στομάχι για τα είδη των μεταρρυθμίσεων που απαιτούνται για την εξασφάλιση διάσωσης από το Διεθνές Νομισματικό Ταμείο (ΔΝΤ).Το σημερινό υπουργικό συμβούλιο, με επικεφαλής τον πρωθυπουργό Χασάν Ντιάμπ, παραιτήθηκε πριν από επτά μήνες για μια έκρηξη στο λιμάνι της Βηρυτού που κατέστρεψε δεκάδες χιλιάδες σπίτια, οπότε λειτουργεί υπό την επίβλεψη. Ο διορισμένος διάδοχός του είναι επίσης ο προκάτοχός του, ο πρώην πρωθυπουργός Saad Hariri, ο οποίος παραιτήθηκε ο ίδιος ενόψει λαϊκών διαμαρτυριών που κατέλαβαν τη χώρα στα τέλη του 2019. Ενώ απολαμβάνει σημαντική υποστήριξη σε ορισμένες ξένες πρωτεύουσες, η εσωτερική θέση του Hariri μπορεί να χαρακτηριστεί μόνο ως αδύναμη , και το απλό γεγονός ότι δεν μπόρεσε να σχηματίσει υπουργικό συμβούλιο μετά από περισσότερο από μισό χρόνο αφήνει λίγη αμφιβολία ότι ακόμα κι αν το καταφέρει, θα είναι σε μεγάλο βαθμό ανίκανος να λάβει αποφασιστική δράση σε σημαντικά ζητήματα.Έχουμε λοιπόν ένα άλλο ερώτημα: πρέπει ο Λίβανος να παραιτηθεί από ορισμένα από τα δικαιώματά του για να επιταχύνει μια συμφωνία που του επιτρέπει να αρχίσει να κερδίζει κάποια απαραίτητα έσοδα από υπεράκτιους πόρους;Η απάντηση σε αυτό πρέπει να είναι ένα ηχηρό «όχι». Η συνοριακή περιοχή περιέχει μερικές από τις πιο υποσχόμενες υπεράκτιες εκτάσεις του Λιβάνου και, εν πάση περιπτώσει, δεν υπάρχει καμία εγγύηση ότι η παραίτησή της θα λειάνει το έδαφος για μια διπλωματική ανακάλυψη – και ακόμη και αν το έκανε, η εξωτερική επένδυση που απαιτείται για να ανεβάσει μια ενεργειακή βιομηχανία και η εργασία εξαρτάται από μια ολόκληρη σειρά προϋποθέσεων, ιδίως από τις μεταρρυθμίσεις που κανείς δεν μπόρεσε να αντιληφθεί.Επίσης, εκτός από την ανάλυση του 2011, οι ένοπλες δυνάμεις του Λιβάνου πραγματοποίησαν δικές τους λεπτομερείς μελέτες, οι οποίες έχουν ενισχύσει σημαντικά τη θέση του Λιβάνου. Οι ανώτεροι αξιωματικοί της LAF έχουν επίσης απαλλαγεί από υψηλό βαθμό επαγγελματισμού στον διαμεσολαβητικό διάλογο των ΗΠΑ με τους Ισραηλινούς. Σε συνδυασμό με τις πρόσφατα κατατεθείσες συντεταγμένες, η ποιότητα του έργου της LAF ενδέχεται να επιταχύνει τη διαδικασία διαπραγμάτευσης αποδεικνύοντας ότι η λιβανική πλευρά δεν θα φουσκώσει, αλλά ούτε θα εκφοβιστεί ούτε θα εκνευριστεί. Κανείς δεν περιμένει ότι η Ουάσινγκτον θα εγκαταλείψει τη στενή σχέση της με το Ισραήλ, αλλά η προσέγγιση της LAF για όλες τις επιχειρήσεις, που δεν έχουν υποστεί απώλειες από τις αντιξοότητες της λιβανικής πολιτικής, ενθαρρύνει τους Αμερικανούς να είναι όσο το δυνατόν πιο συνεργάσιμοι.Και πάλι, η υπόθεση για έγκαιρη και αποφασιστική τροποποίηση της κατάθεσης των συντεταγμένων του Λιβάνου φαίνεται δικαιολογημένη, αλλά μόνο εάν το ζήτημα μπορεί να αναχαιτίσει τη δυσλειτουργική πολιτικής του Λιβάνου.Δεδομένης της ιστορίας της πολιτικής του Λιβάνου, είναι φυσικό ότι ακόμη και οι καλοί καλοί παίκτες θέλουν να διασφαλίσουν ότι έχουν επαρκή πολιτική κάλυψη πριν κάνουν οποιαδήποτε σημαντική κίνηση. Αν και αυτό είναι σίγουρα ένα βήμα συνέπειας, ωστόσο, τα πλεονεκτήματά του είναι τόσο προφανή που πρέπει να απαιτούν μόνο γραφειοκρατική ή και νομική πρωτοβουλία από τα κατάλληλα άτομα στο Υπουργείο Εξωτερικών. Το γεγονός ότι απαιτεί υψηλότερη εξουσιοδότηση δεν θα πρέπει να αποτελεί δικαιολογία για μια ακόμη αντιπαράθεση θάρρους ή δειλίας, που που έχουν αποξενώσει, απογοητευσει, φτωχύνει και έχουν κυριολεκτικά σκοτώσει εκατοντάδες χιλιάδες Λιβανέζους τον τελευταίο μισό αιώνα.Αντίθετα, πρέπει να παρακινήσει τους αξιωματούχους να γίνουν δημιουργικοί για το πώς να σημειώσουν πρόοδο σήμερα χωρίς να αφήσουν τους ανθρώπους να αναβάλλουν για αύριο. Υπάρχουν τρόποι συμβιβασμού στη διαδικασία χωρίς να θυσιάσουμε τη λογοδοσία, την ακεραιότητα ή τη διαφάνεια και τα διακυβεύματα είναι τόσο υψηλά που η εύρεση μιας τέτοιας φόρμουλας θα αξίζει ό, τι προσπάθεια απαιτεί. Και για μια φορά, ο λαός του Λιβάνου μπορεί να πιστεύει ότι οι ηγέτες του ενεργούν για καθαρά εθνικούς λόγους και όχι προσωπικούς.