Electricity is at the heart of modern life, and so it’s easy to assume that our reliance on electricity will increase or even accelerate. However, in many advanced economies the data reveals a surprisingly different story.

Electricity demand has increased by around 70% since 2000, and in 2017, global electricity demand increased by a further 3%. This increase was more than any other major fuel, pushing total demand to 22 200 terawatt-hours (TWh). Electricity now accounts for 19% of total final consumption, compared to just over 15% in 2000.

Yet while global demand growth has been strong, there are major disparities across regions. In particular, in recent years electricity demand in advanced economies has begun to flatten or in some cases decline – in fact electricity demand fell in 18 out of 30 IEA member countries over the period 2010-2017. Several factors can account for this slowing of growth, but the key reason is energy efficiency.

There have been a range of new sources of electricity demand growth in advanced economies, including digitalization and the electrification of heat and mobility. However savings from energy efficiency have outpaced this growth. Energy efficiency measures adopted since 2000 saved almost 1 800 TWh in 2017, or around 20% of overall current electricity use.

Over 40% of the slowdown in electricity demand was attributable to energy efficiency in industry, largely a result of strict, broadly applied, minimum energy performance standards for electric motors. In residential buildings, total energy use by certain classes of appliances has already peaked. For example, energy use for refrigerators (98% of which are covered by performance standards) is well below the high point reached in 2009, and energy use for lighting has also declined. In the absence of energy efficiency improvements, electricity demand in advanced economies would have grown at 1.6% per year since 2010, instead of 0.3%.

Changes in economic structure in advanced economies have also contributed to lower demand growth. In 2000, around 53% of electricity demand in the industrial sector came from heavy industry, but by 2017 this figure had fallen to less than 45%. Advanced economies now account for 30% of global steel production, for example, down from 60% in 2000, and for 25% of aluminium production, also down from around 60% in 2000.

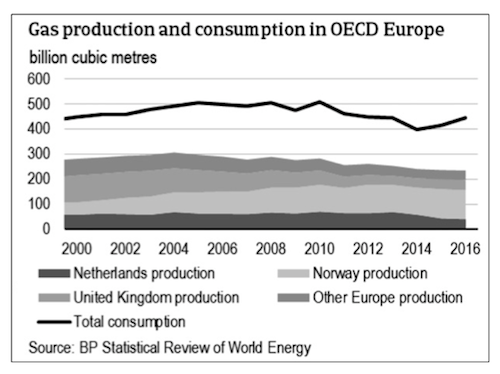

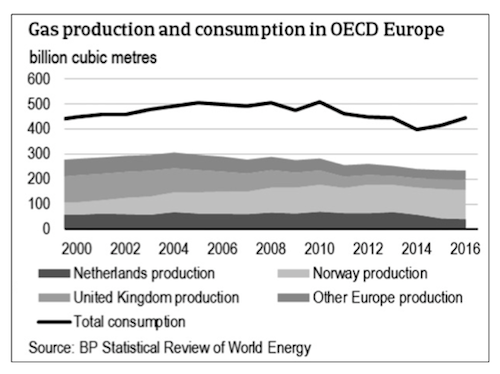

Finally, electricity demand for heat and mobility increased by only 350 TWh between 2000 and 2017. Today, electric cars represent only 1.2% of all passenger vehicle sales in advanced economies and account for less than 0.5% of the passenger vehicle stock. Since 2000, only around 7% of households in advanced economies have switched from fossil fuels (mainly gas) to electricity for space and water heating purposes, and use of electricity for meeting heat demand in the industrial sector remains marginal. In many regions, the price of electricity relative to fossil fuels limits its competitiveness for heating end-uses.

When we look to the future, the pace of electrification is set to pick-up somewhat in advanced economies. Nonetheless, electricity demand growth is projected to remain sluggish in the IEA’s New Policies Scenario (NPS), as improvements in energy efficiency continue to act as a brake on increasing demand for many end-uses. In addition, fewer purchases of household appliances (most households in advanced economies today own at least one of each major household appliance such as refrigerators, washing machines and televisions), and a shift from industry to the less electricity-intensive services sector, all contribute to lower electricity demand growth.

On average, electricity demand in advanced economies is projected to grow at just 0.7% per year to 2040 in the NPS, with the increase largely due to digitalization and policies that incentivise the use of electric vehicles and electric heating. Without those policies, electricity demand would continue to flatten or even decline in many advanced economies.

There are other factors at play. For example, population growth in many advanced economies is barely exceeded by electricity demand growth, meaning that further growth in GDP per capita does not lead to an increase in electricity demand per capita (as an exception, the industry sector in Korea accounts for a large share of electricity demand, and so it is one of the few advanced economies that sees industry contribute to overall electricity demand growth on a per capita basis).

Ultimately, despite moderate growth in electricity demand, fuel-switching to electricity and energy efficiency improvements in the use of other fuels mean the share of electricity in final consumption is projected to increase to 27% in advanced economies by 2040, up from 22% today.