Ρούντι Μπαρούντι: Να Τερματιστεί η Σύγκρουση Ισραήλ- Ιράν, πριν το Κόστος της Γίνει μη Διαχειρίσμο

Σήμα κινδύνου για τις επιπτώσεις που θα έχει ο πόλεμος μεταξύ Ισραήλ και Ιράν, σε όλο τον κόσμο στέλνει ο ειδικός αναλυτής στα ενεργειακά Ρούντι Μπαρούντι. Σε συνομιλία που είχαμε μαζί του με αφορμή άρθρο του που δημοσιεύτηκε στους Gulf Times. O κ. Mπαρούντι εστιάζει στις ενεργειακές επιπτώσεις σημειώνοντας ότι «τα αποθέματα αργού πετρελαίου και φυσικού αερίου του Ιράν

είναι, αντίστοιχα, τα δεύτερα και τρίτα μεγαλύτερα στον κόσμο. Ενώ το Ισραήλ έχει εξηγήσει ότι οι υποτιθέμενες πυρηνικές δραστηριότητες του Ιράν ως τον λόγο.

για τον οποίο ξεκίνησε τον πόλεμο, οι επιθέσεις του έχουν επικεντρωθεί επίσης στις υποδομές πετρελαίου και φυσικού αερίου του Ιράν. Πέντε από τα εννέα μεγάλα διυλιστήρια πετρελαίου του Ιράν είχαν πληγεί και τεθεί εκτός λειτουργίας, μαζί με αποθήκες και άλλες εγκαταστάσεις, ενώ οι ισραηλινές δυνάμεις προκάλεσαν επίσης μια τεράστια πυρκαγιά στο κοίτασμα φυσικού αερίου South Pars, το οποίο το Ιράν μοιράζεται με το Κατάρ – και το οποίο περιέχει σχεδόν τόσο φυσικό αέριο όσο όλα τα άλλα γνωστά πεδία φυσικού αερίου στη Γη. Επίσης οι ιρανικές επιθέσεις εναντίον του ισραηλινού συγκροτήματος διυλιστηρίων στη Χάιφα οδήγησαν στο κλείσιμο αρκετών υπεράκτιων πλατφορμών, μειώνοντας περαιτέρω την περιφερειακή παραγωγή υδρογονανθράκων».

Ο κ.Μπαρούντι εκτιμά ότι η κατάσταση μπορεί να επιδεινωθεί. «Η καταστροφή ή η διακοπή της ικανότητας του Ιράν να εξάγει, να επεξεργάζεται, να διανέμει και να εξάγει υδρογονάνθρακες θα προκαλούσε τεράστια προβλήματα στο εσωτερικό και θα ασκούσε ανοδική πίεση στις τιμές παντού, αν και ο παγκόσμιος αντίκτυπος θα ήταν πιθανότατα διαχειρίσιμος. Η κατάσταση θα ήταν πολύ πιο ανησυχητική εάν οι ισραηλινές επιθέσεις έπλητταν την περιοχή Μπαντάρ Αμπάς. Αυτό θα μπορούσε να προκαλέσει την εκτόξευση των τιμών του φυσικού αερίου – και άλλων μορφών ενέργειας – στις παγκόσμιες αγορές», τονίζει.

Δίνει μάλιστα μεγάλη έμφαση στα στενά του Ορμούζ καθώς συνδέει αρκετούς άλλους από τους πιο παραγωγικούς παραγωγούς πετρελαίου και LNG στον κόσμο – συμπεριλαμβανομένων του Ιράκ, του Κουβέιτ, του Κατάρ και της Σαουδικής Αραβίας – με τους πελάτες τους στο εξωτερικό.

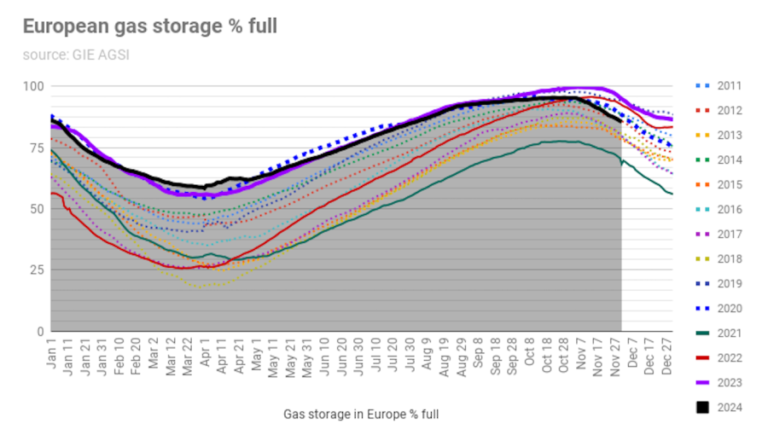

«Ως αποτέλεσμα, κάθε μέρα, περίπου το ένα τέταρτο των παγκόσμιων αναγκών σε αργό πετρέλαιο και LNG εξέρχεται από τον Κόλπο μέσω του Ορμούζ, καθιστώντας τον το πιο στρατηγικά σημαντικό σημείο συμφόρησης της εποχής μας. Εάν αυτή η ροή σταματήσει ή ακόμη και επιβραδυνθεί σημαντικά, οι συνέπειες θα μπορούσαν να είναι καταστροφικές για μεγάλο μέρος του κόσμου. Αν και οι περισσότερες από αυτές τις εξαγωγές συνήθως προορίζονται για τις αγορές της Ασίας, ακόμη και μια σύντομη μείωση του διαθέσιμου πετρελαίου και φυσικού αερίου θα μπορούσε να εκτινάξει τις τιμές του αργού πετρελαίου, που επί του παρόντος είναι λίγο πάνω από 70 δολάρια το βαρέλι, πάνω από τα 100 ή ακόμα και τα 120 δολάρια σύντομα. Αν μια τέτοια κρίση εφοδιασμού διαρκούσε για κάποιο χρονικό διάστημα, η παγκόσμια οικονομία θα εισερχόταν σε αχαρτογράφητα εδάφη. Όχι μόνο οι υπερβολικά υψηλές τιμές ενέργειας θα προκαλούσαν αύξηση του πληθωρισμού σε όλους τους τομείς, αλλά οι ελλείψεις καυσίμων θα μπορούσαν επίσης να παραλύσουν επιχειρήσεις κάθε μεγέθους και είδους. Μεταφορές και μεταποίηση, επεξεργασία τροφίμων και ιατρική έρευνα, παραγωγή ενέργειας, θέρμανση και ψύξη οικιακών συσκευών, ακόμη και το ίδιο το Διαδίκτυο: όλα όσα εξαρτώνται από την ενέργεια θα μπορούσαν να επιβραδυνθούν σε μικρό βαθμό. Μια παγκόσμια ύφεση σχεδόν σίγουρα θα ακολουθούσε, και δεδομένου του τρέχοντος εμπορικού περιβάλλοντος, αυτό θα μπορούσε να οδηγήσει σε μια ακόμη Μεγάλη Ύφεση».

Ο κ. Μπαρούντι καταλήγει ότι η πιθανότητα παγκόσμιας οικονομικής καταστροφής – για να μην αναφέρουμε τους οικολογικούς κινδύνους και τους κινδύνους για τη δημόσια υγεία που προκαλούν οι διαρροές πετρελαίου, πυρηνικών υλικών ή και άλλων τοξινών στο περιβάλλον – απλά δεν είναι ένας κίνδυνος που οι περισσότεροι έξυπνοι άνθρωποι θέλουν να βιώσουν. «Επομένως, αρμόζει σε όσους έχουν τη δύναμη να αλλάξουν την κατάσταση να κάνουν ό,τι μπορούν για να τερματίσουν τη σύγκρουση προτού το κόστος της γίνει μεγαλύτερο από όσο μπορεί να αντέξει μια εύθραυστη παγκόσμια οικονομία»