February 2, 2017

My purpose here is to update you on progress at the eastern end of the Mediterranean – namely some new steps taken by the government of Lebanon to gets its nascent energy sector off the ground.

As you may recall, Lebanon has wasted a lot of time in the past few years. Cyprus recently held its third licensing round, and others have gone even further: Israel, for instance, is already drilling, and while internal legal and policy battles have slowed some aspects, Israeli negotiators have aggressively pursued export or transit deals with other countries – including both Jordan and Turkey.

In Lebanon, things have been very different. A long-running political struggle left the presidency vacant for more than two years, the Parliament granted itself two extensions totaling almost three years without new elections, and the Prime Minister and Cabinet served in a de facto caretaker capacity because of widespread perceptions that they lacked legitimacy.

Even before this breakdown of the constitutional order, rival political camps were so mistrustful of one another – and so evenly matched – that little headway could be made because ach side blocked the other’s initiatives.

Luckily, even with these paralyzing conditions in effect, some preparatory steps were taken. The Lebanese Petroleum Administration was established in 2012, and while dysfunctional politics delayed everything from the onset of its legal authority to the recruitment of qualified personnel, the LPA managed to lay much of the necessary groundwork. The idea was that once the politicians stopped bickering, all of the rules, regulations, and policies would already be in place, so the country would have the wherewithal to start playing catch-up.

I’m happy to report that there has been significant improvement. A new president has now been elected by Parliament, and his genuine support – both in the legislature and among the general population – is more broad-based than many of his predecessors. A new Prime Minister has also been installed, and since this was part of the same deal that allowed the presidency to be filled, he and his Cabinet enjoy relatively strong acceptance. Perhaps most importantly, the long-delayed parliamentary elections are due to be held in June, and while the usual debate is taking place about the rules under which those polls should take place, there is general optimism that they will be held “on time”.

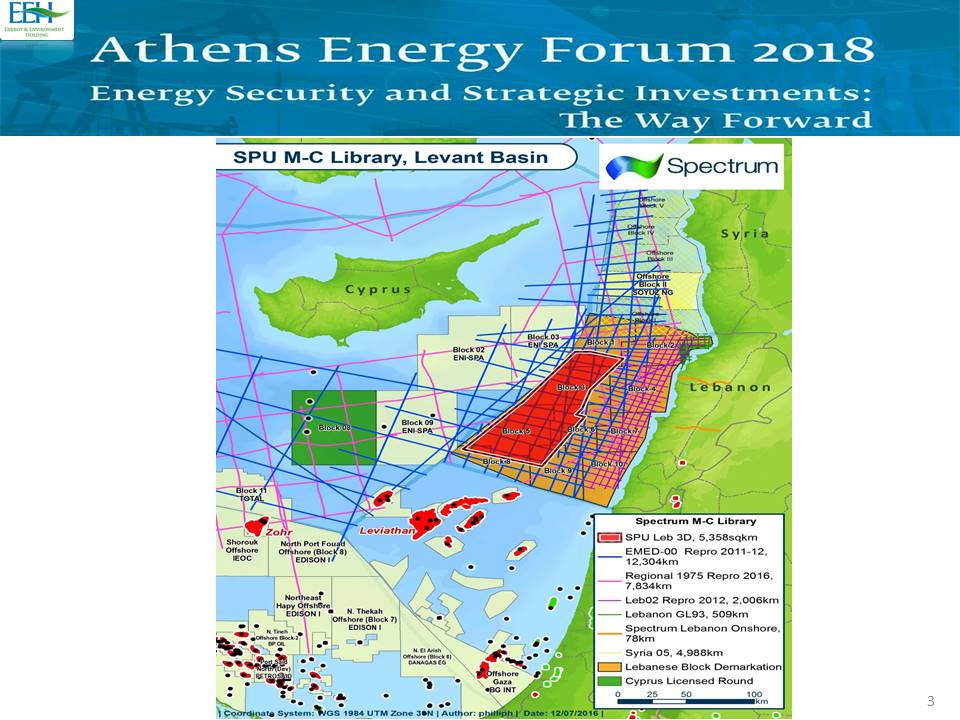

Best of all, the Lebanese Petroleum Administration has taken this momentum as a signal to start activating the energy sector. Last month it took a decisive step in this direction by initiating the country’s first licensing round, inviting bids for offshore exploration in five of the 10 blocks it has delineated in Lebanon’s Exclusive Economic Zone (EEZ). Nonetheless, the process will not be a simple matter of “plug and play”, but this time the obstacles are external.

Again, the LPA has done a lot to make sure all the necessary mechanisms are in place or ready for installation, including tender procedures and draft terms for the fiscal regime. And at least two of the five blocks being licensed should be relatively straightforward: Block 4 lies entirely within Lebanon’s EEZ, directly off the coast, and Block 1 lies in the northwest corner of Lebanon’s EEZ, where its demarcation has already been agreed with both Cyrus and Syria. Those interested in these blocks will know exactly what they’re bidding on, and the successful bidders and their partners free to get on with the business of modern exploration work without other distractions.

Blocks 8, 9, and 10, on the other hand, are a different matter altogether because all three are in the south, where Lebanon’s maritime claims overlap with those of Israel. At issue is a relatively small area of about 840 square kilometers, less than 5% of Lebanon’s EEZ and an even smaller slice of Israel’s. Under normal circumstances, the conflicting claims would likely have been negotiated away with relative ease, but Lebanon and Israel have no diplomatic relations and have remained in a legal state of war – with frequent outbreaks of actual hostilities – for almost 70 years despite the 1949 armistice.

The situation is not irrecoverable, however, and both the United States and the United Nations have worked hard to broker a consensus by holding separate talks with Israeli and Lebanese officials. What is more, whatever the intractability of their other differences, on this score at least both sides have a clear and compelling interest in avoiding any kind of conflict that interferes with the development of their energy reserves. All of the region’s emerging producer countries stand to make substantial revenue gains, allowing game-changing investments in health, education, transport, and other areas whose impact will be felt for decades, even centuries.

It all comes down to mathematics: there is simply too much money at stake, meaning that in addition to the lives that would inevitably be lost, the direct financial and opportunity costs of another armed confrontation would be exponentially greater than the price-tags attached to bombs and missiles.

The numbers don’t lie, so there is reason for optimism that the EEZ issue will be resolved before it impedes exploration activities. In addition, if and when cooler heads prevail and some kind of understanding on indirect cooperation (or even non-interference) is reached, the resulting dividends will go far beyond Dollars, Euros, Pounds or Shekels – and the effects will be felt far beyond the Mediterranean.

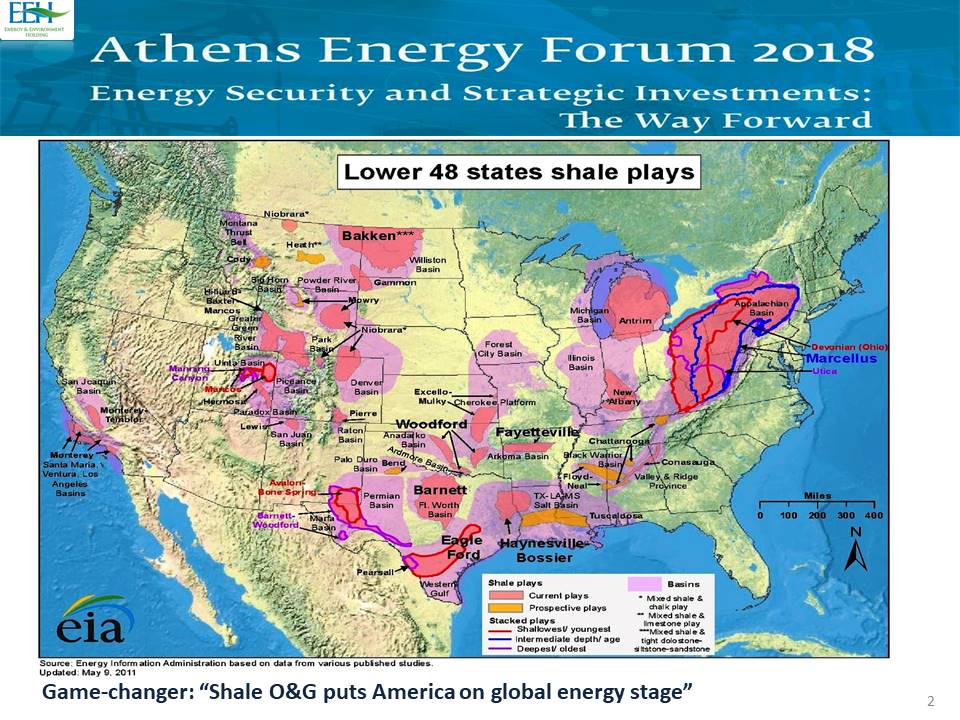

Cheap, clean, and reliable natural gas supplies from the Eastern Med would also significantly enhance energy security for Turkey, the European Union, and other countries. For Europe in particular, it would be a new lease on life, restoring the competitiveness of the Continent’s economy and providing consumers with lower prices for energy and a long list of other goods and services. And for both the MENA region and other parts of the world haunted by conflict or the threat thereof, an East Mediterranean gas boom made possible by sober diplomacy would set an encouraging – and highly lucrative – precedent.

These manifold and far-reaching benefits mean that numerous local and outside actors will want the same thing in the Eastern Med: stability. Cyprus, for instance, figures to be a linchpin for the entire regional gas economy, but it can only play that role to the fullest if it achieves reunification after more than 40 years of division. Each of the main external players on the island – Britain, Greece, and Turkey – also has good reason to want tensions reduced, and Russia’s growing presence in the region (including investment offshore each of Cyprus, Syria, and Egypt) gives it a vested interest in a more predictable region. American companies are also present, and literally no one better understands what is at stake than the incoming US secretary of state, former ExxonMobil boss Rex Tillerson.

Of course, there is still much for Beirut to address, including the structure and management of an effective and transparent Sovereign Wealth Fund to safeguard future energy revenues. There is also the matter of determining the true size of its offshore treasure, but all signs from exploration under way off Cyprus and Israel – plus the discovery of Egypt’s massive Al-Zohr gasfield – suggest that Lebanon is on the verge of a historic windfall. In fact, some 2-D and 3-D studies already indicate that the country’s hydrocarbon potential outstrips those of its immediate neighbors.

At this point, all Lebanon needs to do is play its cards right: avoid unnecessary confrontations with Israel, follow international best practice for safe and environmentally responsible oil and gas development, and protect the ensuing revenues against nepotism, waste, and other forms of mismanagement. So long as it makes itself a stable platform, investment will come and a better future will almost certainly follow.