Options trading firm blows up amid natural gas volatility

Accounts managed by Optionsellers.com “had to be liquidated as a result of these moves,” said INTL FCStone, the company’s futures broker. As its name made plain, Optionsellers.com specialised in selling options contracts to earn income for its investors.

The Tampa, Florida-based company, headed by James Cordier, has been registered as a commodity trading adviser since 2010, according to records at the National Futures Association, a regulatory body. NFA declined further comment.

On Monday, the Optionsellers.com website contained only its name and contact information. Calls to the company were not returned.

Options give holders the right to buy or sell financial products at an agreed price by a given date. Selling options can be a reliable source of revenue when markets do not fluctuate.

However, it can also be an extremely risky strategy. If prices suddenly dive or jump — as they did in oil and gas — the seller can lose almost everything.

Natural gas was long one of the most volatile commodity markets, but surging production from shale formations reduced shortages and damped price moves. In August realised volatility in Nymex gas futures dropped to the lowest level since 1991.

Last week’s move “was out of the ordinary given we had such low volatility for the past four, five, six years. You get kind of lulled,” said Joe Raia, managing director at RJ O’Brien, a futures broker.

An archived version of Optionsellers.com website said the company specialised in dealing options on commodities. “There is only a small segment of the investment community that knows how to deploy it in a portfolio. The tough part is finding somebody that knows how to do it — right,” the website said.

Opening a “starter account” required an initial investment of $500,000, with “founder’s club” and “platinum club” tiers set at $1m and $10m, respectively.

“Once you’re in, you’re one of our family. One of us. One of the elite. You’re an Option Seller,” the website said.

FCStone, a clearing firm at the futures exchange, is required to collect collateral from traders and post it at the exchange clearing house. An FCStone spokesman declined to comment on whether Optionsellers.com customers faced calls to repay any debit balances, but said their accounts were well collateralised.

“Liquidation of these accounts was in accordance with our customer agreements and our obligations under market regulation and standards,” the New York-based broker said.

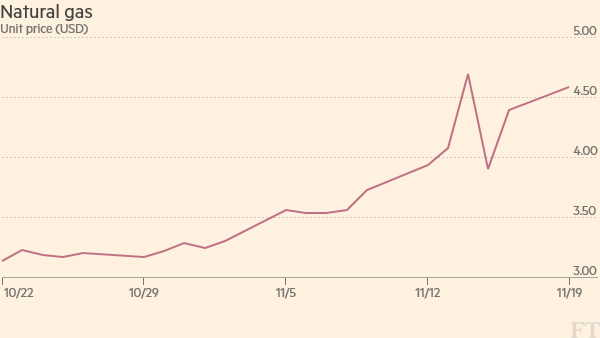

Last week’s turmoil in energy markets began when crude oil futures dropped about 7 per cent on Tuesday. This was followed in natural gas by a rise of 18 per cent on Wednesday, then a 16.5 per cent fall on Thursday.

The volatility continues: on Monday, Nymex December gas closed 10 per cent higher at $4.70 per million British thermal units.