Oil surged on Friday, ending the week at multi-year highs as Russia’s invasion of Ukraine intensified and oil buyers avoided barrels from Russia. Brent futures rose $7.65, or 6.9%, to settle at $118.11 a barrel, while U.S. West Texas Intermediate crude (WTI) rose $8.01, or 7.4%, to end at $115.68. Crude prices posted their largest weekly gains since the middle of 2020, with the Brent benchmark up 21% and U.S. crude gaining 26%. Oil surged throughout last week as the United States and allies heaped sanctions on Russia that, while not aimed at Russian oil and gas sales, nonetheless squeezed its industry, and threatens a growing supply crunch in coming months. Russia exports 4 million to 5 million barrels of oil daily, making it the second-largest crude exporter in the world after Saudi Arabia. Meanwhile, the Biden administration, under pressure from lawmakers, said it is considering options for cutting U.S. imports of Russian oil even as it tries to minimize the impact on global supplies and on consumers. Britain will look to target Russia’s energy sector in future rounds of sanctions, its foreign minister said Friday. The government has resisted this move so far, due to concerns that it will push up energy bills.

Asian LNG prices surge as buyers shun Russian gas

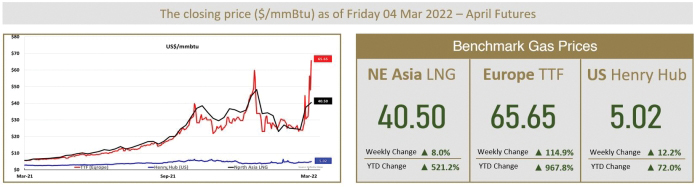

Asian spot liquefied natural gas prices rose last week, buoyed by concerns over Russian supply to Europe as buyers shun Russian gas and LNG in response to its invasion of Ukraine. The average LNG price for April delivery into north-east Asia was estimated at $40.5 per metric million British thermal units (mmBtu), up $3, or 8% from the previous week, industry sources said. Although the market remains extremely strong and extremely volatile, Asian buyers may be unwilling to replicate the price surge in Europe beyond a notional $50 per mmBtu, according to analysts, and may adopt a wait-and-see approach or switch to cheaper alternative fuels such as coal. In Europe, gas prices soared on Friday, with some contracts hitting all-time highs, as market participants continued to fear disruptions to Russian gas supplies to Europe in light of the war in Ukraine. The Dutch front-month contract rose by $17.65 per mmBtu on Friday, as the volatile and uncertain geopolitical landscape continues to drive prices. Meanwhile, an export ban by the Ukrainian government of gas held in the country, including stored gas usually held by Western Europe operators, was not impacting transit flows of Russian gas.

— By the Al-Attiyah Foundation

Oil surges as Russian supply shortfall looms