Central bankers who spent past weeks puzzling over how financial turmoil will impact their outlook now have a jolt in the form of higher oil prices to contend with.

The surprise production cut announced by OPEC+ on Sunday spurred oil traders to speculate $100 a barrel crude could be back on the horizon. In New York, oil was trading over $80 Monday morning.

For officials in Frankfurt, London and Washington who have been focused on core inflation rates — stripped of energy and food — higher oil costs could put renewed pressure on headline prices. That would serve as a reminder of the risk that high overall inflation rates get embedded in households’ expectations, forcing even more monetary policy tightening.

At the same time, production announcements such as Sunday’s can sometimes have limited lasting effects. For his part, Federal Reserve Bank of St. Louis President James Bullard said Monday that he’d already expected higher oil prices, given China’s reopening, Europe’s skirting of a recession and continued strong US data.

“This was a surprise, the OPEC decision, but whether it will have a lasting impact I think is an open question,” Bullard said in an interview with Bloomberg Television. Some oil-price fluctuation “might feed into inflation, and make our job a little bit more difficult,” he added.

European Central Bank Governing Council member Gediminas Simkus said Monday that “there are more factors there than the OPEC+ decisions.”

“In the context of interest rates, general trends are most important. In the last reading, we saw core inflation grew,” Simkus said.

OPEC’s decision marks the third Monday in less than a month when global monetary officials have woken up to a new headache, with episodes of market turmoil following the collapse of Silicon Valley Bank and the forced takeover of Credit Suisse Group AG each having threatened to derail interest-rate hiking plans.

This time, the news adds to the case for institutions from the Federal Reserve to the Bank of England and ECB to stay the course on their monetary-tightening plans, with inflation rates still well above targets.

With fears of a full-blown financial crisis fading last week, money markets were already starting to reprice for more tightening. The oil-production news spurred such moves Monday.

Interest-rate futures suggest about a 65% chance of a quarter-point Fed hike in May, compared with roughly 58% late Friday.

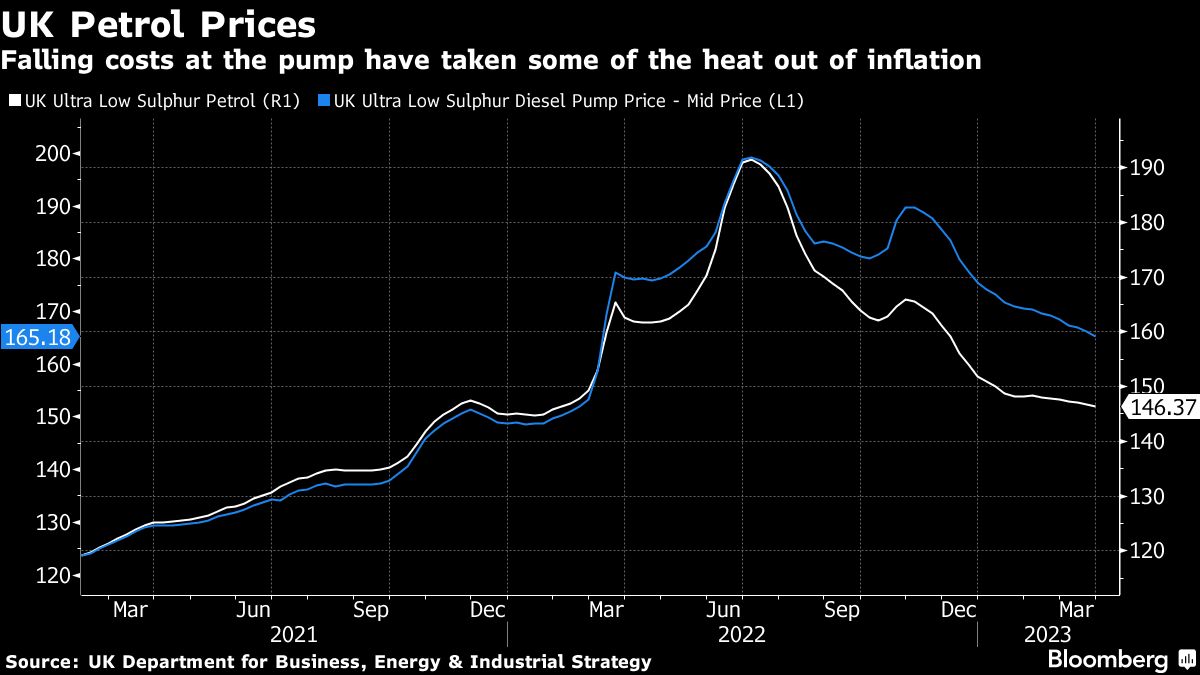

In Europe, the latest readings had shown headline inflation coming down, thanks to energy, with more concerning signs of elevated price increases in the services sector.

Fed Chair Jerome Powell has emphasized the importance of core services inflation excluding housing, which US central bankers see as particularly influenced by the tight labor market.

Data due on Friday on employment and wage costs in America were already set to be a key focus in setting expectations for the Fed’s next policy decision, on May 3.

To the extent that the OPEC+ production cut proves to have a lasting impact — feeding through to gasoline prices ahead of the summer driving season — that could strengthen job-seekers’ wage demands, adding to central bankers’ concerns.

“At the margin, this is a small negative as it will bump up inflation,” said Stephen Stanley, chief US economist at Santander US Capital Markets LLC. “But the Fed typically likes to look through oil price shocks, so the impact on policy is likely to be quite small.”

Another consideration for policymakers: higher energy costs would pose a hit to household budgets for spending on other items, such as travel and dining out. Amid a likely tightening in the availability in credit thanks to the recent banking turmoil, that would be another restraint on the economic outlook.

“Higher oil prices in the near term give the Fed more anxiety about inflation expectations,” said Derek Tang, an economist at LH Meyer/Monetary Policy Analytics in Washington. “But over the medium term, if oil prices stay high, it’s a drag on growth and employment,” he said. So for policy interest rates, “the impact might be a higher peak but quicker reversal.”

In any case, given the moves already taken by central banks since last year, rate-hiking cycles are seen closer to the end than the start at this point.

“With the rapid rate rises since mid-2022, the ECB, Fed and BOE have now largely got on top of their inflation problems,” said Michael Saunders, a former UK policymaker who is now at Oxford Economics. “At this stage, this rise in oil prices does not alter that view.”