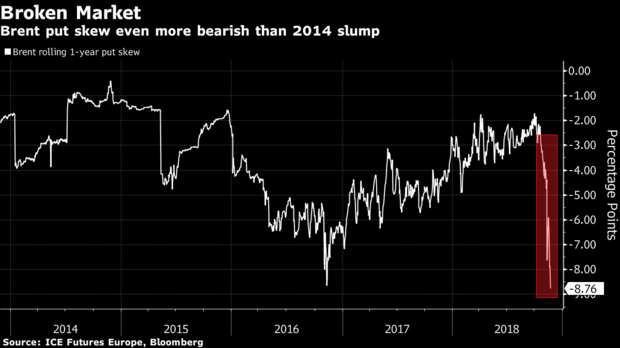

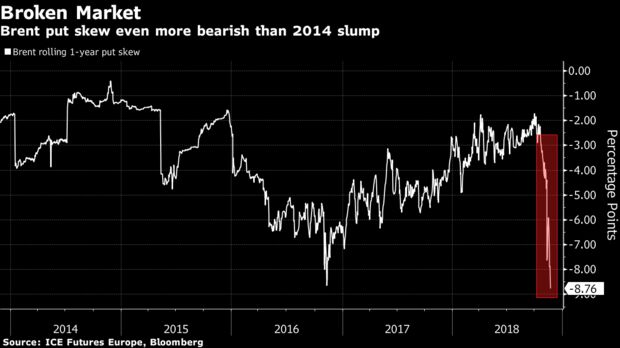

Oil options traders have turned more bearish than when prices plunged back in 2014.

The crude market has been roiled by surging U.S. output and Donald Trump’s unexpected decision to allow buyers of Iranian oil to continue purchases, thereby adding unexpected supply. At the same time the Saudis, under pressure from the American president to help keep prices down, has signaled that it may be producing at a record pace.

Thrown into the mix has been frenetic selling from banks who’ve been forced to sell futures contracts after options contracts that they sold to producers came close to being valuable. The resulting moves have seen crude swing rapidly from talk of $100 a barrel just a few weeks ago, deep into a bear market. Brent traded at about $61 on Friday.

“It shows you the extreme change in perceptions that we’ve just had, the disappointment in expectations,” Thibaut Remoundos, founder of hedging strategies adviser Commodities Trading Corp. in London said of the shift in options markets. “The options volatility market in Brent is broken right now.”

While the premium paid for puts over calls is the biggest in at least five years, it’s not the only corner of the oil options market that has been buffeted by tumbling prices. The CBOE/Nymex Oil Volatility Index, a measure of near-the-money crude options, hit nearly 56 points earlier this week, the highest level in 2 years and almost double where it reached in early November.

The move brings into focus the decisions of some producers to lock in their output when prices were at multi-year highs in recent months.

Remoundos said some producers could have locked in their output for 2019 at $72.50 without any outlay on options contracts, a strategy known as a costless collar. A 128 million barrel hedge by Petroleo Brasileiro SA, as well as Mexico’s national oil hedge — the biggest oil deal of the year — are among those said to have roiled Wall Street banks in recent weeks.