Oil markets are grappling with uncertainty over how long it will take Saudi Arabia to restore output after the devastating attacks that knocked out five per cent of global crude supply.

As state oil giant Saudi Aramco grows less optimistic that there will be a rapid recovery after the strikes that cut the nation’s output by half, investors are seeking clarity on just how bad it could be. Initially, it was said significant volumes could begin to return within days, but Saudi officials later told a foreign diplomat they face “severe” disruption measured in weeks and months. Saudi Energy Minister Prince Abdulaziz bin Salman is scheduled to hold a press briefing on Tuesday evening in Jeddah.

“Today’s press conference is going to be crucial — we have to wait for that really,” said Olivier Jakob, managing director at consultant Petromatrix GmbH in Zug, Switzerland. “We need to have that update in order to make a proper assessment.”

The worst ever sudden disruption to global oil supplies continues to reverberate as geopolitical risk premiums soar on concern over instability in the Middle East and a potential retaliation against Iran, which the U.S. has blamed for the strikes. Traders may not have fully priced in the impact of the supply losses, according to Citigroup Inc.

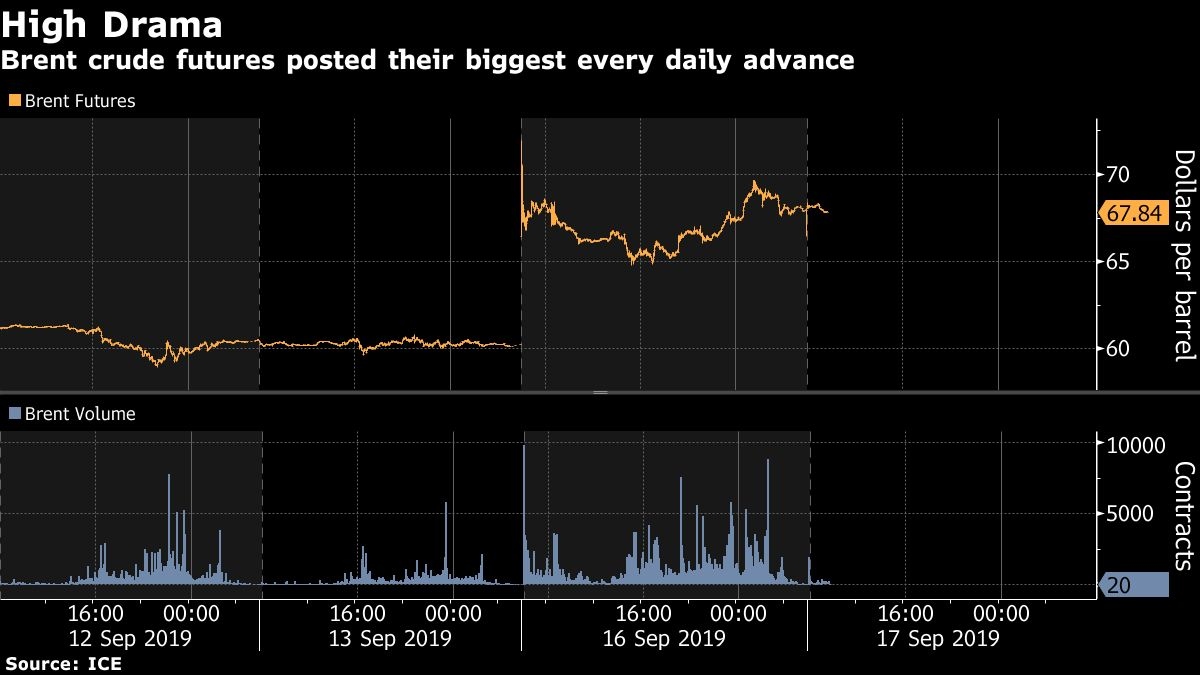

The attacks, which damaged one of the Saudis’ flagship fields and a key processing complex, triggered one of the wildest bouts of trading seen in oil markets, with Brent futures rising 19 per cent in a matter of seconds at the open on Monday and ending the day up 15 per cent, their biggest single-day advance.

It was a more subdued start to trading on Tuesday, with both Brent and West Texas Intermediate futures edging lower.

Saudi Aramco lost about 5.7 million barrels a day of output on Saturday after 10 unmanned aerial vehicles struck the Abqaiq facility and the kingdom’s second-largest oil field in Khurais.

While Aramco is still assessing the state of the Abqaiq site and the scope of repairs, it currently believes less than half of the plant’s capacity can be restored quickly, according to people familiar with the matter, who asked not to be identified because the information isn’t public.

Saudi Aramco is firing up idle offshore oil fields — part of its cushion of spare capacity — to replace some of the lost production, one person said. Customers are also being supplied using stockpiles, though some are being asked to accept different grades of crude. The kingdom has enough domestic inventories to cover about 26 days of exports, according to consultant Rystad Energy A/S.

Customers are also preparing to tap strategic reserves if needed. U.S. President Donald Trump authorized the release of oil from the U.S. Strategic Petroleum Reserve, while the International Energy Agency, which helps coordinate industrialized countries’ emergency fuel stockpiles, said it was monitoring the situation.

The disruption surpasses the loss of Kuwaiti and Iraqi petroleum output in August 1990, when Saddam Hussein invaded his neighbor. It also exceeds the loss of Iranian oil production in 1979 during the Islamic Revolution, according to the IEA.

Nevertheless, U.S Energy Secretary Rick Perry said Tuesday that the market is well-supplied and a “staggering spike” in prices is unlikely.

Brent futures slipped 83 cents to US$68.19 a barrel on the ICE Futures Europe exchange as of 2:02 p.m. London time, while WTI dropped 60 cents to US$62.30 on the New York Mercantile Exchange. Brent is trading at a US$6.11 premium to WTI for the same month.

“It is still difficult to assess the exact scale of the damage caused by the drone attacks to Saudi infrastructure in the Eastern province, but recent official statements lean toward a longer outage than initially anticipated,” Citigroup Inc. analysts Ed Morse and Francesco Martoccia said in a report.

–With assistance from Shery Ahn and Grant Smith.