Oil extended gains after capping its best week in almost two months as an escalation of fighting in OPEC producer Libya overshadowed the biggest increase in U.S. active rigs since May.

Futures gained as much as 0.7 percent in New York after rising 4.9 percent last week. Libya’s internationally-recognized government vowed to counterattack against forces loyal to strongman Khalifa Haftar that are trying to enter the capital Tripoli. Crude pared gains after Saudi Arabian Energy Minister Khalid Al-Falih said in a Bloomberg TV interview that oil markets are “moving in the right direction” and there’s no need for the kingdom to deepen output curbs.

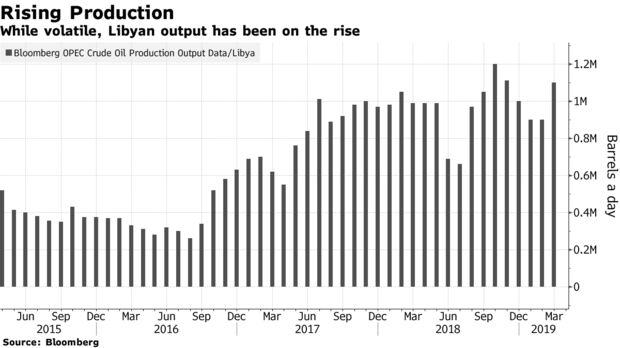

Crude has kept rallying after its best quarter in almost a decade on signs the Organization of the Petroleum Exporting Countries and its allies will extend output cuts beyond June. The escalation of the conflict in Libya, which pumped 1.1 million barrels of a day last month, adds to risks to supply from Iran and Venezuela. On the demand side, a U.S. report last week showing better-than-expected hiring is the latest evidence that the global economy might not be in as bad shape as previously feared

“Supply disruptions in Libya are lifting prices at a time when appetite for risk assets is rising as concerns over global growth ease,” said Ahn Yea Ha, a commodities analyst at Kiwoom Securities Co. in Seoul. “Oil might be rising too quickly at the moment, but it’s hard to find any bearish signals,” she said before the comments by Al-Falih.

West Texas Intermediate for May delivery climbed 27 cents, or 0.4 percent, to $63.35 a barrel on the New York Mercantile Exchange as of 8:08 a.m. in London. Prices rose 1.6 percent to settle at $63.08 on Friday, the highest closing level since Nov. 5.

Brent for June settlement advanced 0.3 percent to $70.56 a barrel on the London-based ICE Futures Europe exchange. The contract added 1.4 percent to $70.34 on Friday, taking its weekly gain to 2.9 percent. The global benchmark crude was at a premium of $7.16 to WTI for the same month.

The structure of the futures market is reflecting supply uncertainty. WTI’s front-month prices rose to a premium, or backwardation, of as much as 4 cents a barrel to the contract four months ahead on Monday. They then flipped back into a discount, or contango. A spot price that’s higher than the forward price indicates tighter supply.

Fighting on the outskirts of Tripoli showed no signs of abating despite appeals for calm by global powers and the United Nations. While the latest fighting is south of Tripoli — away from most of the main oil ports and fields — the risks of disruption rises the more inflamed the tensions get. Western Libya is home to the Zawiya oil terminal, the export point for crude pumped from the country’s largest field, further south at Sharara.

American rigs climbed by 15 to 831 in the first increase since mid-February, according to data from oilfield services provider Baker Hughes.