Global markets have become more connected as LNG shipments grow more flexible

Utilities across Europe are enjoying a windfall, as a gas glut caused by excess liquefied natural gas shipments from Asia drives prices to multi-year lows.

A mild Asian winter coupled with nuclear-plant restarts in Japan and ample supplies from the US and Russia have cut down deliveries of LNG to large buyers in the region. As prices for the supercooled fuel have fallen, hitting a three-year low, cargoes have been directed instead to Europe.

That is pushing down prices there, too: the UK wholesale day-ahead gas price, for example, is trading just above 31p per therm, the lowest seasonal level since 2016 and below a 5-year average of 46p per therm.

The price moves show how gas markets around the world have become more connected thanks to increasing volumes of LNG cargoes moving the gas from one continent to another, freed from an old regime of rigid contracts with fixed destinations.

“In the future, gas prices in Europe will be driven by LNG,” said Niall Trimble, managing director of oil and gas consultants The Energy Contract Company.

LNG will also gain greater influence on European and UK gas markets as volumes from the region’s production areas in the North Sea, Netherlands and Norway decline. The UK became a net importer of natural gas in the mid-2000s as North Sea production fell.

The UK is among the leading destinations for LNG cargoes thanks to plentiful terminal storage capacity. The amount of LNG used in the UK gas pipeline system quadrupled in the fourth quarter of 2018 from the previous year and jumped 4.5 times in the first quarter of this year.

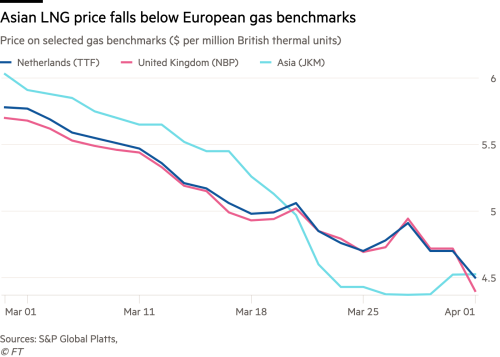

Asia and Europe are the two main LNG importing regions, and until recently, robust demand from China, South Korea and Japan have kept the Japan-Korea Marker (JKM), the Asian benchmark, higher than the European equivalent.

He said any resolution of the trade spat between Washington and Beijing would likely see more oil and LNG flow from the US to Asia, tightening supplies available to Europe.

National Grid, which plays a role in ensuring UK energy supply matches demand, said in a recent report that it was expecting much higher deliveries of LNG this summer than in 2018. This was because LNG shipping costs had risen over the winter, making Europe, which is a closer destination, a more profitable market than Asia for cargoes from the US and Russia.

However, some analysts said that the weakness in the Asian price was encouraging some producers to shut down their facilities for maintenance. Meanwhile, the LNG flows to Europe could push prices down in the region, making the Asian markets more attractive again.

Samer Mosis, LNG analyst at S&P Global Platts, said that the Asian discount to European price benchmarks was unsustainable. He noted that Qatar had already “swung its flexible production towards Europe alongside continued US and Russian deliveries, which is threatening to lead to oversupply”.

Copyright The Financial Times Limited . All rights reserved. Please don’t copy articles from FT.com and redistribute by email or post to the web.