East Med Gas: The Impact of Global Gas Markets and Prices

Ever since the discovery of the giant gas-fields Tamar, Leviathan and Zohr in the Eastern Mediterranean, the area has attracted growing international attention, with Egypt at the centre of it.

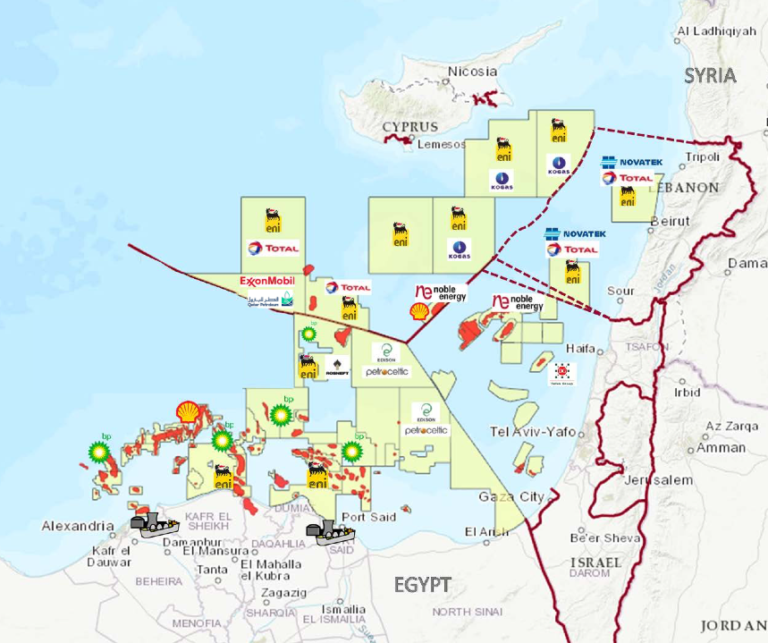

A lot is happening in the Eastern Mediterranean. Aside from the long-standing Cyprus issue and a number of other tense geopolitical standoffs, hydrocarbon exploration and production is taking centre stage, with more expected in the near future (see Figure 1).

The key question, however, revolves less around the size of new discoveries and international investments in the area. More important will be to assess how global gas markets and prices will affect these discoveries, spurring or dashing the high-hopes of an emerging export-oriented “gas hub” in the Eastern Mediterranean.

As we enter 2019, two events stand out in the region: the drilling by ExxonMobil in block 10 off Cyprus (already in progress) and the potential for a sizable new gas discovery by the Italian company Eni in the Nour North Sinai concession, offshore from Egypt’s Sinai peninsula.

Both are very promising. Should major discoveries be confirmed, for which there are high hopes, these could transform the region, not just in terms of the gas industry and exports, but also geopolitically.

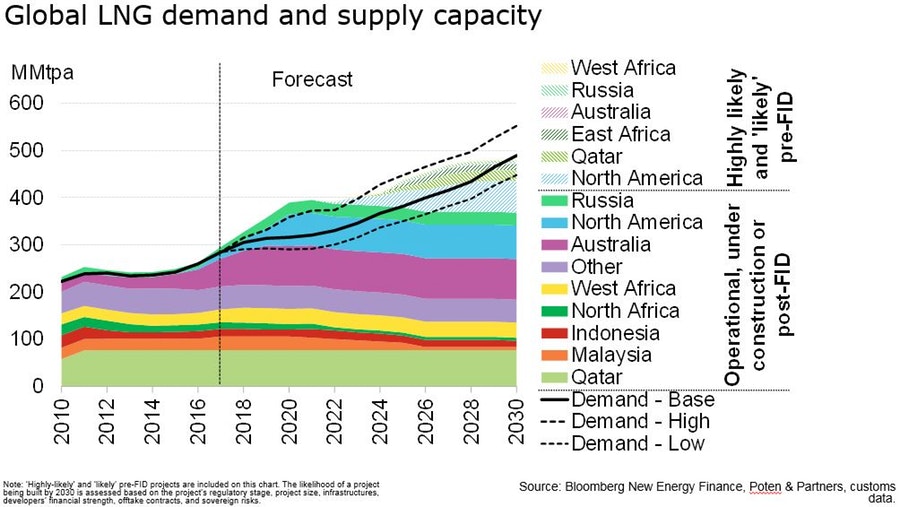

Both developments are happening at a time when Bloomberg forecasts increasing global demand for liquefied natural gas (LNG) with a gap between demand and supplies developing after about 2025 if one follows its base projections (see Figure 2), or earlier, if higher demands actually materialise.

This would open opportunities for LNG exports from the region, from both Egypt and Cyprus. But there will be strong competition from new projects emerging in North America, Qatar, Africa, Australia and Russia.

The global gas and LNG market is in a state of flux. This is driven in part by China’s slowing economic growth, but also due to concerns about the global economy, with global GDP growth expected to slow over the next few years.[5]

Sanctions and the trade war between the US and China are posing increasing threats to global LNG trading. These have brought home to China its vulnerability in energy supplies, where these rely mostly on imports. On top of this, China is going through an economic slowdown, expected to be long-lasting.

In response to these developments, China moved to change its energy policies in mid-2018, allowing regional governments to increase clean coal production and consumption.[6]

Combined with a rapid increase in renewables and nuclear capacity, China is countering these threats by boosting indigenous resources. In doing so, it has relaxed its clean air policies that led to the massive increase in LNG demand in late 2017 and for most of 2018. In addition, the Power of Siberia pipeline, with 38 billion cubic metres (bcm) per year capacity, is expected to start delivering gas to China in 2019.[7]

Meanwhile, in mid-2018, Japan also released its new energy plan to 2030, which includes a return to nuclear power and a reduction in the use of imported LNG, a process that has already started. On this latter aspect, Tokyo aims to reduce LNG imports from 84 million tonnes in 2017 to 62 million tonnes a year by 2030.[8] South Korea is also moving in a similar direction, continuing to rely on nuclear and coal power to the middle of the next decade.

Moving to India, while there is much talk about increased gas use in the future, New Delhi’s pipeline infrastructure cannot handle increased LNG imports beyond the existing import terminal capacity of 30 million tonnes a year.[9]Building new pipelines is very challenging, not least due to complex right-of-way processes. New Delhi is also not giving up coal – quite the contrary. The priority in India is a rapid increase in cheap renewables, with a target to increase capacity to 175 gigawatts (GW) by 2022.

These developments are already having an impact on prices and are slowing LNG demand in Asia.

Looking to Europe does not provide much respite either. Europe is well supplied with gas. At the Platts gas and LNG conference in London last October, Gazprom confirmed it could sell gas at 4 US dollars per million British thermal units (mmBTU) and still make a profit.[10] In addition, US LNG companies are confident they will increase their sales to Europe at about 6.5 dollars/mmBTU.

Longer term gas price forecasts made at the international gas and LNG conferences in October and November 2018 confirmed that, with record LNG supply, by mid-2020s spot LNG prices will return back to about 8 dollars/mmBTU in Japan and 6 dollars/mmBTU in north-western Europe.[11]

East Med gas will have to compete with such prices if it is to secure export markets. With US shale on the resurgence, renewables penetration becoming an unstoppable phenomenon and coal holding its own competition to secure markets is going to be as fierce as ever.[12]

Global LNG demand can of course be expected to increase but, given recent developments in Asia, it will probably be nearer to Bloomberg’s base projections (see Figure 2).[13] Moreover, such increases will be price-driven.

New LNG projects in Qatar and North America, which are at an advanced stage of approval, may lead to supplies in excess of Bloomberg’s base projections, with the risk that over-supply may extend to the end of the next decade, keeping prices low.

Figure 2 | Global LNG supply and demand capacity

Source: Maggie Kuang, “The Future of LNG”, cit.

New energy outlooks expect a peak in fossil fuel demand in the 2030s,[14] warning that expensive gas could hasten the penetration of renewables and lead to a faster decline in hydrocarbon use. On the other hand, with low prices, gas could continue doing well.

International efforts to combat climate change can also be expected to impact the global energy market, including East Med gas.[15]

The EU has upped its 2030 climate targets, with renewables set to account for 32 per cent, energy efficiency 32.5 per cent and CO2 emissions reductions at 40 per cent in comparison to 1990 levels.[16] In addition, carbon pricing is increasing fast, promoting renewables and impacting fossil fuels. Renewables accounted for over 70 per cent of net additions to global power generation capacity in 2017. They now comprise over 26 per cent of global electricity.

While major oil and gas companies remain steadfast in their defence of the industry, the risk of increased divestment by the insurance industry and institutional investors, as well as litigation by activists, do pose threats to the industry.

As a result, and in addition to pursuing exports, Eastern Mediterranean countries should consider ways to maximise use of discovered gas in the region.

ExxonMobil’s Vice-President of Europe, Russia and the Caspian, Tristan Asprey, made clear at the Economist Summit in Nicosia in November 2018 that competitiveness will be essential in demonstrating commercial viability of an LNG export project in Cyprus.[17]

As also stated at the Economist Summit, there is a need to find ways to reduce regional geopolitical risk. LNG projects involve multi-billion dollar investments, the returns from which take decades to materialise. Such projects and investments need certainties.

Among the key challenges is Turkey’s effectively untenable position that islands, including Cyprus, are not entitled to Exclusive Economic Zones (EEZs). Turkey does not recognise the United Nations Convention on the Law of the Sea (UNCLOS) and takes the view that mainland continental shelves take precedence over islands.

On this basis, Turkish authorities continue to challenge Cyprus’s right to develop its EEZ, disputing all related hydrocarbon activity. However, this is at odds with the EU, the US and the international community who recognise Cyprus’s rights to its EEZ and its exploitation for the benefit of all Cypriots.

Overall, the Eastern Mediterranean still has strong prospects for more gas discoveries, especially ExxonMobil in Cyprus and Eni at Noor in Egypt, but unlocking this potential by securing export markets remains a challenge due to global markets, price viability and the fraught geopolitics of the region.

A prerequisite for further integration and realisation of the full gas potential of the Eastern Mediterranean is geopolitical and regional stability through resolution of regional conflicts. The recent establishment of the East Med Gas Forum should contribute to this and is a welcome development.[18] The EU and the US could also play a central role by putting diplomacy into action and developing incentives and disincentives for regional players.

Against this backdrop, a diplomatic solution on Cyprus could go a long way in improving regional geopolitics in the Eastern Mediterranean. But is this likely to happen? There is a glimmer of hope that negotiations may resume mid-2019, but few are holding their breath.

Yet, in addition to looking for exports, which is proving to be challenging, Eastern Mediterranean countries should consider ways to maximise use of this gas regionally, an approach that would likely be more commercially viable and perhaps even lead to increased intra-regional cooperation in the area.

Gas exports from Israel and Cyprus face political and commercial challenges. But with Israeli and Cypriot gas exports to Egypt looking more likely, there is hope for Egypt to emerge as an energy hub in the Eastern Mediterranean, triangulating gas from multiple sources while improving its infrastructure for a better distribution and export potential. Egypt has already turned from an LNG importer to an LNG exporter in 2019, making Egypt the first true “winner” in the emerging East Med gas rush.

* Charles Ellinas is CEO of EC Cyprus Natural Hydrocarbons Company Ltd (eCNHC), Nicosia, and nonresident Senior Fellow with the Atlantic Council’s Global Energy Center.

[1] Charles Ellinas, “Exxon’s Drilling: All Outcomes Are Possible”, in Cyprus Mail, 13 January 2019, https://cyprus-mail.com/?p=225852.

[2] Mohamed Adel, “Noor Gas Field Reserves Record 10tn Cubic Feet”, in Daily News Egypt, 14 November 2018, https://dailynewssegypt.com/?p=681060.

[3] Charles Ellinas, “Optimism Over Gas Drilling, But It’s the Sharing That Counts”, in Cyprus Mail, 18 November 2018, https://cyprus-mail.com/?p=217519.

[4] Maggie Kuang, “The Future of LNG”, in Bloomberg NEF, 4 May 2018, https://about.bnef.com/blog/the-future-of-lng.

[5] World Bank, Global Economic Prospects, January 2019: Darkening Skies, Washington, World Bank, 2019, p. 231, http://hdl.handle.net/10986/31066.

[6] Feng Hao, “China releases 2020 action plan for air pollution”, in Chinadialogue, 6 July 2018, https://www.chinadialogue.net/article/show/single/en/10711.

[7] Jessica Jaganathan, “China Overtakes Japan As World’s Top Natural Gas Importer”, in Reuters, 12 November 2018, https://reut.rs/2T60vJO.

[8] Charles Ellinas, “Japan Hovers Between Gas and Nuclear”, in NGW Magazine, Vol. 3, No. 16 (13 September 2018).

[9] Charles Ellinas, “India Natural Gas Needs: An Open Question”, in NGW Magazine, Vol. 3, No. 18 (9 October 2018).

[10] Charles Ellinas, “EastMed Gas Pipeline Increasingly Doubtful”, in Cyprus Mail, 2 December 2018, https://cyprus-mail.com/?p=219757.

[11] Charles Ellinas, “Natural Gas in 2019”, in NGW Magazine, Vol. 4, No. 2 (21 January 2019).

[12] Ibid.

[13] Maggie Kuang, “The Future of LNG”, cit.

[14] DNV GL, Energy Transition Outlook 2018, September 2018, https://eto.dnvgl.com/2018.

[15] Charles Ellinas, “UN Climate Change and Energy Security”, in NGW Magazine, Vol. 3, No. 20 (30 October 2018).

[16] European Commission, Commission Welcomes European Parliament Adoption of Key Files of the Clean Energy for All Europeans Package (IP/18/6383), Brussels, 13 November 2018, http://europa.eu/rapid/press-release_IP-18-6383_en.htm.

[17] Charles Ellinas, “Dreams Versus Reality in the Push for Cyprus Gas”, in Cyprus Mail, 16 December 2018, https://cyprus-mail.com/?p=222210.