Chevron’s Anadarko Bid Seen Heralding Permian Shale Deals

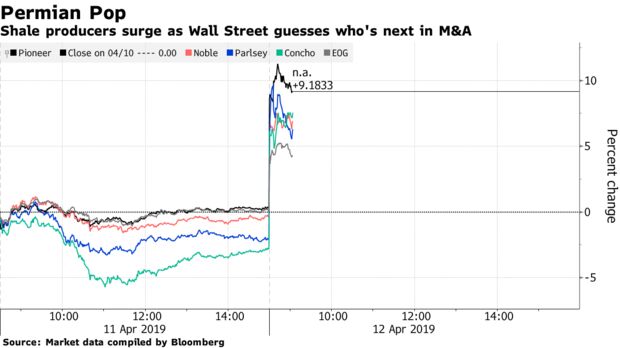

Chevron Corp.’s $33 billion bid for Anadarko Petroleum Corp. may presage a new Permian Basin buying spree, with Pioneer Natural Resources Co. and Concho Resources Inc. among the next prime targets.

Pioneer, Concho and Noble Energy Inc. surged Friday after Chevron unveiled plans to buy Anadarko, a deal that expands the supermajor’s presence in the Permian region, Gulf of Mexico and East Africa. The transaction vaults Chevron into the rarefied air of rivals Exxon Mobil Corp. and Royal Dutch Shell Plc, which in turn may be roused to make acquisitions of their own.

“Best day in years,” said Todd Heltman, senior energy analyst at Neuberger Berman Group LLC, which has $323 billion under management. “The space really needs consolidation. Maybe the time is finally right given the outperformance of the majors.”

Occidental Petroleum Corp., fresh off its own failed bid for Anadarko, may now find the tables have turned as its hefty footprint in the world’s biggest oil field attracts the attention of acquisitive rivals. Investment bank Tudor Pickering Holt & Co and BP Capital Fund Advisors LLC both cited Occidental as a potential target.

“Everyone is trying to figure out who’s next,” Heltman said.

“From a big-picture perspective, the majors have really bought into shale, but from an asset perspective, the majors don’t necessarily have the right asset portfolios,” Tudor Pickering’s Matthew Portillo said by telephone. “We do think this is going to be the spark that really catalyzes a lot of M&A.”

For Exxon, buying Pioneer or Concho would help the oil giant plug a hole in its Permian portfolio, Portillo said. Shell also will feel pressure to buy more acreage in the prolific stretch of West Texas and New Mexico, possibly by acquiring smaller players like WPX Energy Inc. and Cimarex Energy Co., Portillo said. BP Plc may too embark on expansionist takeovers, he added.

Buying Neighbors

The peculiar nature of shale exploration is an impetus for acquisitions. Unlike in conventional oil fields, shale requires sideways drilling to access crude-soaked rocks, so the further a company can drill horizontally, the more oil it captures. In that context, buying neighboring drillers makes a lot of sense.

For Chevron, Anadarko presented an enticing target. In addition to vast deepwater holdings in the Gulf of Mexico and an ambitious liquefied gas development in Mozambique, the company controls Permian drilling rights across an area twice the size of Los Angeles. Multiple layers of oil-rich shale extend for more than 1.5 miles (2.4 kilometers) underground within that zone.

The most obvious target companies “are the ones that represent the same opportunity Anadarko presented to Chevron,” said Ben Cook, a portfolio manager at BP Capital in Dallas. “It becomes a game of matching up maps.”

What Bloomberg Intelligence Says

“Anadarko was an acquisition target during a weaker price environment for the industry, so we’re puzzled why it agreed to Chevron’s offer when fundamentals are improving. The valuation is disappointing and we think other reasons are behind the deal. Expect Anadarko shareholders to resist the price despite passive-fund representation.”

— Vincent G. Piazza and Evan Lee, analysts

Click here to view the piece

In addition to Pioneer and Concho, Cook highlighted EOG Resources Inc., Occidental and Parsley Energy Inc. as names that could fit the bill for supermajors on the prowl. Noble was also floated as a top-three candidate in a note by RBC Capital Markets.

“You see a deal like this and it does tend to kick off a wave of M&A activity,” Cook said. “This is yet another confirmation that shale development and the short-cycle barrel is increasingly attractive to the majors.”

High Overhead

Investors have pressured producers to cut administrative costs or consolidate

Note: Chart shows expected 2019 general & administrative costs as a percentage of EBITDA esimates

Investors have been pressing shale producers to consolidate in order to gut overhead costs and increase shareholder returns. In a note to clients the day before the deal was announced, Tudor Pickering said Anadarko continually came up in meetings as a high-cost standout. Chevron said it can axe about $1 billion a year in operating costs under the transaction, with another $1 billion in savings on capital expenditures.

That may put pressure on other explorers with bloated administrative costs, driving “more meaningful industry consolidation,” Tudor Pickering’s Portillo said. “There’s significant synergy opportunities.”

Spokespeople for Exxon, BP, Shell, WPX, Cimarex, Parsley, Noble, Pioneer, EOG, Occidental and Concho declined to comment or didn’t immediately respond to requests.

— With assistance by Alex Nussbaum, Tina Davis, Ryan Collins, and Kevin Crowley

https://www.bloomberg.com/news/articles/2019-04-12/chevron-s-anadarko-deal-seen-putting-permian-drillers-into-play