The transition from coal is gathering momentum

As of late 2018, 30 national governments, 22 sub-national governments and 28 businesses had committed to phase out coal by 2030, under the Powering Past Coal Alliance. Nonetheless, a common critique was that these governments only accounted for about 3% of global coal consumption. But, in the last few months, the transition from coal has started to get under way in the major coal-using economies.

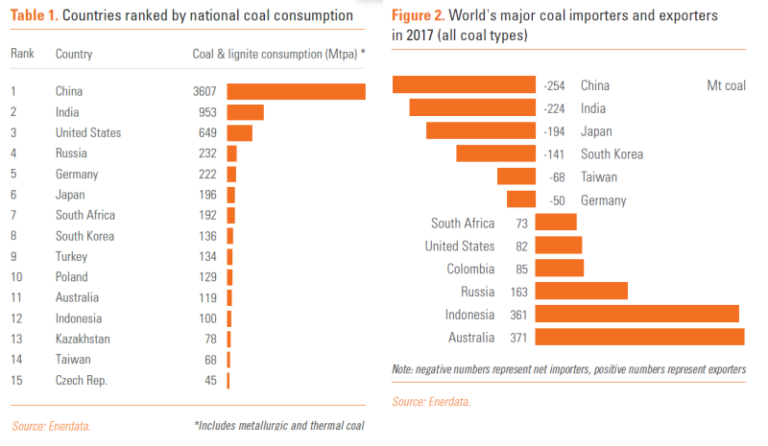

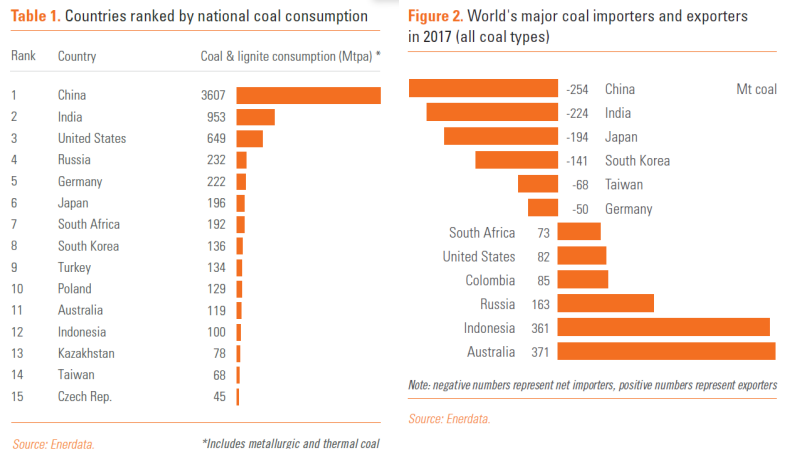

Germany is the world’s fourth biggest economy and fifth largest consumer of coal. Only China, India, Indonesia and Russia consume more coal per year than Germany. On January 26th, Germany’s “coal commission”—a committee established by the Government and made up of coal sector stakeholders tasked to explore the terms for a fair and feasible German coal exit—came to a landmark compromise agreement on a full exit from coal by 2035-2038 (full text in German here).

The German decision was followed by three other major events in the coal market

Firstly, Glencore Xtrata, the 4th largest commodities miner and biggest coal exporter in the world, announced that it was capping its coal output at 129Mt/yr and would begin to diversify its assets away from coal as part of a new strategy to “enable the transition to a low-carbon economy”.

Second, in Australia, which is the world’s biggest coal exporting country, a very significant court decision was handed down in the state of New South Wales, which for the first time prevented a company from developing new mines because its investment was not considered consistent with the Paris Agreement.

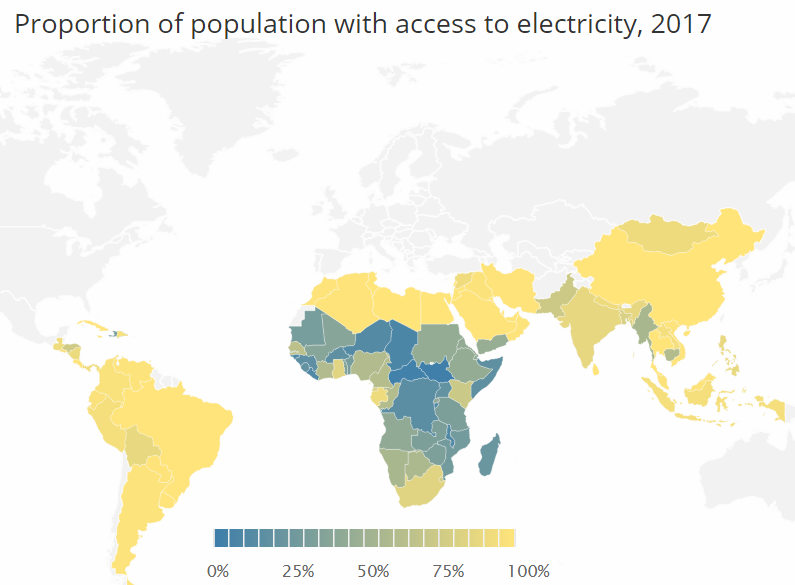

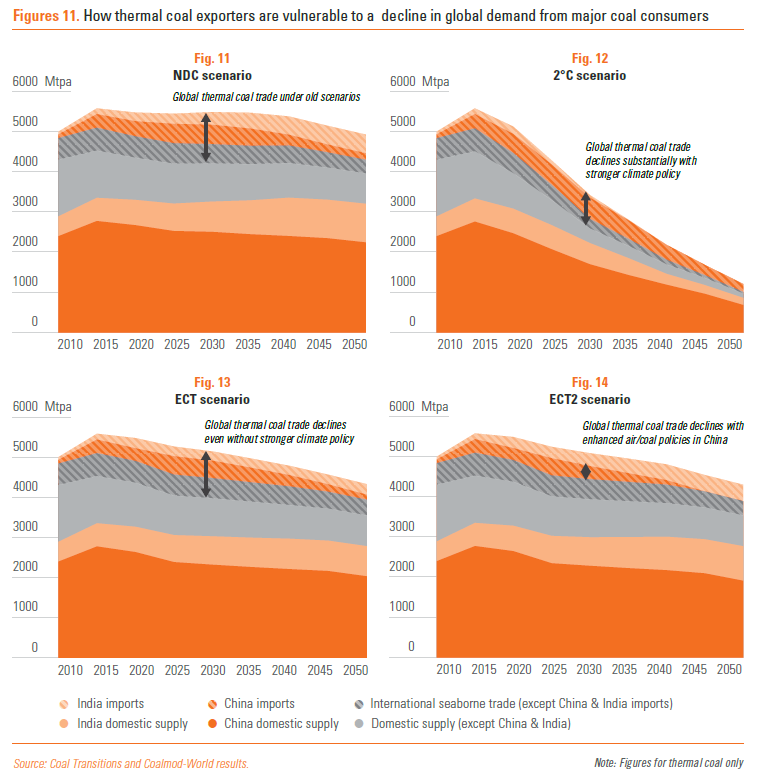

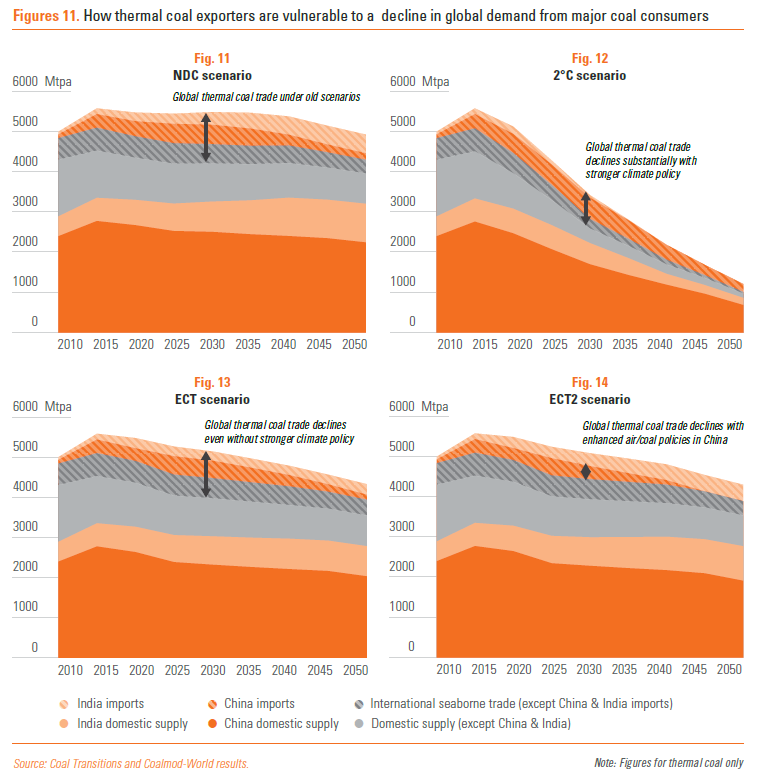

Third, China, which consumes half of global coal production and accounts for a similar share of global imports(1), announced that it was going to cap imports of metallurgical coal from Australia, effectively blocking imports equivalent to about 10% of Australia’s annual exports to China. This decision reflects a new normal in China, which is that its domestic coal demand is now peaking, despite massive domestic production overcapacity.

SOURCE: “Insights from case studies of major coal-consuming economies” – IDDRI

What does all this mean?

These events by themselves do not, of course, mean that suddenly the world is on track to phase out coal in the time needed achieve the Paris Agreement’s goals. However, it underscores the fact that, globally, the “social licence” to keep investing in, trading and burning coal is fading fast. This means that, as existing coal plants and mines expire, it is increasingly unlikely that new investments will be in coal. This has major implications for countries, sub-national governments, companies, local communities, and workers that are currently dependent on coal—they need to start urgently preparing and planning for the future beyond coal, before events overwhelm them.

A Just Transition

Secondly, the German coal exit decision highlights the central importance of an inclusive and just transition for all citizens as the condition sine qua non for phasing out fossil fuels. Germany’s coal exit compromise is not just a phase-out schedule. It puts workers, affected coal mining regions and affected power consumers at the heart of the strategy. For instance, it includes agreement to ensure that every single worker currently in the coal sector will have the opportunity, if not retiring, to find alternative and equivalent quality employment. It also includes agreement on funding for regions to develop alternative economic activities, building on existing initiatives, such as Lausitzlab. A key lesson from Germany’s agreement is that the transition from fossil fuels cannot succeed unless it is based on a high degree of stakeholder consensus and offers a desirable, post-coal future to the most vulnerable in society.

Economic common sense

A third take away from all this news is that the technological alternatives to coal are much more advanced that they were even 5 years ago. This allows other countries who are planning or contemplating new coal plants to think again. Once it was argued that wind and solar were too expensive and variable. But costs, both of production and small scale storage solutions, have fallen massively in the last 5 years. Experience with integration of variable renewables in the OECD is showing that solutions exist to enable much higher shares than previously thought. The proof is that major industrialised economies like Germany are phasing out coal—while also phasing out nuclear power—in favour of very high goals for renewables; and that China is capping coal consumption in absolute terms. These are industrial powerhouse countries who would not do this if it put their economic model in jeopardy.

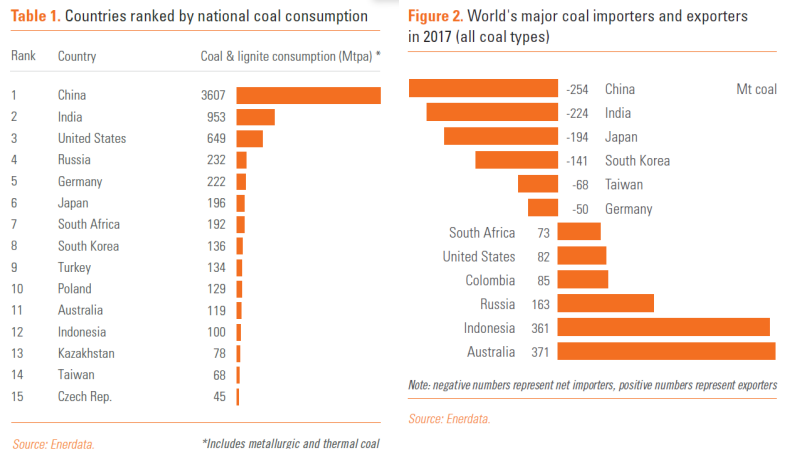

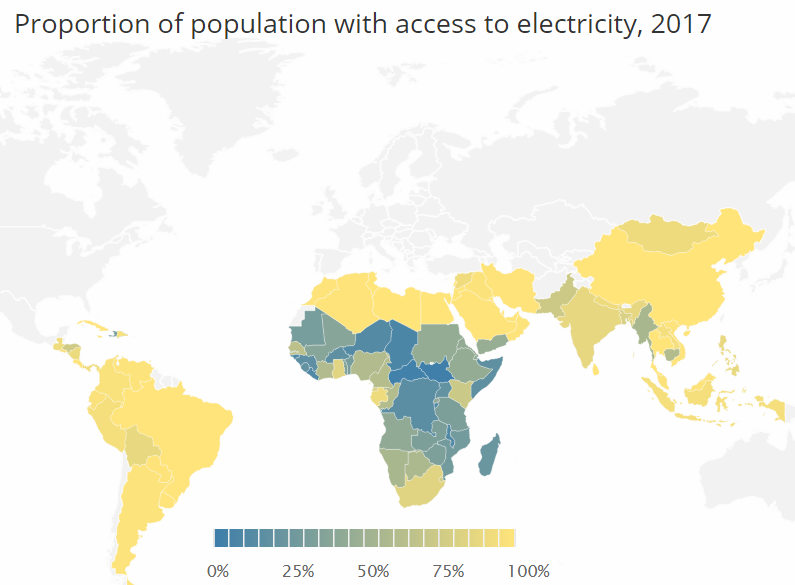

This conclusion dovetails with a recent IEA analysis, which argued that, for the world’s population without access to electricity, 70% of new connections by 2030 could be done more cheaply or at equivalent cost via renewables or renewables plus small scale battery solutions. With the right policy frameworks, political will and finance, developing countries can industrialise, provide affordable, universal power access and exit from coal.

SOURCE: IEA

In other places, the conversation on the decline of coal is also picking up. At the end of February, for example, an International Roundtable on the Future of Coal was held in South Africa (a top 4 coal exporter) back to back with a Symposium on a Just Coal Transition for South Africa.

What needs to happen now?

Nonetheless, much remains to be done. While the world on aggregate is moving away from coal, specific countries, such as Japan, India, Vietnam, Indonesia, Mongolia, Turkey, Bangladesh, Pakistan, South Korea and some parts of Africa are still building new coal plants. Policymakers in many developing countries are keen to support industrialisation. In this context, they are often offered coal energy investment packages—often by Chinese SOEs—containing cheap finance, technology, construction, skills transfer, and the promise of “cradle-to-grave” services. These packages tend to outcompete renewables in the current market, even though alternatives to coal could be just as cheap, fast to build and reliable under the right (but missing) policy conditions. But thus far, high climate ambition countries and multi-lateral development banks have not yet been able to work with recipient countries to provide a sufficiently attractive alternative, at the scale required, to crowd out new coal.

Meanwhile, major coal users need to up their efforts to phase down coal. China has capped coal use, but now needs to begin planning a progressive phasing down of its coal assets over the coming decade. India needs to set a peaking date for coal use, like China has done, and do more to improve the investment environment and market integration policies for renewables and alternative fuel use to coal in industry. South Africa needs to find a way to make the most of its current power generation crisis: it needs to avoid a contentious debate over privatisation and instead focus on using the bailout of bankrupt state power monopoly Eskom onto a pathway out of coal and into cheaper renewable alternatives. Other major exporting countries like Australia, South Africa or Colombia, and key coal states of the USA, are still grappling with a fast changing reality. In general, policymakers in these countries have not yet fully grasped the economic and social risks associated with continuing to assume that the future will be like the past.

SOURCE: “Insights from case studies of major coal-consuming economies”

Most of all, however, workers, citizens, and other stakeholders and their governments need to come together to agree on a strategy for the transition out of coal, oil and gas in line with the goals of the Paris Agreement on climate. Anything less leaves them open to a transition that is speeding up and could quickly get ahead of them, leaving it too late to catch up.

(1) For more information on the global coal market, and more specifically on major coal-consuming countries, read the report “Implementing Coal Transition – Insights from case studies of major coal-consuming economies – Pathways to “below 2°C”-compatible coal transitions in major coal-consuming economies” published in September 2018 by IDDRI and its partners within the framework of the project Coal Transitions: Research and Dialogue on the Future of Coal.