QATARENERGY TO PARTICIPATE IN IRAQ’S GAS GROWTH INTEGRATED PROJECT (GGIP) –

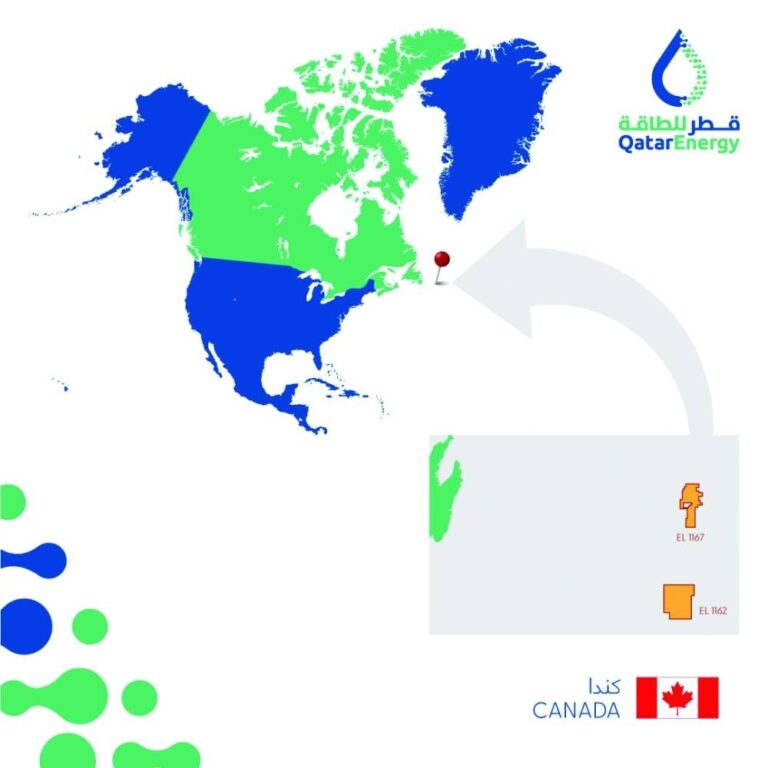

QatarEnergy has entered into a farm-in agreement with ExxonMobil Canada for two exploration licences offshore the province of Newfoundland and Labrador in Canada.

Pursuant to the agreement, QatarEnergy holds a 28% working interest in licence EL 1167, where the Gale exploration well and associated activities are planned.

ExxonMobil Canada (operator) holds 50% while Cenovus Energy holds 22%. QatarEnergy also holds a 40% working interest in licence EL 1162, while ExxonMobil Canada (operator) holds the remaining 60%.

The transaction has completed all necessary formalities with the Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB).

Commenting on this occasion, HE the Minister of State for Energy Affairs, Saad bin Sherida al-Kaabi, also the President and CEO of QatarEnergy, said: “We are pleased to sign this agreement with our strategic partner, ExxonMobil, to further grow our offshore Atlantic Canada portfolio as part of our international growth drive, and look forward to continue working within Canada’s transparent and stable regulatory environment.”

Al-Kaabi added: “I would like to take this opportunity to thank the Canada-Newfoundland and Labrador Offshore Petroleum Board, which has been very supportive of this process, and look forward to a successful exploration campaign with our partners.”

Located offshore Eastern Canada, EL 1167 and EL 1162 lie in water depths ranging from 100 to 1,200 metres and cover an area of approximately 1,420 and 2,400 square kilometres, respectively.

GECF LNG exports have jumped 12% (1.74mn tonnes) year-on-year (y-o-y) to 16.45mn tonnes in February, driven by Qatar, which is the forum’s top liquefied natural gas exporter, Doha-headquartered Gas Exporting Countries Forum said in its latest monthly report.

The surge in GECF’s LNG exports was driven by Qatar (+0.84mn tonnes), Norway (+0.36mn tonnes), Malaysia (+0.33mn tonnes), Egypt (+0.15mn tonnes), Mozambique (+0.15mn tonnes), Angola (+0.14mn tonnes), Algeria (+0.10mn tonnes), Trinidad and Tobago (+0.08mn tonnes), Russia (+0.05mn tonnes) and Peru (+0.02mn tonnes).

In contrast, LNG exports declined in the United Arab Emirates (-0.26mn tonnes) and Nigeria (-0.21mn tonnes), GECF noted.

Looking at Qatar and Angola, lower maintenance activity at LNG facilities in both countries compared to a year earlier boosted the countries’ exports.

In Norway, the continued ramp-up in production from the Hammerfest LNG facility, following its restart in June 2022, drove the increase in exports.

Furthermore, higher feedgas availability for LNG exports in Malaysia, Egypt, Algeria and Trinidad and Tobago supported the increase in exports from these countries.

With regard to Mozambique, the ramp-up in production from the Coral South FLNG facility supported the rise in LNG exports.

On the other hand, the decline in LNG exports from the UAE was attributed to maintenance activity at the Das Island LNG facility.

In Nigeria, lower feedgas availability for LNG exports contributed to the lower LNG exports.

NLNG declared force majeure on feedgas supply to the liquefaction facility in January 2023, which remained in effect in February, GECF noted.

In February 2023, global LNG exports rose sharply y-o-y by 11% (3.48mn tonnes) to 34.00mn tonnes.

Stronger LNG exports from GECF member countries, non-GECF countries and higher LNG reloads drove the growth in global LNG exports.

Non-GECF countries were the largest LNG exporters during the month with a share of 49.5% in global LNG exports, followed by GECF (48.4%) and LNG reloads (2.1%).

In comparison to February 2022, the shares of GECF member countries and LNG reloads increased from 48.2% and 0.8% respectively while the share of non-GECF countries declined from 51.0%, the monthly report showed.

At a country level, the US was the largest exporter in February 2023, followed by Australia and Qatar.

For January and February of this year, combined, global LNG exports rose by 6.7% (4.33mn tonnes) y-o-y to 69.44mn tonnes, GECF noted.

Nakilat, whose liquefied natural gas (LNG) carriers account for about 10% of the global LNG carrying capacity, has said its greater fleet capacity and increased operational efficiency provide it with a “competitive” edge as its expands its international shipping portfolio through the recent strategic expansion of Nakilat’s fleet with an additional four LNG carriers, and the improved performance of its joint ventures and support services operating in the shipyard,

Nakilat has achieved sustainable and long-term growth over the past year, demonstrating its commitment to innovative sustainability and operational excellence, its chairman Abdulaziz al-Muftah told shareholders yesterday at the annual general assembly meeting, which approved the 2022 results and 13% dividend.

“This commitment has provided Nakilat with a greater fleet capacity and increased operational efficiency, providing us with a competitive edge in the LNG shipping sector, as the company expands its international shipping portfolio,” he said.

With a fleet strength of 74 vessels – one of the largest LNG shipping fleets in the world, Nakilat’s portfolio comprises 69 LNG carriers, four liquefied petroleum gas carriers and one floating storage regasification unit – the company is backbone of the transportation link in Qatar’s LNG supply chain, according to him.

“Our LNG fleet has a combined carrying capacity of over 9mn cubic metres, which is about 10% of the global LNG fleet carrying capacity,” he said, adding the majority of Nakilat’s vessels are fixed with long-term charters to reputable counterparties, creating a “steady and healthy” cash flow for the company.

Nakilat followed through its expansion plans with the delivery of “Global Sealine”, a technologically advanced LNG carrier new-build during 2022, demonstrating commitment to innovation, sustainability, and operational excellence.

“This allowed Nakilat to provide greater fleet capacity and flexibility to its customers and gave the company a significant competitive advantage in the energy transportation sector,” al-Muftah said, adding this also contributed towards the company’s efforts at reducing its carbon footprint and operating sustainably apace growing its international shipping portfolio.

He said the company’s resilience and the convergent efforts have enabled its sustained growth momentum and business continuity, creating immense value for both its customers and shareholders.

With a solid sense of direction from the company’s long-term expansion strategy and opportunities that re-emphasised its importance in achieving its targets, Nakilat has been smoothly sailing towards making significant contributions and notable accomplishments during 2022, al-Muftah said in the latest board report.

Supported by its Erhama Bin Jaber Al Jalahma Shipyard, Nakilat’s joint venture companies continue adding strategic value to its operations through dedicated services, including ship repair, offshore fabrication, as well as a range of maritime services, all of which contribute towards establishing Qatar as a shipping and maritime hub, in support of the Qatar National Vision 2030, according to him.

Yet another feather in the cap for the Public Works Authority (Ashghal). In recognition of its distinguished health and safety performance, and wellness initiatives, Ashghal has been declared the overall winner of two International Safety Awards 2020 by the British Safety Council, in recognition of its commitment to keeping workers and workplaces healthy and safe during the 2019 calendar year. The awards reflect Ashghal’s commitment to health and safety in its construction projects and the leading position that Ashghal plays in the Qatari construction industry in terms of spreading awareness and best H&S practices.

Ashghal is one of the very few organisations to be crowned the overall winner in the following categories: “Wellbeing Initiative” for protecting its employees from the risk of injury and ill health at work, and “Best Team of the Year” for the Roads and Infrastructure project in West Muaither (Package 3) in recognition of its commitment to keeping its workers and workplaces healthy and safe in 2019.

Engineer Yousef Al-Emadi, Director of Projects Affairs, said: “The International Safety Awards are part of numerous awards won by Ashghal during the past few years. They are a result of well-implemented strategies set by Ashghal’s leadership and nurtured at every level across the organisation.”

In 2019, Ashghal succeeded in undertaking the health screening of 78,197 workers, or 96.5% of the entire workforce. The British Safety Council commended Ashghal on the achievement, which is in line with the Council’s vision that no one should be injured or made ill through work – anywhere in the world

In March this year, Ashghal won the Government Sustainability Initiative Award presented by the Qatar Green Building Council (QGBC), a member of the Qatar Foundation, for applying best environmental practices in project implementation works. The Award comes in recognition of Ashghal’s efforts in the field of environmental sustainability, and in the context of several initiatives by the authority within the roads and infrastructure projects implemented by the Roads Projects Department.

Under the five-year plan (2018-2022), Ashghal will implement 25 plans related to the evaluation and follow-up of road safety, including achieving safety at work sites, managing traffic congestion and building an intelligent transportation system.

Ashghal continues to implement sustainable infrastructure for the State of Qatar. The achievements come within the framework of the State’s interest in the infrastructure, construction and reconstruction sector in line with the aspirations of its National Vision 2030 and to serve its hosting of the 2022 FIFA World Cup Qatar.

Qatar is among the list of ‘Top 10 LNG exporters’ in January, data provided by the Gas Exporting Countries Forum (GECF) show. The other LNG exporting countries in the list are US, Australia, Russia, Malaysia, Indonesia, Algeria, Oman, Nigeria and Trinidad and Tobago.

Qatar is among the list of ‘Top 10 LNG exporters’ in January, data provided by the Gas Exporting Countries Forum (GECF) show.

The other LNG exporting countries in the list are US, Australia, Russia, Malaysia, Indonesia, Algeria, Oman, Nigeria and

Trinidad and Tobago.

In its inaugural edition of the Monthly Gas Market Report (MGMR) GECF said that in January, global LNG exports grew by 2.8% (0.98mn tonnes) y-o-y to 35.56mn tonnes.

The higher LNG exports were driven mainly by non-GECF countries and to a lesser extent from GECF member countries and LNG reloads.

However, GECF member countries were the largest LNG exporter globally with a share of 49.7%, down from 50.9% during the same period a year earlier.

Similarly, the share of LNG reloads in global LNG exports decreased from 1.5% to 1.2% during the same period.

In contrast, the share of non-GECF countries LNG exports globally increased from 47.9% to 48.8%.

GECF cited Rystad Energy’s preliminary forecast and said global natural gas production was estimated to have decreased by 0.4% to 4,032 bcm in 2022 due to the decline in production in the CIS and Africa regions.

Several factors, including a decrease in gas demand due to high prices and geopolitical tensions, exerted downward pressure on gas production.

Conversely, natural gas output of North America, the Middle East, Europe, and Latin America increased by 64 bcm, 19 bcm, 7 bcm, and 3bcm, respectively.

The 2022 figures have been slightly revised upward from the previous month’s estimates due to upward revisions in natural gas output in Asia Pacific, the Middle East, and North America. Non-GECF natural gas output is estimated to increase by 3.8% to reach 2,388 bcm in 2022, mainly due to a production increase of 47bcm in the US.

In 2023, the forecasts reveal a growth in global gas production, driven by growth in North America, the Middle East, Africa, Latin America, and Asia Pacific.

GECF said it is pleased to unveil the inaugural edition of the Monthly Gas Market Report (MGMR). This new publication offers a comprehensive analysis of the global gas market on a monthly basis.

The report provides essential insights for industry players, policymakers, and stakeholders, including a detailed analysis of gas demand and supply, international trade flows, gas storage trends, pricing trends, and the impact of the global economy on the gas market.

“The GECF is committed to delivering high-quality information and analysis, and is confident that the Monthly Gas Market Report will be a valuable resource for all those interested in the gas industry,” said Mohamed Hamel, secretary-general, GECF.

QatarEnergy, in a consortium with TotalEnergies and Petronas, has been awarded the Agua-Marinha Production Sharing Contract (PSC), under the 1st Cycle Permanent Offer round, by Brazil’s National Agency of Petroleum, Natural Gas, and Biofuels (ANP).

Under the terms of the PSC and associated agreements, QatarEnergy will hold a 20% working interest, alongside the operator Petrobras (30%), TotalEnergies (30%) and Petronas Petroleo Brasil Ltda (20%).

The Agua-Marinha block has a total area of 1,300sq km and is located in water depths of about 2,000m off the coast of Rio de Janeiro in the prolific Campos Basin.

Commenting on this occasion, HE the Minister of State for Energy Affairs, Saad bin Sherida al-Kaabi, also the president and CEO of QatarEnergy, said: “We are pleased to achieve this latest successful joint-bid, which adds further highly prospective acreage to our upstream portfolio in Brazil, and particularly in the prolific Campos Basin.”

Al-Kaabi added: “We are delighted to achieve this success with our valued partners Petrobras, TotalEnergies, and Petronas. I wish to take this opportunity to thank the ANP and the Brazilian authorities for this opportunity and for their ongoing support.”

The acquisition, which is expected to close in the first half of 2023, further establishes QatarEnergy as one of the leading upstream players in Brazil, where it already holds working interests in two producing fields and numerous exploration blocks.

Nakilat-managed liquefied natural gas (LNG) carrier Global Star, with a carrying capacity of 173,400 cubic metres, has become the first Nakilat vessel to deliver cargo to Escobar LNG Terminal in

Argentina. Escobar LNG terminal is located on the Parana River in Argentina. It has the capacity to handle 500mn cubic feet (mcf) of LNG a day and a peak capacity of 600 mcf.

HE the Minister of State for Energy Affairs Saad bin Sherida al-Kaabi took part in the 16th annual forum of the Gulf Petrochemicals and Chemicals Association (GPCA), which was held in Riyadh in Saudi Arabia.

The forum, which was inaugurated by Prince Abdulaziz bin Salman al-Saud, Saudi Arabia’s Minister of Energy, was held under the theme ‘Managing net-zero ambitions in the energy sector with growth’.

Delegates are taking part in discussions on developing policies to adopt a lower carbon strategy in the energy sector, driving the shift towards clean energy sources through innovative strategies, realising the future of the region to lead the evolution of ‘carbon circular economy’, and the way forward for the GCC to lead the development of a ‘hydrogen economy’.

The Annual GPCA forum is the flagship petrochemical gathering in the Middle East, bringing together officials and executives of the leading petrochemical and chemical industry companies for an exchange of views on the current situation and future prospects.

The 17th GPCA Forum will be held next year in Doha.

QatarEnergy has announced a successful bid for Parcel 8 of the Orphan Basin, offshore the province of Newfoundland and Labrador in Canada, expanding its North American footprint.

The Parcel 8 winning bid by QatarEnergy (30% working interest) and ExxonMobil (operator, with a 70% working interest) was announced by the Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB) as part of the 2022 Newfoundland and Labrador Call For Bids NL22-CFB01.

Commenting on this occasion, HE the Minister of State for Energy Affairs, Saad bin Sherida al-Kaabi, also the President & CEO of QatarEnergy said, “We are pleased to be the successful bidder in Parcel 8 offshore Canada, and look forward to maturing the lead prospect’s potential, testing an exciting play within a transparent and stable regulatory environment.”

Al-Kaabi added, “This successful bid demonstrates our ambition to further increase our footprint in the Atlantic basin, as part of our international growth drive. I would like to take this opportunity to thank the C-NLOPB for an efficient tender process, as well as our strategic partner, ExxonMobil, for their excellent co-operation in achieving this result.”

Located offshore Eastern Canada, Parcel 8 lies in water depths of 2,500 to 3,000 metres and covers an area of approximately 2,700 square kilometres.

The entry to the Parcel 8 license is subject to customary government approvals, QatarEnergy said yesterday.