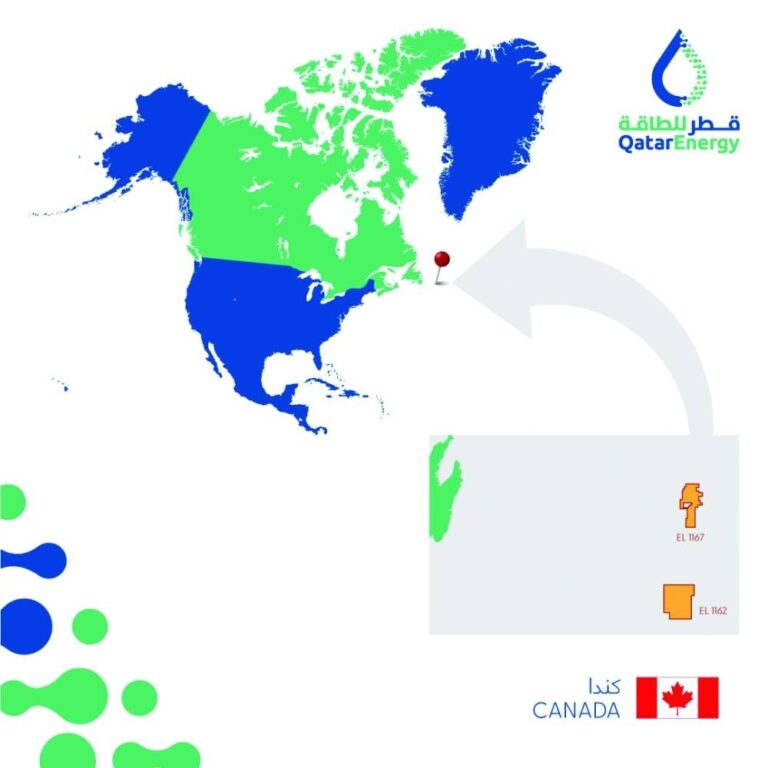

QatarEnergy enters Suriname offshore exploration

QatarEnergy has entered into two Production Sharing Contracts for Blocks 6 and 8 offshore the Republic of Suriname, following successful bids in these blocks, as previously announced in June 2021.

Pursuant to the signed agreements, QatarEnergy will own a 20% working interest in both blocks, where licensing of the new 3D seismic and associated exploration activities are planned. The remaining working interest is shared equally between TotalEnergies (Operator) and Staatsolies affiliate, Paradise Oil Company.

Commenting on the signing of the agreements, HE Minister of State for Energy Affairs, the President and CEO of QatarEnergy Eng. Saad bin Sherida Al Kaabi said: “We are pleased to have concluded our entry into Blocks 6 and 8 along with our partners, TotalEnergies and Staatsolie, and look forward to commencing exploration in this promising basin.”

HE Minister Al Kaabi added: “I would like to take this opportunity to thank the Surinamese authorities, Staatsolie, and our strategic partner TotalEnergies for their excellent commitment and support that resulted in the signing of these agreements.”

The contracts, and other key agreements, were signed on behalf of QatarEnergy by Manager of International Upstream and Exploration Ali Abdullah Al Mana during a ceremony hosted by Staatsolie, Surinames State Oil Company in Paramaribo, the capital of Suriname.

Located in the Southern part of offshore Suriname, the adjacent Blocks 6 and 8 are immediately South of Block 58 in shallow waters, with depths ranging between 40 and 65 metres.