Lebanon sets starting point for sea border negotiations with Israel

BEIRUT (Reuters) – President Michel Aoun on Thursday specified Lebanon’s starting point for demarcating its sea border with Israel under U.S.-mediated talks, in the first public confirmation of a stance sources say increases the size of the disputed area.

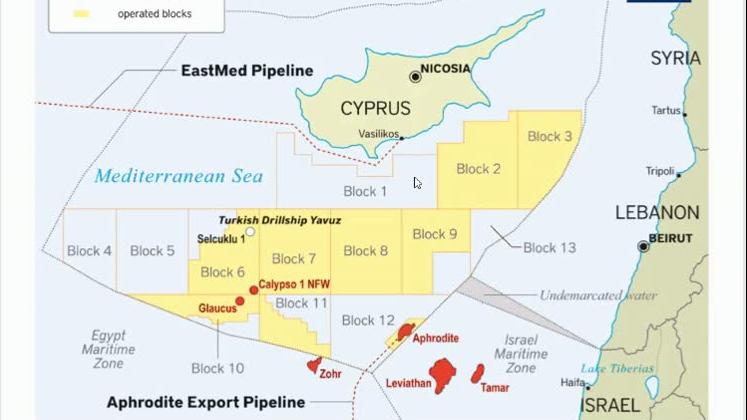

Israel and Lebanon launched the negotiations last month with delegations from the long-time foes convening at a U.N. base to try to agree on the border that has held up hydrocarbon exploration in the potentially gas-rich area.

A presidency statement said Aoun instructed the Lebanese team that the demarcation line should start from the land point of Ras Naqoura as defined under a 1923 agreement and extend seaward in a trajectory that a security source said extends the disputed area to some 2,300 square km (888 sq miles) from around 860 sq km.

Israel’s energy minister, overseeing the talks with Lebanon, said Lebanon had now changed its position seven times and was contradicting its own assertions.

“Whoever wants prosperity in our region and seeks to safely develop natural resources must adhere to the principle of stability and settle the dispute along the lines that were submitted by Israel and Lebanon at the United Nations,” Yuval Steinitz said.

Any deviation, Steinitz said, would lead to a “dead end”.

Last month sources said the two sides presented contrasting maps for proposed borders. They said the Lebanese proposal extended farther south than the border Lebanon had years before presented to the United Nations and that of the Israeli team pushed the boundary farther north than Israel’s original position.

The talks, the culmination of three years of diplomacy by Washington, are due to resume in December.

Israel pumps gas from huge offshore fields but Lebanon, which has yet to find commercial gas reserves in its own waters, is desperate for cash from foreign donors as it faces the worst economic crisis since its 1975-1990 civil war.

Additional reporting by Ari Rabinovitch in Jerusalem; Writing by Ghaida Ghantous; Editing by Janet Lawrence