Oil and gas investment rise 7% y-o-y to $718bn in 2022; may rise further in 2023: GECF

Oil and gas investment increased by 7% y-o-y to reach $718bn in 2022 and is expected to rise further in 2023, but looming uncertainties may deter investment, the Gas Exporting Countries Forum said in its fourth edition of its Annual Gas Market Report Wednesday.

In 2023, oil and gas investment is expected to rise further, on the back of greater investment in the upstream industry and LNG import terminals.

However, several looming uncertainties, including a slowdown in global economic growth, tight financial conditions, inflation, and high energy price volatility, may deter investment, GECF noted.

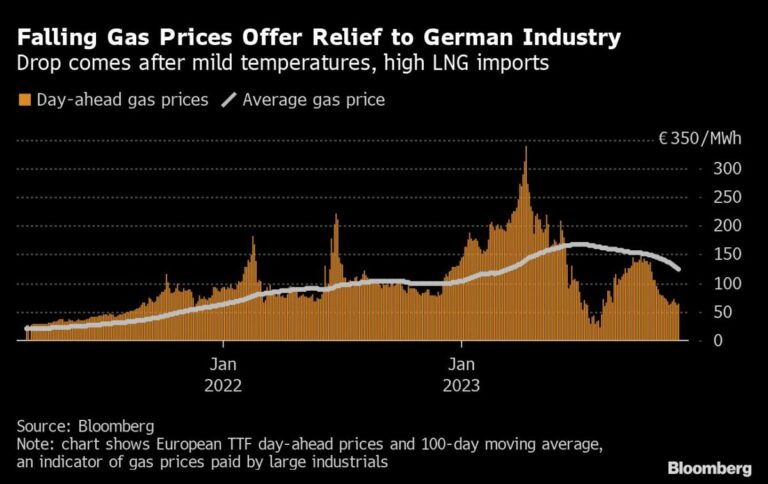

Spot gas and LNG prices in Europe and Asia reached record highs in 2022, with significant volatility throughout the year. This, the report noted, was mainly due to a tight LNG market as Europe’s LNG demand surged to replace lower pipeline gas imports.

In 2022, the Title Transfer Facility (TTF) spot gas prices in Europe averaged $38/MMBtu, 136% higher y-o-y, while Northeast Asia (NEA) LNG spot prices averaged $33/MMBtu, a 79% increase y-o-y.

This shift in prices made Europe the premier LNG market for suppliers, as TTF spot prices maintained a high premium over Asian LNG spot prices. In 2023, spot prices are expected to remain volatile.

Factors such as a relatively mild winter, high gas storage levels in Europe, and weakened gas demand growth in the midst of a slowdown in global economic growth may exert downward pressure on spot prices.

However, there may be some upward pressure on spot prices this year due to the anticipated recovery in China’s gas demand,

higher imports in price-sensitive countries in Asia Pacific, and a rebound in gas demand in the industrial sector.

Additionally, any further supply disruptions or extreme weather conditions during the year may also boost prices, GECF said.

Energy security concerns took precedence over climate change mitigation goals in 2022, with policymakers focusing on meeting the energy needs of their people, the report said.

Following a record rebound in 2021, global gas consumption declined in 2022, but is expected to resume growth in 2023 and reach an all-time high level, with the power generation sector remaining the largest consumer of gas.

US, China, and some emerging countries in Asia Pacific are forecasted to drive the growth of global gas consumption in 2023, it said.

GECF secretary-general Mohamed Hamel said, “The Annual Gas Market Report is comprehensive and I hope it will become an essential tool for anyone interested in natural gas.”

The publication comes at a time when natural gas markets are undergoing fundamental transformations in terms of physical flows, investment, trade, and market functioning.

“The developments in the gas industry are an indication of the bright prospects for the expansion of the global gas industry, as natural gas is set to play a pivotal role in socio-economic development and towards just and inclusive energy transitions,” Hamel added.