Regional Energy Expert Roudi Baroudi Earns Award from Washington Think Tank

Transatlantic Leadership Network Recognizes Author for Contributions to Peaceful Development in Eastern Mediterranean

WASHINGTON, DC November 9, 2023: Doha-based Lebanese author Roudi Baroudi was one of two people presented with the 2023 Transatlantic Leadership Award at a ceremony in Washington this week.

Although circumstances relating to the conflict in the Gaza Strip prevented Baroudi from attending the event, both he and Joshua Volz – the Deputy Assistant Secretary for Europe, Eurasia, Africa, and the Middle East and the Office of International Affairs at the US Department of Energy – were recognized by the Transatlantic Leadership Network (TLN). Each was cited at a gala dinner on Monday for his “valuable contribution in building a peaceful and prosperous Eastern Mediterranean” as part of the TLN’s 2nd Annual Conference on Freedom of the Media.

“I was deeply honored to be named a recipient of this prestigious award, and I will always be grateful for the many ways in which the TLN has supported my work for several years now,” Baroudi said. “I also look forward to working together in the future so that one day, our descendants can know the benefits of peace and coexistence. It is precisely in difficult and trying times that cooler heads must be able and willing to look at the reasons for current bloodshed and recrimination, then envision pathways to a better future.”

Baroudi, who serves as CEO of independent consultancy Energy and Environment Holding in Doha, is a long-time champion of dialogue, cooperation, and practical solutions to both the global climate crisis and recurrent tensions in the East Med. A regular speaker at regional energy and policy conferences, Baroudi’s insights are also avidly sought by local and international media, as well as governments, major energy companies, and investors.

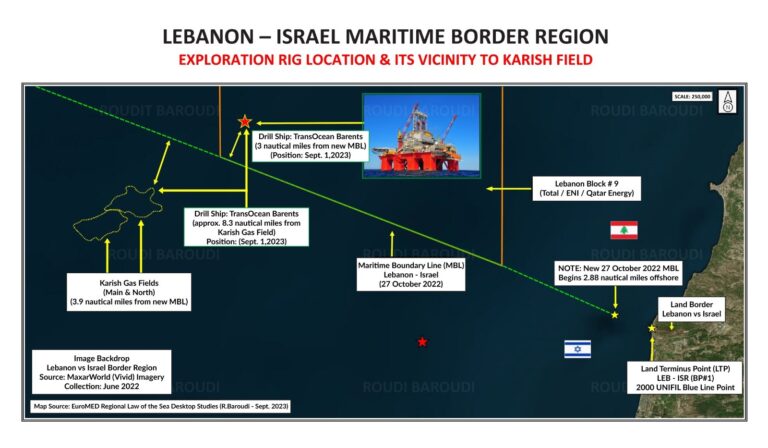

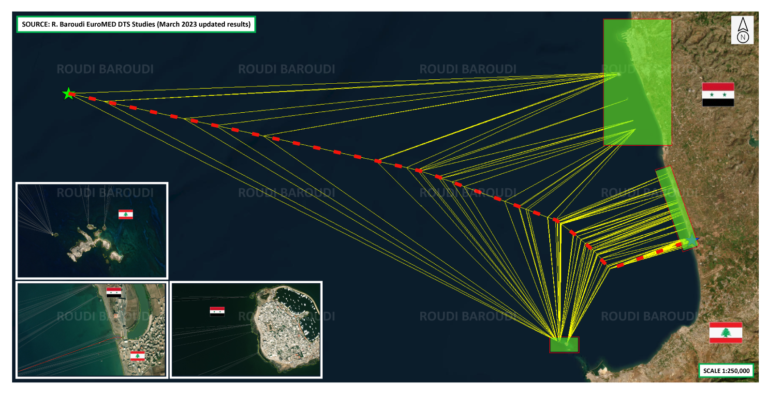

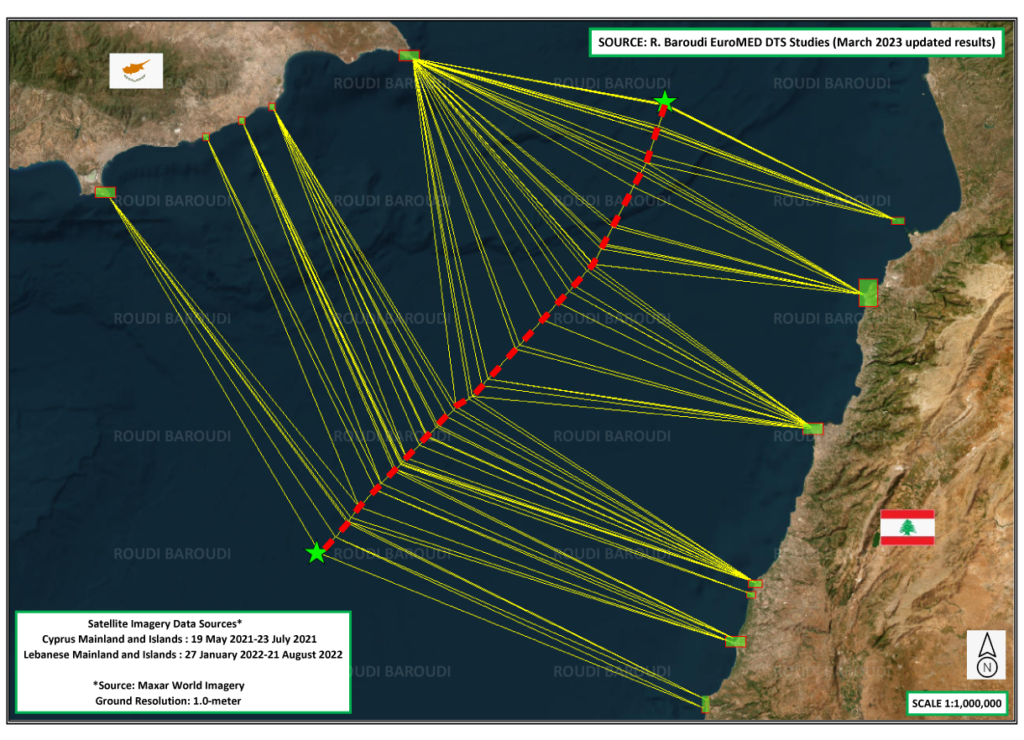

Having advised both public and private sector actors on a wide variety of energy issues, Baroudi is widely credited with bringing unique perspective to all manner of policy discussions. He is the author of several books, including “Maritime Disputes in the Eastern Mediterranean: The Way Forward” (2021), and “Climate and Energy in the Mediterranean: What the Blue Economy Means for a Greener Future” (2022). Together with Notre-Dame University – Louaize, Baroudi has also published a study of the US-brokered October 2022 Maritime Boundary Agreement between Lebanon and Israel, and is currently preparing another volume on Lebanon’s prospects for similar deals with Cyprus and Syria.

The TLN describes itself as “a nonpartisan, independent, international network of practitioners, private sector leaders and policy analysts dedicated to strengthening and reorienting transatlantic relations to the rapidly changing dynamics of a globalizing world.”

Monday’s ceremony was attended by a broad cross-section of high-profile figures, including senior officials from the Departments of Energy and State, numerous members of Washington’s extensive diplomatic corps, and representatives of both international organizations and various media outlets.