‘Prerequisites for peace’: Expert applauds Skylakakis for endorsing energy transition policies that ‘open the way to dialogue and cooperation’

ATHENS, July 7, 2024 Greece: Energy and Environment Minister Theodoros Skylakakis is on the right track with his approach to Greece’s energy transition plans, a noted regional expert says.

“He’s got the right perspective,” industry veteran and author Roudi Baroudi said after Skylakakis spoke at this week’s Athens Energy Summit. “He understands that although the responsibility to reduce carbon emissions is universal, the best policy decisions don’t come in ‘one-size-fits-all’.”

Baroudi, who has more than four decades in the field and currently serves as CEO of Doha independent consultancy Energy and Environment Holding, made his comments on the sidelines of the forum, where he also was a speaker.

In his remarks, Skylakakis expressed confidence that Greece’s increasing need to store electricity – as intermittent renewables generate a growing share of electricity – would drive sufficient investment in battery capacity, without the need for subsidies. Among other comments, he also stressed the need for European Union policymakers to account for the fact that member-states currently face the cost s of both limiting future climate change AND mitigating the impacts that are already under way.

“Every country is different in terms of how it can best fight climate change. Each one has its own set of natural resources, industrial capacity, financial wherewithal, and other variables. What works in one situation might be a terrible idea elsewhere. That’s crucial and Skylakakis gets it,” Baroudi said. “He also understands that an effective transition depends on carefully considered policies, policies that attract investment to where it can not only have the greatest impact today, but also maximizes the impact of tomorrow’s technologies and tomorrow’s partnerships.”

“What Skylakakis is saying and doing fits in nicely with many of the same ideas I spoke about,” Baroudi added. “When he talks about heavier reliance on wind farms, the added storage capacity is a foundation that will help derive a fuller return from each and every turbine. When he highlights the utility – pun intended – of power and gas interconnections with other countries and regions, these are the prerequisites for peace, the building blocks for cooperation and dialogue.”

In his own speech shortly after Skylakakis’, Baroudi told the audience at the capital’s Hotel Grande Bretagne that countries in the Eastern Mediterranean should work together to increase cleaner energy production and reduce regional tensions.

“Surely there is a method by which we can re-establish the same common ground enshrined in the wake of World Wars I and II, recall the same common interests and identify new ones, and work together to achieve common goals, just as the UN Charter implores us to,” he said.

Baroudi advises companies, governments, and international institutions on energy policy and is an award-winning advocate for efforts to promote peace through dialogue and diplomacy. He told his audience that with both climate change and mounting geopolitical tensions posing threats to people around the world, policymakers needed to think outside the usual boxes.

In this way, he argued, “we might develop the mutual trust which alone can create a safer, happier, and better world for our children and grandchildren.”

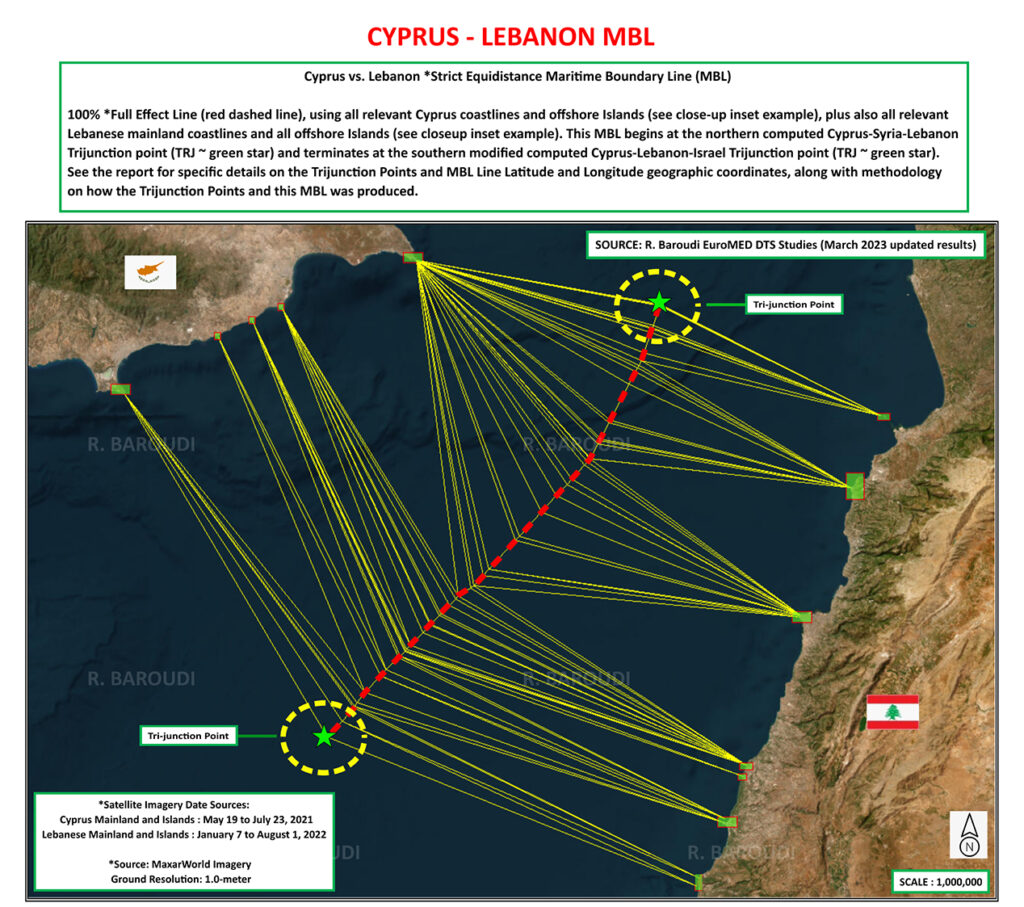

“Consider the possibilities if Greece, Türkiye, and Cyprus became de facto – or de jure – partners in a pipeline carrying East Med gas to consumers in Bulgaria, Romania, and Italy,” he said. “Imagine a future in which Israeli and Lebanese gas companies were similarly – but independently – reliant on the same Cypriot LNG plant for 10-20%, or even more, of their respective countries’ GDPs.”

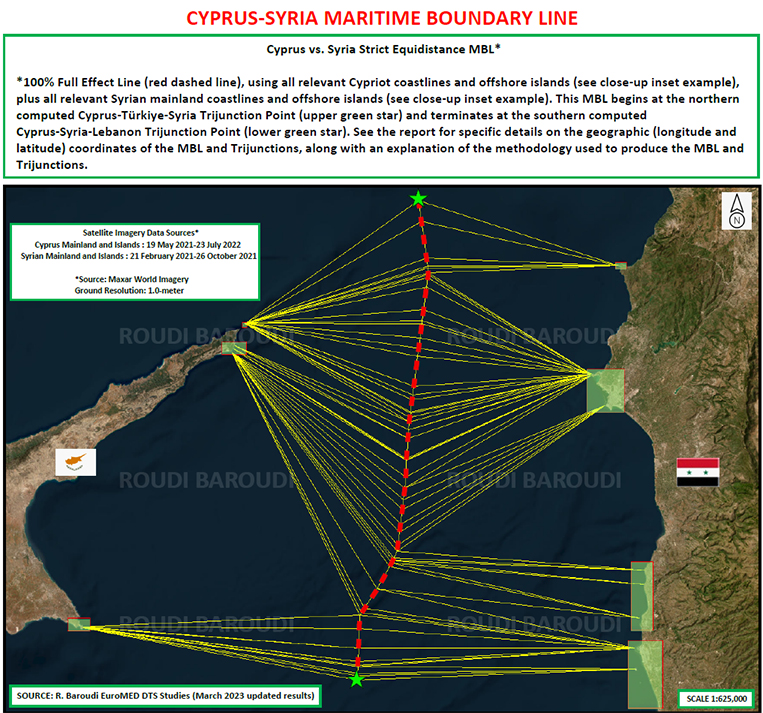

He also envisioned bilateral cooperation scenarios between Greece and Turkey and Syria and Turkey, as well as a regional interconnection that would provide backup energy for multiple coastal states.

“Instead of accepting certain ideas as permanently impossible, we ought to be thinking ahead and laying the groundwork,” Baroudi said. “For Greece and Türkiye – as for other pairs of coastal states in the region – a good starting point would be to emulate the Maritime Boundary Agreement agreed to by Lebanon and Israel in 2022.”

Stressing the potential for cooperation to address both energy requirements and the stability required for stronger growth and development, Baroudi – whose books include a 2023 volume about the Lebanon-Israel deal and a forthcoming one urging other East Med countries to do the same – called on the EU to take up the challenge.

“Using dialogue and diplomacy to expand energy cooperation would benefit not just the countries of the East Med but also the entire European Union and much of its surrounding ‘neighborhood’,” he told an audience of energy professionals and key government officials. “That level of promise more than merits the attention of Brussels, the allocation of support resources, and even the designation of a dedicated point-person tasked with facilitating the necessary contacts and negotiations.”

“This is how we need to be thinking if we want to get where we need to go,” Baroudi said. “Instead of allowing ourselves to be discouraged by the presence of obstacles, we need to be investigating new routes that go around them, strengthen the rule of law – especially human rights law – as a basis for the international system, and promote lasting peace among all nations. Only then can we declare victory over what the 18th-century Scottish poet Robert Burns called ‘man’s inhumanity to man’.”