A decision to close Europe’s biggest natural gas field is starting to raise concerns about the impact on the region’s biggest trading hub for the fuel. The Dutch Title Transfer Facility has grown into Europe’s largest gas market in the past few years, surpassing the U.K., partly because of the scale of flows converging in the Netherlands.A plan to shut down production at the Groningen field in the northeast corner of the Netherlands will make the nation dependent on imported gas. That’s prompting questions about how the trading hub will work in the future, according to Annie Krist, chief executive officer at GasTerra, a venture between Royal Dutch Shell Plc, Exxon Mobil Corp. and the Dutch state that handles flows from the field. “The Netherlands has a very liquid and attractive natural gas trading hub,” Krist said in a rare interview. “TTF is growing so well, that people seem to forget how we got there. If we don’t have Groningen’s flows, how is it going to be? Countries that are used to being dependent on imports, have other market mechanisms.”After earthquakes caused by the earth settling as gas drained from the Groningen reservoir, the Dutch government has ordered the field to shut down gradually by 2030. That will remove both a source of flows and some flexibility for the market.

Five years ago, GasTerra handled more than a fifth of all the gas produced in Europe. It’s already been forced to adapt to output constraints at Groningen when tremors damaged nearby buildings.

But shutting down completely is a bigger step, one that’s left Krist concerned about the impact on the broader industry in the Netherlands.

“That was the first moment when we heard about zero. Zero really means no more gas. And that for a country that is dependent on gas.”

The giant Groningen field has been fueling Europe’s energy needs, and the Dutch budget, since 1963. Its importance, coupled with the development of sufficient infrastructure for gas transportation and trading, helped the TTF take the crown of Europe’s biggest market from the U.K.’s National Balancing Point in 2016.

But intensive gas production has generated a series of earthquakes, affecting inhabitants in the region and damaging the image of gas as a source of energy. The insecurity has forced the government to curb production, with output in the year to October seen rising to that limit, which is just a fifth of the field’s peak in 1975-76.

The Economy Ministry vowed last year to close Groningen by 2030. Following further tremors related to production, its output after October is uncertain limbo after the nation’s highest court demanded the ministry better explain how it weighed safety concerns of people in the region against security of supply.

And not only production levels are unclear. The TTF’s role is also in question as the Netherlands goes from an exporter to “a normal European importing country,” according to Krist.

“It will be interesting to see what balance we will have in terms of physical flows and how the liquidity in the hub will evolve as we shut down Groningen,” Krist said. “Whether or not players will think that the country is still interesting, is yet to be seen.”

In 2018, gas imports exceeded exports for the first time in the Netherlands, with the bulk of supplies coming from Norway, according to the Dutch national statistics office. The Netherlands will account for more than 60 percent of the decline in the region’s supply from 2018 to 2024, according to the International Energy Agency.

“The main question for me is how quickly the Netherlands will be able to adapt as it becomes a gas importer,” said Gergely Molnar, a gas analyst in Europe at the International Energy Agency. “A trading hub is trusted by market participants if it is always able to deliver the physical volumes. So the Dutch gas infrastructure must adapt to the changing trading balance.”

The country now needs to build up more import capabilities, conversion facilities and preserve seasonal storage capacity, he said.

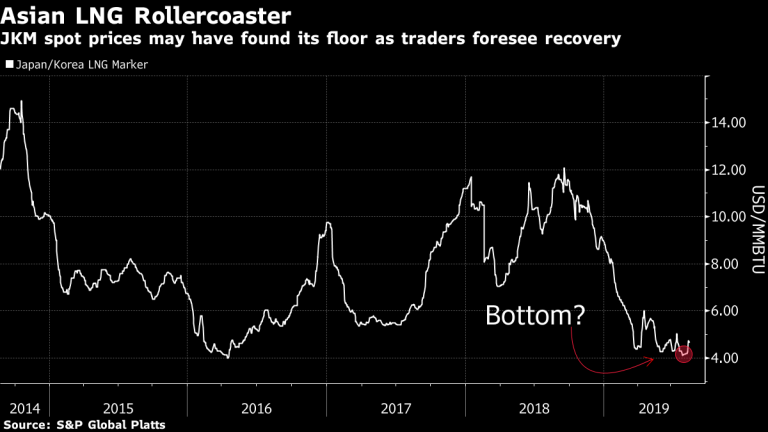

So far, Groningen’s production reductions hasn’t had any effect on TTF’s liquidity. The Dutch gas hub’s ratio of traded volume to actual physical throughput, known as churn, surpassed 100 for the first time in July, according to Molnar. That compares with a rate of 10 to 30 for the NBP, 50 to 90 for the U.S. Henry Hub and below 1 for the barely liquid Japan-Korea Marker.

“History doesn’t show a strong correlation between a gas production cut and the hub liquidity,” Molnar said. “TTF has become important because of a number of factors beyond production, including infrastructure, legal framework and the private sector’s willingness to invest in gas trading capabilities.”

As Groningen ramps down, the Netherlands is becoming more reliant on its so-called small fields to meet export obligations, most of which are in the final phase of their production cycle and produce gas that’s too rich to be pumped directly into the region’s networks.

“Amid restrictions, we have to decide on a day-by-day basis how much Groningen gas we need to add to other sources to guarantee security of supply,” GasTerra’s Krist said. “We have to secure the right balance, which is much harder now than it was in the past.”

And with the Netherlands losing its role as a large producer, companies are questioning their own future. GasTerra’s shareholders are discussing what to do with the whole value chain as Groningen production declines, “including the role of GasTerra in it,” Krist said.

The Dutch government last year launched fiscal benefits for investments in gas exploration in the North Sea in order to try to preserve the offshore gas sector.

“That Groningen production would reduce was foreseen, but it’s happening much sooner than originally was anticipated,” she said. “It has not been business as usual in the last couple of years, and it definitely won’t be. We need to adapt to this situation quite significantly.”