المركزية- حاضر الخبير الدولي في شؤون الطاقة رودي بارودي عن صناعة الطاقة العالمية خلال مؤتمر أثينا الذي انعقد الأسبوع الفائت تحت عنوان “حوارات الطاقة 2022″، حيث لفت إلى أنه “يمكن لأوروبا أن تخفف من أزمتها في مجال الطاقة من خلال الدعم والاستثمار في طفرة الطاقة النظيفة في منطقة البحر الأبيض المتوسط”.

وجاء في مداخلته: “خلال السنوات الأخيرة، دارت كل المناقشات العلمية في صناعة الطاقة العالمية حول موضوعين: تغيّر المناخ وتقلبات أسعار السوق.

هناك، بالطبع، ضغوطات متزايدة لاستبدال الوقود الأحفوري بموارد الطاقة المتجددة مثل الرياح والطاقة الشمسية. والهدف من ذلك هو الجمع بين موارد طاقة جديدة مستدامة بيئيًا وقابلة للاستمرار اقتصاديًا، كذلك الدمج بين زيادة الوعي وتحسين التكنولوجيا يجعلنا أقرب إلى تحقيق كلا الهدفين.

لطالما كانت إحدى المشاكل الرئيسية تكمن في أن هذا التغيير لا يمكن أن يتم بين ليلة وضحاها. إن إنتاج وأداء وحجم الاتكال على المصادر النظيفة والصديقة للبيئة ليس كافيا بعد لتلبية الطلب بالكامل، وسيتطلب الوصول إلى تلك المرحلة سنوات طويلة من التخطيط والاستثمار والبناء. إذا أخذنا التقنيات المتوفرة في وضعها الحالي قبل أن يتم استبدالها بالتقنيات الحديثة، فإن النقص الناتج سيؤدي إلى ارتفاع الأسعار، مما سيزيد من تكاليف المعيشة والتسبب في انهيار الاقتصادات بأكملها. من ناحية أخرى، إذا انتظرنا وقتًا طويلاً قبل التخلي عن موارد الطاقة العالمية المنتجة لانبعاثات الكربون، فإن التغيرات المناخية تهدد بإلحاق أضرار أكبر من سابقها.

من البديهي القول إنه كانت هناك دائمًا عملية موازنة دقيقة في هذا المنحى، فقد أجبرت تقلبات الأسواق صانعي السياسات مراراً على إعادة النظر في خططهم وإعادة التفكير فيها وإعادة ضبطها. ثم جاءت جائحة كورونا (كوفيد – 19) التي تسببت بضغط غير مسبوق على الإنتاج والاستهلاك على حد سواء. وقد نجحت مجموعة حلول من الفئات العامة والخاصة في التغلب على أسوأ ما في تلك العاصفة بشكل مثير للدهشة. لكن التعافي العالمي لا يزال هشاَ وغير متوازن لا سيما في ضوء الانتشار الواسع للتضخم وانهيار خطوط الإمداد.

أما الآن تلوح أمامنا أزمة جديدة تهدد موارد الطاقة وتتسبب بصدمات قوية قد تؤدي الى انهيار معاييرنا الجديدة والتسبب بأسوأ موجة كساد في التاريخ الحديث. أشير بالطبع إلى الحرب في أوكرانيا والتي لم تكشف فقط عن اعتماد أوروبا المفرط والخطير على الغاز الطبيعي وواردات الطاقة الأخرى من روسيا، ولكنها كشفت أيضا إلى اي مدى يمكن أن يسبب اختلال هذه العلاقة من فوضى في العالم أجمع. منذ أن شنت موسكو غزوها للأراضي الأوكرانية في أواخر شباط / فبراير، كان الاتحاد الأوروبي مترددًا في فرض عقوبات على قطاع صناعة الطاقة الروسية لأنه يفتقر إلى بدائل أخرى بسبب عدم امتلاكه لمصادر متنوعة من الطاقة ومورديها بشكل كاف.

تجري في العديد من البلدان بعض التحركات التي طال انتظارها لزيادة قدرتها على التكيف، لكن التوقيت يزيد من التحديات بطرق عدة. فعلى سبيل المثال تم رفض أو تأخير المقترحات المختلفة لمد خطوط أنابيب الغاز من شمال إفريقيا وآسيا الوسطى، والتي قد تمر بالأراضي الروسية. بالإضافة إلى ذلك، قررت بعض الحكومات الأوروبية في السنوات الأخيرة، إغلاق محطات الطاقة لديها التي تعمل على الفحم و / أو الطاقة النووية، ما جعلها تفتقد إلى المرونة والقابلية في التعويض عن الغاز الطبيعي الروسي واستبداله بموارد وأنواع أخرى من الوقود. كما تعاني القارة أيضًا من عجز في القدرة على إعادة معالجة الغاز ليكون قابلا للاستهلاك، ما يعني أنها لا تستطيع الاستغناء كليا عن الغاز المستورد عبر الأنابيب الروسية، واستبدالها بشحنات الغاز الطبيعي المسال المنقولة بحراً من دول أخرى.

هناك حلول لكل هذه المشاكل، وبعضها قيد التنفيذ بالفعل:

• تقوم ألمانيا حالياً ببناء محطتين جديدتين لاستقبال الغاز الطبيعي المسال، وتقوم هولندا بتوسيع طاقتها الاستيعابية الحالية، كذلك أكدت اليونان مؤخراً أن لديها خططاً في نفس الاتجاه.

• تمتلك إسبانيا خطوط انابيب غاز داخلية وكذلك تمتلك القدرة الاحتياطية لإعادة تحويل الغاز المسال إلى غاز قابل للاستهلاك، لكنها تفتقد إلى القدرة على زيادة الإنتاج والضخ إلى باقي الدول الأوروبية. لذلك فإنه من المنطقي القول إن الوقت قد حان لربط شبكة الأنابيب الإسبانية بفرنسا، ما يتيح للغاز أن يتدفق إلى الشبكة الأوروبية.

• من المنطقي أيضًا الإسراع في وضع الخطط لإنشاء خط أنابيب جديد آخر و / أو زيادة القدرة على نقل الغاز من أذربيجان ومناطق أخرى في آسيا الوسطى إلى تركيا، ما يُتيح لإمدادات الغاز هذه أن تدخل الأسواق الأوروبية.

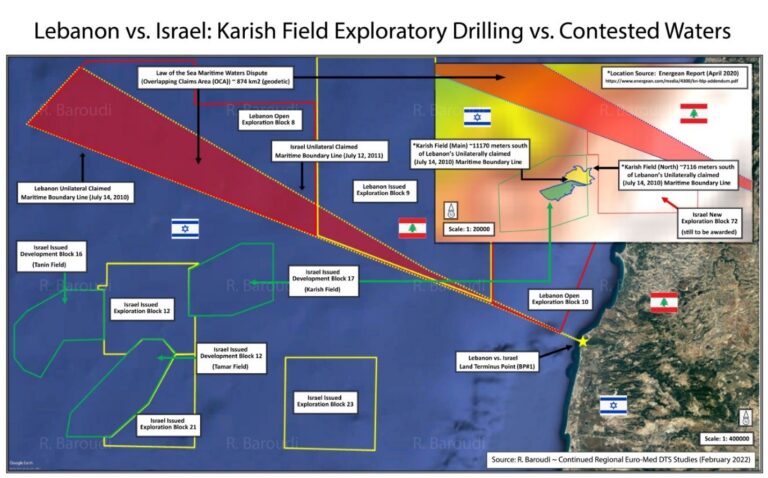

• يمكن أيضاً لأوروبا أن تعزز أمنها في الطاقة من خلال المساعدة على تطوير حقول الغاز ألغنية بشكل متزايد في شرق البحر الأبيض المتوسط ، والتي يمكن بعد ذلك ربط إنتاجها عن طريق خط أنابيب تحت البحر و / أو فوق الأرض إلى البر الرئيسي الأوروبي.

• سيتم أيضًا تعزيز الفائدة من هذه الخطوات وغيرها بشكل كبير من خلال بناء مرافق تخزين جديدة لكل من الغاز الطبيعي المسال والغاز التقليدي، مما سيجعل أوروبا أكثر صلابة أمام انقطاع إمدادات الغاز في المستقبل.

• نظرًا لقرار الاتحاد الأوروبي الجاد في فك قيود سياسته الخارجية والتوقف عن اعتماده على الغاز الروسي، فمن الممكن أيضًا تأجيل إغلاق محطات الإنتاج التي تعمل على الفحم والطاقة النووية والإسراع بتنفيذ مشاريع الطاقة النظيفة، حقول الطاقة الشمسية، ومزارع الرياح على وجه الخصوص.

• بالإضافة إلى الغاز الذي يجري ضخه عبر الأنابيب، تتلقى إسبانيا الكهرباء المولدة من مزارع الطاقة الشمسية في شمال إفريقيا، كما أن هنالك مجال كبير جدا لإنشاء شبكات مشتركة مماثلة عبر المنطقة الأورو- متوسطية.

• لعل الحل الأفضل على المدى الطويل هو أن تغتنم أوروبا الفرصة من خلال استثمارها في مجالات انتاج الطاقة ذات الإمكانيات الكبيرة بواسطة الرياح البحرية في منطقة المتوسط.

تجدر الإشارة هنا إلى أنني نشرت منذ مدة وجيزة كتابًا جديدًا بعنوان “المناخ والطاقة في منطقة البحر الأبيض المتوسط: ماذا يعني الاقتصاد الأزرق لمستقبل أكثر خضرة؟”. لقد أكملت كتابته قبل اندلاع الحرب في أوكرانيا، وكان هدفي من وراء كتابته التركيز على خفض انبعاثات الكربون أكثر من التقليل على الاعتماد على الغاز الروسي. لكن الأزمة الحالية تجعل موضوع الكتاب أكثر أهمية من أي وقت مضى. وتذهب التوصية الأساسية للكتاب إلى أنه يمكن لأوروبا أن تستفيد بشكل كبير من برنامج لتوليد الطاقة عبر تطوير مرافق استفادة من الرياح البحرية في حوض المتوسط. كما يتضمن الكتاب تقديرات لإمكانيات استفادة كل دولة أورو- متوسطية من الرياح البحرية، والارقام في تزايد.

أساساُ، فإن الاستفادة الكاملة من هذه الإمكانات – في المياه الساحلية وحدها – يمكن أن توليد ما لا يقل عن 500 مليون ميغاواط من الكهرباء. بمعنى آخر ما يعادل مجموع إنتاج مولدات الطاقة النووية في العالم أجمع! ويجدر الإشارة أن هذه التقديرات واقعية، وقد تم التوصل إليها من خلال دراسات شاملة وحثيثة للغاية تستند إلى التكنولوجيا القياسية المستخدمة في أيامنا هذه.

يعيدنا هذا إلى موضوعنا الأساسي، فنظريا، كل ما سبق ذكره من محطات الغاز الطبيعي المسال، وخطوط الأنابيب الجديدة، وأعمال التطوير لزيادة عمر محطات توليد الطاقة التي تعمل على الفحم وتلك التي تعمل على الطاقة النووية، وتسخير الإمكانات الهائلة للبحر الأبيض المتوسط - كل هذا سيتطلب أموالا طائلة. ستكون السنوات الثلاث إلى الخمس المقبلة حاسمة، ليس فقط من أجل تقليل الاعتماد على الغاز الروسي، وبالتالي استعادة استقلالية السياسة الخارجية للاتحاد الأوروبي، ولكن أيضًا لتكثيف مصادر الطاقة المتجددة التي ستساعد في الحفاظ على تغيرات المناخ ضمن حدود يمكن التحكم فيه.

يمكن لمنطقة البحر الأبيض المتوسط - بما في ذلك الدول المطلة عليها من مكونات الاتحاد الأوروبي وتلك غير التابعة له – أن تكون جزءًا كبيرًا من هذا المسعى لتحقيق قابلية مزدوجة لمواجهة التحديات الاقتصادية والبيئية على حدٍ سواء. تعتبر الاستثمارات الأوروبية في إنتاج الطاقة في بلدان الشرق الأوسط وشمال إفريقيا منطقية لعدة أسباب ومنها، انخفاض قيمة اليد العاملة وتكاليف البناء الأخرى، فضلاً عن إمدادات طاقة أكثر تنوعًا والتي يمكن الاعتماد عليها بشكل أكبر. ناهيك عن المزايا المساعدة على تطوير اقتصادات أقوى واستقرار سياسي أكبر على أطراف أوروبا. ستساعد هاتان النتيجتان على تحسين الفقر واليأس، وتحد من تدفق المهاجرين غير الشرعيين، الذين لقي الآلاف منهم حتفهم أثناء محاولتهم عبور البحر المتوسط في القوارب المتهالكة والمثقلة بالأعباء التي زودهم بها مهربو البشر عديمو الضمير.

سيداتي وسادتي، أعتقد أنه يمكننا أن نتفق جميعًا على أن هذه ليست أولويات ثانوية. على العكس من ذلك، فهي أولويات استثنائية تتطلب اتخاذ تدابير استثنائية، وقد تكون الآثار المترتبة على عدم التصرف كارثية في السنوات القادمة. وبالتالي، فإن المطلوب ليس فقط أن تتعاون الدول الأعضاء في الاتحاد الأوروبي لتحقيق هذه الأهداف، كما يفعل البعض منها حالياُ، ولكن المطلوب من جميع الهيئات ذات الصلة أن تتقدم وتتدخل وتشارك كما لم تفعل من قبل.

حول هذا الموضوع بالذات، تلقينا بعض الأخبار الجيدة جدًا مؤخرًا. فقبل حوالي أسبوع، حددت المفوضية الأوروبية خطة جديدة لإنهاء اعتماد أوروبا على الغاز الروسي، خطة تتطلب إنفاق أكثر من 200 مليار يورو على مدى السنوات الخمس المقبلة. هذا رقم كبير، لكن الخطة تحتاج الآن إلى التمويل.

ستتطلب المشاريع المعنية دعما هائلا، سواء المباشر منها أو غير المباشر، وذلك إذا أريد لها أن تبدأ في العمل بسرعة، وإذا كانت ستفعل ذلك دون أن تخضع لفرض ضرائب غير مستدامة و / أو دون أن تتأتى منها أعباء ديون على الاقتصادات الفردية. هذا يعني أنه ليس فقط على الاتحاد الأوروبي نفسه أن يبدأ بالتمويل، ولكن على كل من بنك الاستثمار الأوروبي والبنك الدولي وصندوق النقد الدولي – أن يبدأوا بالتمويل كذلك. كما يجب على القطاع الخاص إن يشارك في هذا الإجراء أيضا.

ستكون هناك فوائد كبيرة إذا اعتمدنا على مثل هذا البرنامج، وبالمقابل ستكون هناك أزمات أكبر إذا لم نفعل ذلك. لذلك لا يمكن اعتبار الحلول المذكورة انفاقاً منتظماً، بل هي بدلا من ذلك ترقى لتكون استثمارات ضرورية وتاريخية في مستقبل أفضل للقارة بأكملها ولجيرانها في الشرق الأوسط وشمال إفريقيا، وبإمكاني أن أقول وكذلك الأمر بالنسبة للعالم أجمع.

لسوء الحظ، لقد فات الأوان لمنع الحرب في أوكرانيا. لكن كلما تحركت أوروبا بشكل أسرع وفعال لإنهاء اعتمادها على الغاز الروسي، وتبنت شراكة أوثق مع جيرانها في البحر الأبيض المتوسط، والتي ستحقق الاستقلالية الكاملة لسياستها الخارجية، كلما تمكنت من المساعدة في استعادة السلام – ومنع حدوث كوارث مماثلة في المستقبل”.