UN climate report reignites global fight for compensation

With this week’s UN climate science report laying bare the staggering economic costs and losses already faced from climate change, an inevitable question arises: who should pay?

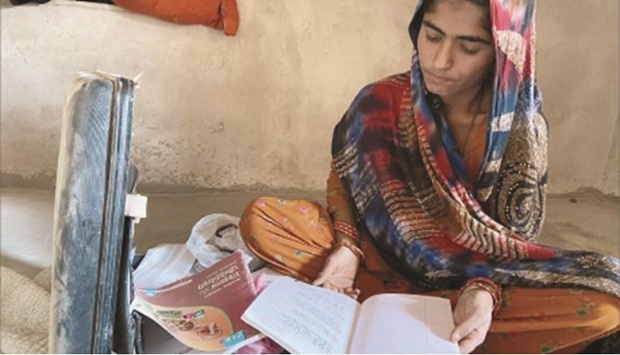

Within UN climate negotiations, “loss and damage” refers to the costs countries are incurring from climate-related impacts and disasters — costs that disproportionately hit the world’s poor and vulnerable who did least to cause global warming.

Drawing on more than 34,000 references from the latest scientific papers, the report released on Monday by the UN Intergovernmental Panel on Climate Change (IPCC) confirmed that economic sectors from agriculture and fishing to tourism were already being damaged.

Extreme heat has fuelled crop losses. Rising seas have turbo-charged cyclones that have razed homes and infrastructure, slashing economic growth.

And as the bills mount up, poorer countries are left with even less to spend on heath, education and infrastructure — compounding suffering.

“It’s an unending situation,” said Anjal Prakash, a lead IPCC author and research director at the Indian School of Business.

The report is likely to intensify a years-long political fight over funding to pay for climate-linked losses, ahead of the next UN climate summit, COP27, in Egypt in November.

Vulnerable countries for years have sought funding to help them shoulder these costs. So far, it hasn’t arrived, and rich nations have resisted steps that could legally assign liability or lead to compensation.

The mention of “loss and damage” in the 2015 Paris Agreement came with the caveat that it “does not involve or provide a basis for any liability or compensation”.

Last November at the COP26 climate summit in Glasgow, poor countries called for a special “loss and damage” fund to be established, but the United States and other rich nations resisted. The delegates agreed to set up a UN body to help countries address loss and damage, and to continue discussions towards making “arrangements” for funding.

But there is no clarity on where the money would come from.

“We can’t just create more talk shops when people are dying,” said Harjeet Singh, senior adviser at Climate Action Network. He said COP27 needed to establish the funding facility that developing countries, including China, had called for at COP26.

Singh and other campaigners said the IPCC report — which has been approved by nearly 200 governments — could intensify pressure on the world’s most powerful nations.

“It will help us to say that science is clear, the impacts are clearer now. So you are accountable for this, and you have to pay for this,” said Nushrat Chowdhury, a policy advisor at NGO Christian Aid.

The report’s discussion of climate losses is bolstered by recent improvements in “attribution science”, which allows scientists to confirm when climate change caused or worsened a specific extreme weather event.

Still, putting a number on the resulting losses remains contentious. For example, can climate-linked losses from a weather event be separated from losses caused by poor disaster planning? Can costs be counted for losses outside our economic systems, such as when nature is degraded or a community burial site is destroyed?

“We are still debating that in the scientific community,” said another IPCC lead author Emily Boyd, a professor at Sweden’s Lund University.

As climate disaster costs mount and UN negotiations remain stuck, some are considering other options.

“Liability and compensation have other avenues to be taken forward, which are courts,” said Saleemul Huq, an adviser to the Climate Vulnerable Forum group of 55 countries.

Sophie Marjanac, lawyer at environmental law firm ClientEarth, said the IPCC report “will generally support litigation” to address climate change.

The legal avenue faces other obstacles, however.

Last year a federal appeals court rejected New York City’s attempt to use state law to hold five oil companies liable to help compensate harm caused by global warming. The court said the regulation of greenhouse gas emissions should instead be addressed under federal law and international treaties.

“Challenges in climate change litigation are related to the law, not to do with the science,” Marjanac said. “The science has been clear, very clear for years.”

DENVER – For decades, we at the Rocky Mountain Institute (now RMI) have argued that the transition to clean energy will cost less and proceed faster than governments, firms, and many analysts expect. In recent years, this outlook has been fully vindicated: costs of renewables have consistently fallen faster than expected, while deployment has proceeded more rapidly than predicted, thereby reducing costs even further.

Thanks to this virtuous cycle, renewables have broken through. And now, new analyses from two authoritative research institutions have added to the mountain of data showing that a rapid clean-energy transition is the least expensive path forward.

Policymakers, business leaders, and financial institutions urgently need to consider the promising implications of this development. With the United Nations Climate Change Conference (COP26) in Glasgow fast approaching, it is imperative that world leaders recognize that achieving the Paris climate agreement’s 1.5° Celsius warming target is not about making sacrifices; it is about seizing opportunities. The negotiation process must be reframed so that it is less about burden-sharing and more about a lucrative race to deploy cleaner, cheaper energy technologies.

With the world already suffering from climate-driven extreme weather events, a rapid clean-energy transition also has the virtue of being the safest route ahead. If we fail at this historic task, we risk not only wasting trillions of dollars but also pushing civilization further down a dangerous and potentially catastrophic path of climate change.

One can only guess why forecasters have, for decades, underestimated the falling costs and accelerating pace of deployment for renewables. But the results are clear: bad predictions have underwritten trillions of dollars of investment in energy infrastructure that is not only more expensive but also more damaging to human society and all life on the planet.

We now face what may be our last chance to correct for decades of missed opportunities. Either we will continue to waste trillions more on a system that is killing us, or we will move rapidly to the cheaper, cleaner, more advanced energy solutions of the future.

New studies have shed light on how a rapid clean-energy transition would work. In the International Renewable Energy Agency (IRENA) report The Renewable Spring, lead author Kingsmill Bond shows that renewables are following the same exponential growth curve as past technology revolutions, hewing to predictable and well-understood patterns.

Accordingly, Bond notes that the energy transition will continue to attract capital and build its own momentum. But this process can and should be supported to ensure that it proceeds as quickly as possible. Policymakers who want to drive change must create an enabling environment for the optimal flow of capital. Bond clearly lays out the sequence of steps that this process entails.

Examining past energy revolutions reveals several important insights. First, capital is attracted to technological disruptions, and tends to flow to the areas of growth and opportunity associated with the start of these revolutions. As a result, once a new set of technologies passes its gestation period, capital becomes widely available. Second, financial markets draw forward change. As capital moves, it speeds up the process of change by allocating new capital to growth industries, and by withdrawing it from those in decline.

The current signals from financial markets show that we are in the first phase of a predictable energy transition, with spectacular outperformance by new energy sectors and the de-rating of the fossil-fuel sector. This is the point where wise policymakers can step in to establish the necessary institutional framework to accelerate the energy transition and realize the economic benefits of building local clean-energy supply chains. As we can see from market trends highlighted in the IRENA report, the shift is already well underway.

Reinforcing the findings from the IRENA report, a recent analysis from the Institute for New Economic Thinking (INET) at the Oxford Martin School shows that a rapid transition to clean energy solutions will save trillions of dollars, in addition to keeping the world aligned with the Paris agreement’s 1.5°C goal. A slower deployment path would be financially costlier than a faster one and would incur significantly higher climate costs from avoidable disasters and deteriorating living conditions.

Owing to the power of exponential growth, an accelerated path for renewables is eminently achievable. The INET Oxford report finds that if the deployment of solar, wind, batteries, and hydrogen electrolyzers continues to follow exponential growth trends for another decade, the world will be on track to achieve net-zero-emissions energy generation within 25 years.

In its own coverage of the report, Bloomberg News suggests as a “conservative estimate” that a rapid clean-energy transition would save $26 trillion compared with continuing with today’s energy system. After all, the more solar and wind power we build, the greater the price reductions for those technologies.

Moreover, in his own response to the INET Oxford study, Bill McKibben of 350.org points out that the cost of fossil fuels will not fall, and that any technological learning curve advantage for oil and gas will be offset by the fact that the world’s easy-access reserves have already been exploited. Hence, he warns that precisely because solar and wind will save consumers money, the fossil-fuel industry will continue to try to slow down the transition in order to mitigate its own losses.

We must not allow any further delay. As we approach COP26, it is essential that world leaders understand that we already have cleaner, cheaper energy solutions ready to deploy now. Hitting our 1.5°C target is not about making sacrifices; it is about seizing opportunities. If we get to work now, we can save trillions of dollars and avert the climate devastation that otherwise will be visited upon our children and grandchildren.