Opec slashes oil demand forecast as virus threatens new glut

OPEC slashed forecasts for global oil demand as the coronavirus hits fuel use in China, leaving the group facing a renewed glut despite its recent production cuts.

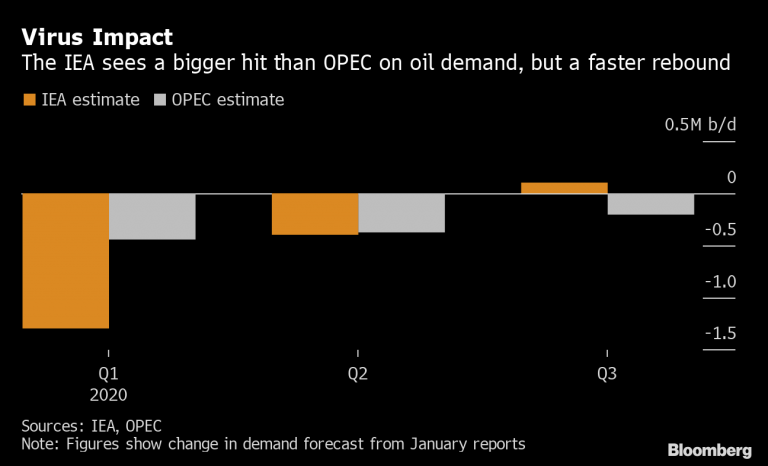

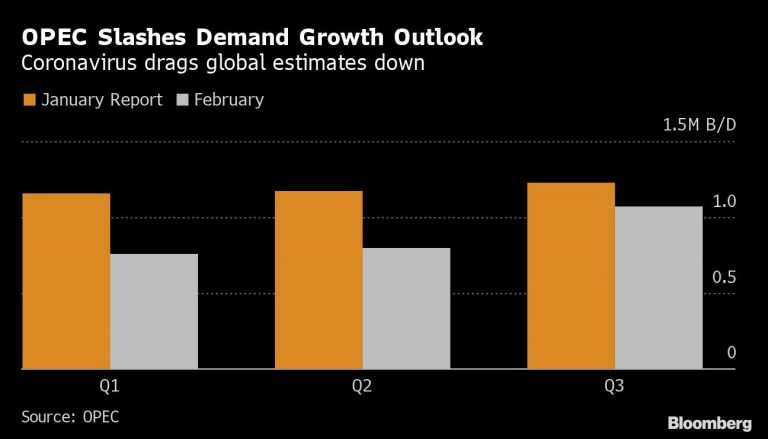

The cartel reduced projections for demand growth in the first quarter by 440,000 barrels a day, or about a third, in its monthly report. Oil prices sank to a one-year low on Monday as the infection leaves businesses idle and millions quarantined in the world’s biggest crude importer.

Oil’s slump has spurred the Organization of Petroleum Exporting Countries’ biggest exporter, Saudi Arabia, to press fellow members and allies to hold an emergency meeting and consider new output cutbacks. Yet the proposal has so far met resistance from Russia, the group’s most important ally, which is able to weather lower prices more easily.

The report showed that, even though many OPEC members made a strong start with fresh output curbs that took effect last month, the virus’ impact on consumption will leave them with a new overhang.

The group collectively pumped 28.86 million barrels a day in January, and if it maintains that rate there will be a surplus of 570,000 barrels a day during the second quarter, when consumption slows down seasonally. The monthly report is compiled by OPEC’s Vienna-based research department.

OPEC doesn’t see the effects of the disease confined to the start of the year, bringing down its growth estimate for global oil demand in 2020 as a whole by about 230,000 barrels a day to just under 1 million a day. Still, the increase remains slightly higher than last year’s.

Though crude futures have recovered on speculation the spread of the disease could be nearing its peak, prices of about $55 a barrel in London remain well below the levels most OPEC members need to cover government spending.

Since the producer group formed an alliance with non-members such as Russia three years ago, the coalition has restrained supplies to offset a surge of production from the U.S. shale industry, and keep prices supported. They embarked on a new round of cutbacks in January.

Last week, a committee of technical experts from the alliance, known as OPEC+, recommended reducing output by a further 600,000 barrels a day to offset the impact of the coronavirus. Russia, however, says it’s “studying” the proposal and its energy minister, Alexander Novak, is consulting with oil companies today.

OPEC’s latest outlook may encourage them to give greater consideration to taking additional measures.

“Clearly, the ongoing developments in China require continuous monitoring and assessment to gauge the implications,” the report said.