Why Gulf Dollar Pegs Survive Through Wars, Oil Shocks

1. Who has currency pegs and why?

The six members of the Gulf Cooperation Council — Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates — have been running currency pegs or managed foreign-exchange regimes since the 1970s and 1980s. Kuwait’s dinar tracks the value of a basket of currencies believed to be dominated by the dollar, while others are linked solely to the greenback. The pegs have helped to shield the region’s economies from the volatility of energy markets and allowed central banks to accumulate reserves in the good times. Those reserves, along with foreign assets held by the region’s sovereign wealth funds, are used in turn to defend the pegs.

2. What could put the pegs under stress?

Fixed exchange-rate regimes in Asia were swept away during the currency crisis of the late 1990s, when speculators forced the likes of Thailand and South Korea to abandon their links with the dollar. They’re now largely confined to the major oil producers in the Middle East along with Hong Kong, whose dollar has been pegged to the U.S. currency since 1983. The Gulf pegs mean local central banks often take a cue on monetary policy from the U.S. Federal Reserve, which creates the risk of policy misalignment when business cycles are out of step. Today, the Gulf region is grappling with heightened inflation and the prospect of global interest-rate increases led by the Fed. There is disquiet about global dollar dominance, and the U.S.’s willingness to use the dollar as a weapon in sanctions to punish Russia for its invasion of Ukraine.

3. What might the Gulf states do next?

None of the region’s governments have suggested they might abandon the pegs and let markets decide the value of their currencies. However, Saudi Arabia, the biggest economy in the region, is said to be considering accepting yuan payments for its oil exports to China. If the kingdom does take that step, the petrodollar system would be tested, especially if neighbors follow suit, with China accounting for over 20% of the bloc’s total oil shipments. Currency strategists said Saudi Arabia appeared to be sending a political message to the U.S. with the yuan reports, amid strained relations with Washington, and played down the likelihood of any immediate action.

4. What stresses have there been in the past?

The system has survived stern tests, including successive years of low oil prices in the 1990s, a period of dollar weakness before the financial crisis in 2008 and an oil-price crash in 2014. Speculators jumped in at that point in a failed effort to challenge the Saudi peg, boosting the price of 12-month forward contracts used by investors to bet on the peg breaking or to hedge in case it does.

5. How did Saudi Arabia react?

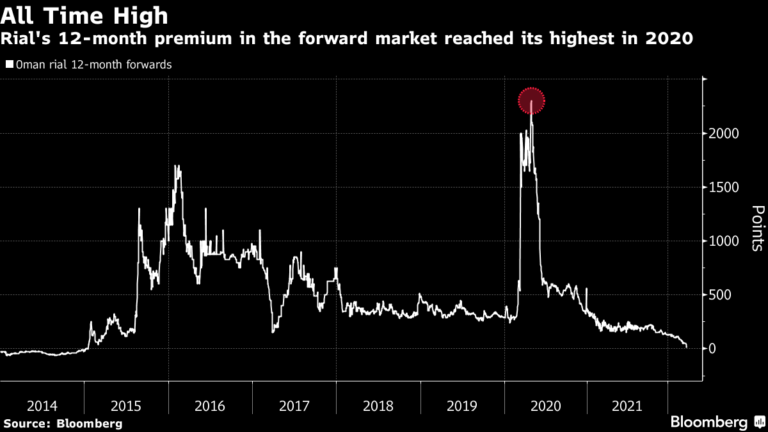

Instead of choosing to devalue the riyal, the kingdom cut spending and subsidies and turned to debt markets to fund its budget deficit. Its neighbors have adopted similar strategies. The Saudi forward contract jumped again in 2020 amid the double-hit of weaker crude prices and the pandemic. Oman’s rial forwards reached a record high that year, before edging lower.

6. What happens to Gulf economies if the U.S. hikes rates?

The risk is that, to maintain their pegs, the region’s governments are forced to follow the Fed with a succession of interest rate rises that end up hammering their own economies. If they do, there’s still a way for them to avoid recessions: Oil prices are riding high, leaving them with plenty of ready cash to boost state spending and support growth.

7. Which pegs appear most vulnerable to speculators?

The weakest economies in the region have for long been Oman and Bahrain, with the latter being the only nation in the region needing oil above $100 a barrel to balance its budget, according to the International Monetary Fund. The two countries have fared better recently, with S&P Global Ratings raising Oman’s credit ratings in April. The oil rally has eased concerns about the sultanate’s ability to keep the rial pegged, prompting traders to slash bets on a devaluation. Saudi Arabia, the UAE, Kuwait and Qatar have for the most part always had firepower in the form of sizable currency reserves to defend their pegs.

8. What if dollar pegs were abandoned?

While the pegs give the region’s governments less freedom to pursue policy goals like reviving growth or creating jobs, they provide more predictability for investors and foreign residents. The dollar’s status as a global reserve currency would be undermined if GCC countries dismantled the pegs. Middle East countries account for between 10% and 15% of global foreign exchange reserves outside of China, according to Goldman Sachs. Saudi Arabia alone makes up around 5%. If Saudi Arabia accepted yuan for oil, it would accumulate big yuan reserves that it would then need to allocate, Goldman pointed out in a research note in March. This could pose challenges of its own, given the size of China’s bond market.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.