Woodside eyeing Browse gas project deal in 2020

Reuters/Melbourne

Woodside Petroleum Ltd yesterday said it was aiming to bring forward the target date for approving the mammoth Browse gas project off northwest Australia by a year to 2020, with the $15bn cost estimate potentially being pared.

Woodside, operator and top stakeholder in Browse, expects the earlier final investment decision thanks to recent progress on technical contracts and commercial agreements for processing gas from the project, Woodside chief financial officer Sherry Duhe said yesterday.

“It is something that technically we’re quite confident about at this point. And the progress that we’re making, in particular on getting very imminently to sign the preliminary agreements, is also supporting that as well,” Duhe told Reuters.

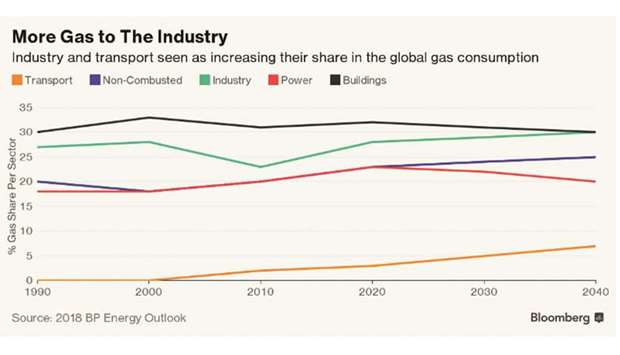

Woodside is driving Browse and the $11bn Scarborough project, also off northwestern Australia, looking to capitalise on an LNG supply gap expected to open up in the early 2020s.

“It’s really about us having the confidence to proceed and knowing that the market is there,” Duhe said in an interview after the company released its quarterly production report.

Browse, the biggest undeveloped gas resource off northwestern Australia, has been stuck on the drawing board for years as plans for onshore and floating LNG developments estimated at up to $45bn were scrapped.

The development cost has been slashed as Browse will now feed the existing North West Shelf LNG plant, rather than requiring a new plant to be built.

And contractors have indicated there might be opportunities to trim the estimated $15bn cost of the project, Duhe said.

Royal Dutch Shell, BP and PetroChina, along with Japan’s Mitsubishi Corp and Mitsui & Co, are Woodside’s partners in Browse.

“BP supports developing the Browse resources as soon as possible and is working hard with its JV partners to achieve that,” a BP spokeswoman said.

However, a Mitsui spokesman said the joint venture had yet to agree on a 2020 target for a final decision.

Shell deferred to Woodside for comment, while Mitsubishi and Petrochina declined to comment.

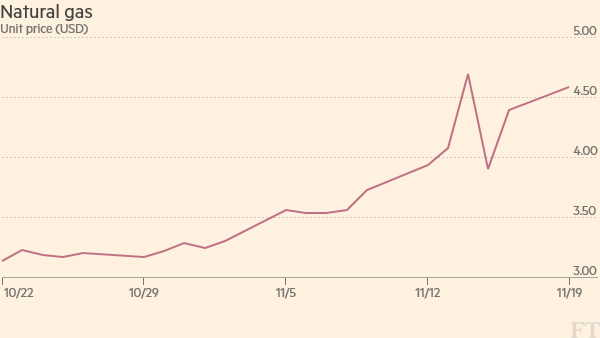

Woodside, Australia’s largest independent gas and oil producer, reported a 25% jump in third-quarter revenue to $1.16bn, underpinned by rising output at the Wheatstone LNG project, run by Chevron Corp, and higher oil and LNG prices.

Production for the quarter rose to 23.1mn barrels of oil equivalent (mmboe) from 20.3 mmboe at the same time last year.

In Myanmar, Duhe said Woodside had obtained “encouraging” results from an appraisal of the Shwe Yee Htun gas find, but did not set out timelines for further work on it.