Two Big Producers Just Called a Bottom for Oil: $60 a Barrel

Italy’s top oil producer and Oman’s energy minister predict the latest oil rebound will stick.

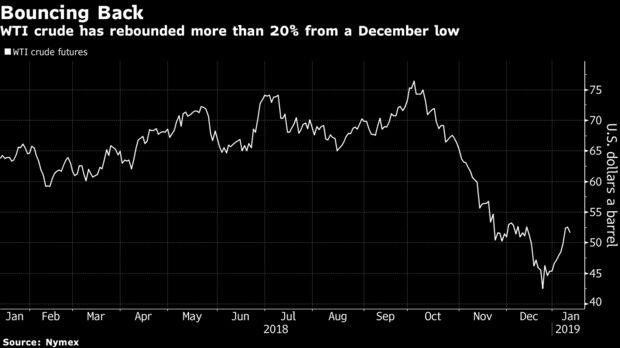

Prices are up more than 20 percent since hitting an almost two-year low in December, enough to alter OPEC+ rhetoric from reassuring investors that it will cut output to taking credit for the rebound, and in the case of Oman, forecasting where oil will trade for the year

Mohammed Al-Rumhi

Oman Oil Minister Mohammed Al-Rumhi told Bloomberg TV that the agreement between the Organization of Petroleum Exporting Countries and partners including Russia and Oman can sustain prices at $60 a barrel. He sees crude trading between that bottom and $70 a barrel this year. Claudio Descalzi, the chief executive officer of Italy’s Eni SpA, told Bloomberg TV the range will be between $60 and $62 a barrel.

“I see demand for hydrocarbons still growing,” Descalzi said. “When we talk about 1.3 to 1.4 million barrels a day, that is still there,” referring to potential demand increases.

A few weeks ago, as global benchmark Brent crude briefly dipped below $50 a barrel, OPEC ministers were taking turns to remind investors that they would trim supply. That message, along with brightening prospects for U.S.-China trade talks seem to have worked, pushing the gauge above $60 a barrel and ending talks about an extraordinary OPEC meeting.

No Extra Meeting

“We only do that during emergencies, and there is no emergency,” U.A.E. Energy Minister Suhail Al Mazrouei said in an interview on Sunday, referring to a proposed meeting he floated in December. The oil glut will be cleared in the first quarter and OPEC+ remains committed to making “whatever is the right decision to balance the market.”

Suhail Al Mazrouei

The volatility that became a feature in financial markets last year is expected to continue for oil in 2019. Prices could rise higher than $60 a barrel if consumers perceive a gap between supply and demand, according to Descalzi. Ruhmi predicts even sharper swings between $50 and $80 a barrel during for the year.

Iran Waivers

The effort to balance the market will be judged when demand usually increases in the second quarter, Oman’s Rumhi said. The timing coincides with the expected expiration of U.S. sanctions waivers that allowed some buyers of Iranian crude to continue purchases.

U.S. sanctions have cut Iran’s exports to about 1 million barrels a day from 2.7 million before sanctions were announced, Brian Hook, the U.S. State Department’s special representative for Iran, said in an interview.

Claudio Descalzi

“There’s a lot more to come. We’re going to continue our path to get to zero,” Hook said. “We have to do it in the context of oil prices”

So once again, global oil supply will be subject to decisions on Iran waivers made by the Trump Administration, far from the traditional halls of power in Riyadh and Vienna that have policed a large portion of the world’s crude production since the 1960s.

If U.S. sanctions curtailing Iran’s exports begin to crimp markets, the group will respond, Rumhi said. “There is a commitment by all of us to make sure there is no dent in the supply side. And if there’s oversupply, we cut that fat as well.”

— With assistance by Hussein Slim, and Giovanni Prati