While the Natural Gas Public Company (Defa) plans to finally seal a contract in October for the installation of an FSRU plus infrastructure, Greece’s Energean is pushing hard for the Cyprus market to be opened up.

Defa’s troubled tender process – launched last year – closes on July 12, its fourth attempt to nail down a supplier of natural gas.

It has extended the deadline several times since “to allow companies interested in bidding sufficient time to put together top-quality proposals so Defa has a better chance of success,” an official Cypriot source told S&P Global Platts.

Defa invited expressions of interest for the supply of LNG for the FSRU, which will be connected to the main power station at Vassiliko.

“There are two processes in the EoI. One calls for expressions of interest in the LNG SPA, which will involve negotiations for mid-term, 3-5 year LNG SPAs. The second invites expressions of interest for master sales agreements that will enable Defa to procure cargoes from the spot market,” the source said.

“The September 6 deadline relates to the SPA process and includes the first lot of MSA suppliers. The MSA will last up to June 2023 and it will be assessed annually after each subsequent September 6,” the source added.

“The first assessment starts September 6, 2019. Any company that submits an MSA after that date and before September 6, 2020, will be assessed in the next assessment period.”

“That will last up to four years. Defa plans multiple MSA agreements that will lead to mini-tender each time it wants to procure cargo from the spot market. Defa intends to arrange to have 15-20 MSAs available.”

But as this process unfolds, Energean Oil & Gas is lobbying hard to be allowed access to the Cyprus market so it can sell its Israeli gas via pipelines to Vassiliko by early 2021.

Officials from Energean visited Cyprus last week to make their pitch to Energy Minister George Lakkotrypis and convince other stakeholders, such as the Cyprus Electricity Authority (EAC) and the employers federation (OEB).

Although the government has rebuffed Energean’s “unsolicited offer” the Greek firm insist they can deliver quicker than the FSRU project and that competition should be allowed for the benefit of the end-user.

“We pointed out that Cyprus should not rely only on one source: all the countries in the region combine pipeline gas with LNG to enhance security of supply,” a company source told the Financial Mirror.

“Energean emphasised the fact that we can supply Cyprus with natural gas in 2021 -no way that FSRU will be ready by then- and at really competitive prices,” the source added.

Even if the figures add up financially, Nicosia is reluctant to abandon its plan as it doesn’t want to be dependent on a single supplier and forsake the construction of an LNG terminal.

“Defa [has] selected the FSRU solution and it has secured a €101 mln grant from the European Union, which gives the project economic sense, more so than anything in the past,” said an official source said.

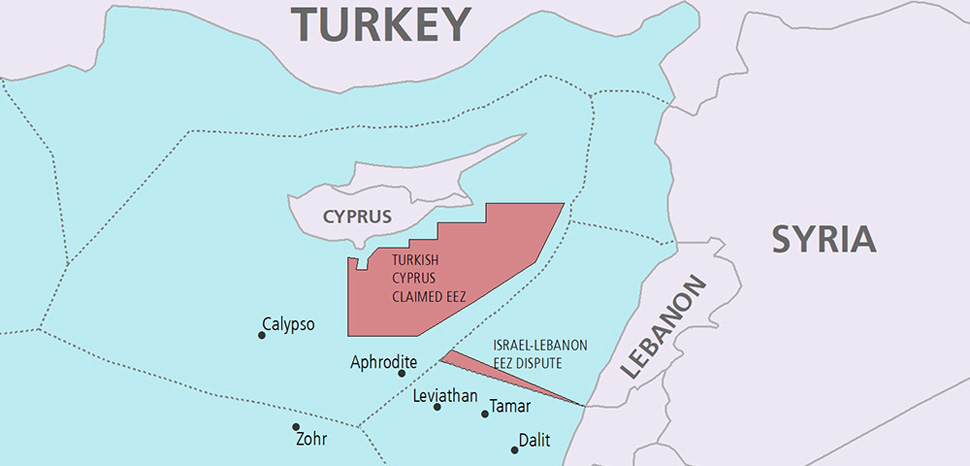

Energean has submitted to the Cyprus Energy Regulatory Authority (CERA) an updated proposal to supply the island with natural gas through an FPSO, which will commence operations in March 2021 in the EEZ of Israel.

Legal action

There are even some suggestions the Greek firm could seek legal action to force its way into the Cyprus supply chain.

In its presentation to officials in Nicosia, Energean said it has the rights to export by the Israeli government, it has partners “willing to invest” in the $315 mln pipeline and “can work with the authorities to “achieve all the energy objectives”.

Energean said it can seek to obtain EU support to make the supply of gas even more competitive while reminding that Cyprus is legally obligated to switch from diesel to gas power generation.

Last month, Energean submitted an updated technical report detailing the way natural gas will be imported to Cyprus through pipelines from Karish offshore block to the “Energean Power” Floating Production, Storage and Offloading unit, and from there through a pipeline to Vassiliko where it will emerge onshore.

Energean has also signed a Letter of Intent (LOI) for the supply of natural gas to private power generation licence holders in Cyprus.

The company argues it would establish competition in the Cypriot energy market as a whole, as there are now options for the supply of natural gas to private electricity producers.

The Greek firm said it has already initiated the procedures for obtaining the necessary Natural Gas Εxport and Pipeline Construction Licences from its FPSO in the Israeli EEZ to Vasiliko.

CEO of Energean Mathios Rigas said in May: “We have submitted a comprehensive Plan to supply the Republic of Cyprus with natural gas through the infrastructure that Energean is constructing and will be operating in Israel.”

The company argues that its solution is “cheaper and quicker than any other” and that having multiple supply sources strengthens security of supply as well as competition for the benefit of consumers and the economy.

“We are at the disposal of the Cypriot Government and the Cypriot Authorities to discuss how this Plan could be implemented so that Cyprus will be able to start using affordable natural gas in March 2021, provided there are no delays in permitting procedures,” said Rigas.

Emerging market

Complicating matters is that the government has declared the natural gas market in Cyprus as isolated and emerging.

It effectively means that Defa is not only the sole importer and distributor of natural gas on the island but also the solitary entity allowed to supply the fuel.

Defa’s grip on the market squeezes out potential suitors wanting to supply the island with natural gas.

As the market was declared an emerging one, observers say the energy regulator is not obliged to accept or examine applications from companies like Energean wanting to secure a supply permit.

Defa issued a tender for the design, construction and operation of a floating LNG import terminal to be located at Vassiliko Bay, near Limassol, separately of efforts to import the fuel by January 2020 to avoid emissions fines.

Last July, Defa described as “unsolicited” a proposal from Energean to build a pipeline to Cyprus from Israeli offshore gas fields.

DEFA chairman Simeon Kassianides said at the time that the proposal was not submitted as part of a call for tender.

The new tender, issued on behalf of the Natural Gas Infrastructure Company (ETYFA), is for a floating storage and regasification unit (FSRU), a jetty for mooring the FSRU, a jetty borne gas pipeline and related infrastructure, all of which is expected to cost some EUR 250 mln.

The LNG terminal will be completed in 2020 and has secured a funding of 40%, or up to EUR 101 mln, as a grant from the EU under the Connecting Europe Facility (CEF) financial instruments.